Financial Algebra 1st Edition Chapter 4 Consumer Credit

Page 208 Problem 1 Answer

We will determine whether there a better time during the billing cycle when Elena could have made her payment so that the average daily balance would have been less.

The closer the payment is made to the beginning of the billing cycle, the lower the average daily balance will be.

The closer the payment is made to the beginning of the billing cycle, the lower the average daily balance will be.

Page 208 Problem 2 Answer

We will determine when might Elena have made her purchases during the billing cycle in order to decrease her finance charge.

The later in the billing cycle purchases are made, the lower the average daily balance, which results in a lower finance charge.

The later in the billing cycle purchases are made, the lower the average daily balance, which results in a lower finance charge.

Page 209 Problem 3Answer

Given – The best way to deal with credit card debt is to educate yourself.We will determine how might the quote apply to what we have learned.

The quote implies that you need to be cautious when dealing with a credit card,because when you use a credit card,

then you will create debts and you should always be cautious when entering into any debt agreement.

The caution is due to the fact that you need to be sure that you can pay back these debts, because else you could lose everything you own.

The quote implies that you need to be cautious when dealing with a credit card.

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Cengage Financial Algebra Chapter 4.6 Consumer Credit Guide

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 209 Problem 4 Answer

Given – Ralph just received his June FlashCard bill. He did not pay his May bill in full, so his June bill shows a previous balance and a finance charge.

The average daily balance is$470, and the monthly periodic rate is1.5%.

We will determine what should Ralph’s finance charge be.

The finance charge is the product of the average daily balance and the monthly periodic rate.

Hence,$470×1.5%=$470×0.015

=$7.05

Ralph’s finance charge is$7.05.

Page 209 Problem 5 Answer

Given – Lauren did not pay her January FlashCard bill in full, so her February bill has a finance charge added on.

The average daily balance is$510.44, and the monthly periodic rate is2.5%.

We will find Lauren’s finance charge on her February statement.

The finance charge is the product of the average daily balance and the monthly periodic rate.

Hence,$510.44×2.5%=$510.44×0.025

=$12.76

Lauren’s finance charge on her February statement is$12.76.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 209 Problem 6 Answer

Given – Jennifer did not pay her FlashCard bill in full in September. Her October bill showed a finance charge, and she wants to see whether or not it is correct.

The average daily balance is$970.50, and the APR is28.2%.

We will find the finance charge for her October statement.

The finance charge is the product of the average daily balance and the monthly periodic rate.

The monthly periodic rate is the APR divided by the number of months in a year.

$970.50×28.2%/12

=$970.50×0.0235

=$22.81

The finance charge for her October statement is$22.81.

Page 209 Problem 7 Answer

Daniyar paid his April FlashCard with an amount equal to the new purchases shown on his bill.

His May bill shows an average daily balance of$270.31 and a monthly periodic rate of1.95%.

We will find the finance charge on Daniyar’s May statement.

The finance charge is the product of the average daily balance and the monthly periodic rate.

$270.31×1.95%=$270.31×0.0195

=$5.27

The finance charge on Daniyar’s May statement is$5.27.

Solutions For Exercise 4.6 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 209 Problem 8 Answer

Given; He made no additional payments or purchases before he received his next bill.

The monthly periodic rate on this account is 2.015 %

To find; What expression represents the finance charge on ∣ his June statement?

we know that The finance charge is the product of the balance and the monthly periodic rate.

z×2.015%=z×0.02015

Hence we conclude that the expression represents the finance charge on his June statement z×2.015%=z×0.02015

