Financial Algebra 1st Edition Chapter 4 Consumer Credit Page 188 Problem 1 Answer

The given data is, P=18000

T=8yrs

R=4.3%

How much will she pay in interest

The interest is calculated as,

I=PTR/100

=18000×8×4⋅3/100

=$6192

Therefore, the solution is calculated as, $6192.

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 189 Problem 2 Answer

Considering the previous example’s values.

Calculate the impact an increase in the monthly payment of $50 has on the length of the loan.

The loan length is calculated as,

⇒ \(=\frac{\ln \left(\frac{M}{P}\right)-\ln \left(\left(\frac{M}{p}-\frac{r}{12}\right)\right)}{12 \ln \left(1+\frac{\gamma}{12}\right)}\)

Additional amount = $50

Initial = $300

⇒ \(t=\frac{\ln \left(\frac{350}{25000}\right)-\ln \left(\frac{350}{25000}-\frac{5.9}{100^* 12}\right)}{12 \ln \left(1+\frac{5.9}{12 * 100}\right)}\)

⇒ \(=\frac{-4.2687-(-4.7013)}{0.05885}\)

= 7.35

= 7 years

Therefore, the solution is calculated as, 7 years.

Cengage Financial Algebra Chapter 4.3 Consumer Credit Guide

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 190 Problem 3 Answer

Considering the previous example’s values.

Compare the computed loan balances when x=2

The linear equation is, y=−6777,539x+13726080,

The quadratic equation is, y=−1007797000+1006140x−251,0951x2,

The cubic equation is, y=50082020000,00001−74983100x+37423,4x2−6,22616x3

Therefore, the solution is calculated for the equations and proved using the graphs.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 4 Answer

Find how might the quote apply to what you have learned

The quote implies that the loan and debts are considered as, which worries because this makes sure that the payment of the loan occurs every month on time and thus needs to make sure that enough money is set aside each month to pay for the loan.

But if the loans are failed to pay off, it is possible to lose everything.

Therefore, the payments of the loans have to be paid on time every month, to avoid worries.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 5 Answer

The given data is,P=32000

r=6.1 %

t=10 yrs

Calculate the total interest.

Hence the monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{32,000\left(\frac{0.061}{12}\right)\left(1+\frac{0.061}{12}\right)^{12 \times 10}}{\left(1+\frac{0.061}{12}\right)^{12 \times 10}-1}\)

⇒ \(\Rightarrow M=\$ 356.87\)

The total paid is the product of the monthly payment as,

$356.87×12×10=$42,824.40

$42,824.40−$32,000=$10,824.40

Therefore, the solution is calculated as, $10824.4.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 6 Answer

The given data is, P=15000

t=4 yrs

r=5.5 %

Calculate how much will the person pay in interest over the life of the loan.

Hence the monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{15,000\left(\frac{0.055}{12}\right)\left(1+\frac{0.055}{12}\right)^{12 \times 4}}{\left(1+\frac{0.055}{12}\right)^{12 \times 4}-1}\)

⇒ \(M=\$ 348.85\)

The total paid is the product of the monthly payment as,

$348.85×12×4=$16,744.80

$16,744.80−$15,000=$1,744.80

Therefore, the solution is calculated as, $1744.8.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 7 Answer

The given data is, P=7000

t=8 yrs

r=8.6 %

Calculate which loan will have the lower interest Over its lifetime.

Hence the monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{7,000\left(\frac{0.086}{12}\right)\left(1+\frac{0.086}{12}\right)^{12 \times 8}}{\left(1+\frac{0.086}{12}\right)^{12 \times 8}-1}\)

⇒ \(M=\$ 101.10\)

The total paid is the product of the monthly payment and the number of payments,

$101.10×12×8=$9,705.60

$9,705.60−$7,000=$2,705.60

Hence the monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{7,000\left(\frac{0.10}{12}\right)\left(1+\frac{0.10}{12}\right)^{12 \times 5}}{\left(1+\frac{0.10}{12}\right)^{12 \times 5}-1}\)

⇒ \(M=\$ 148.73\)

The total paid is the product of the monthly payment and the number of payments,

$148