Page 210 Problem 9 Answer

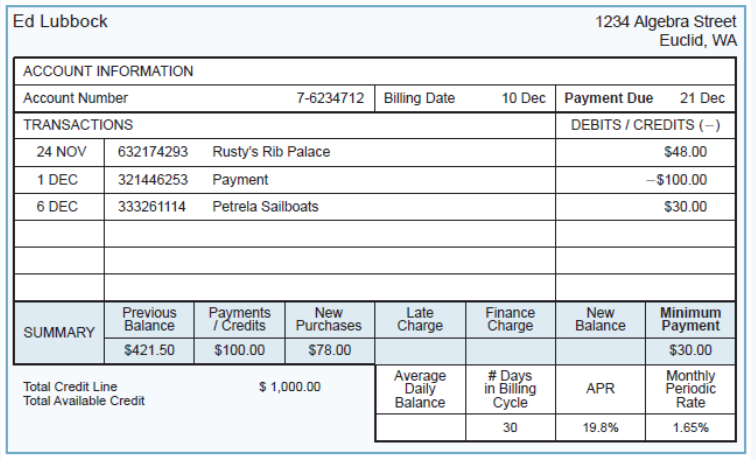

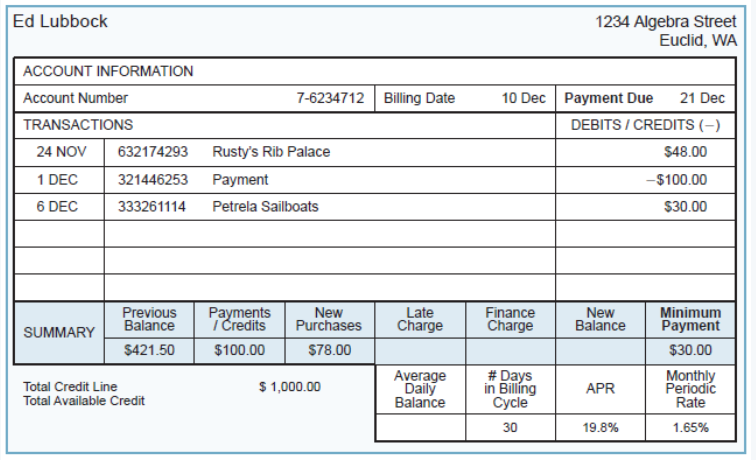

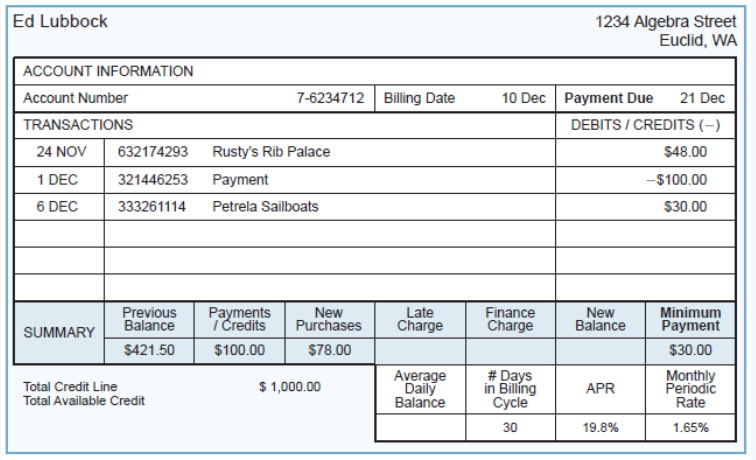

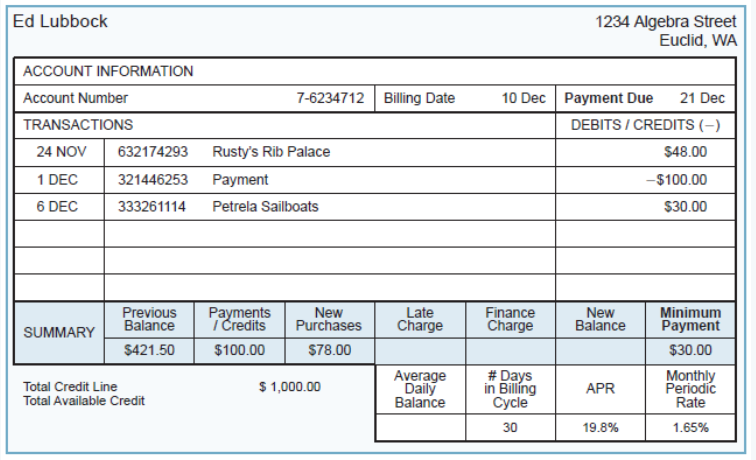

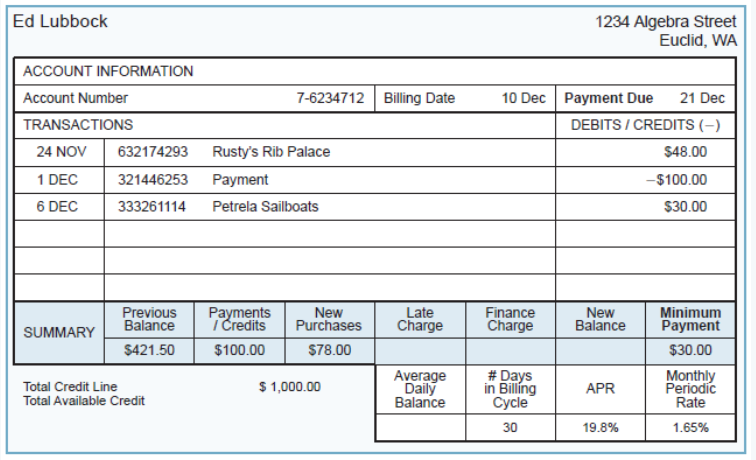

Given: Ed Lubbock’s FlashCard bill is below. There are entries missing.

To find : What is Ed’s average daily balance?

Here we will Determine the balances and the amount of time this balance is accurate.

If a payment was made, then you need to decrease the previous balance by this amount.

If a purchase was made, then you need to increase the previous balance by the amount of the purchase.

Note that the 4 transactions are given underneath TRANSACTIONS and their amounts are given under DEBITS/CREDITS(-).

Note that the dates are given along with the transactions, which allows you determine how long each balance remained constant.

13 days at 421.5 (previous balance) 7 days at 421.50+48.00=469.50

5 days at 469.50−100.00=369.50

5 days at 369.50+30.00=399.50

The average daily balance is the sum of the daily balances divided by the number of days.

13×421.50+7×469.50+5×369.50+5×399.50/30

=420.37

Hence we conclude that the average daily balance is 420.37

Chapter 4 Exercise 4.6 Consumer Credit Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 208 Problem 10 Answer

Given; Ed Lubbock’s FlashCard bill is below. There are entries missing.

To find; What is Ed’s finance charge?

The average daily balance found 420.37

we know that The finance charge is the product of daily balance and the monthly periodic rate.

420.37×1.65%=420.37×0.0165

=6.94

Hence we conclude that the finance charge is foudn to be 6.94

Page 208 Problem 11 Answer

Given: Ed Lubbock’s FlashCard bill is below. There are entries missing.

To find: What is Ed’s new balance?

The average daily balance found 420.37

we know that The finance charge is the product of daily balance and the monthly periodic rate.

420.37×1.65%=420.37×0.0165

=6.94

The new balance is the previous balance decreased by the payments/credits and increased by the new purchases/finance charge.

Finance charge found in part:6.94

421.50−100.00+78.00+6.94

=406.44

Hence we concllude that the new balance is foudn to be 406.44

How To Solve Cengage Financial Algebra Chapter 4.6 Consumer Credit

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 208 Problem 12 Answer

Given; Ed Lubbock’s FlashCard bill is below. There are entries missing.

To find; What is Ed’s available credit?

The average daily balance found 420.37 we know that The finance charge is the product of daily balance and the monthly periodic rate.

420.37×1.65%=420.37×0.0165

=6.94

The new balance is the previous balance decreased by the payments/credits and increased by the new purchases/finance charge.

Finance charge found in part:

6.94421.50−100.00+78.00+6.94

=406.44

The total available credit is the total credit line decreased by the new balance.

1,000.00−406.44=593.56

Hence we conclude that the total avalable credit 593.56

Cengage Financial Algebra Consumer Credit Exercise 4.6 Solutions

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.6 Consumer Credit Page 208 Problem 13 Answer

Given; Ed Lubbock’s FlashCard bill is below. There are entries missing.

To find; If the 30 charge to Petrela Sailboats had been posted on ,12/9 would the finance charge be higher or lower for this billing cycle? Explain

Answer: Hence we conclude that the finance charge for this billing cycle will be Lower because the later charge decreases the average daily balance.

Hence we conclude that the finance charge for this billing cycle will be Lower because the later charge decreases the average daily balance.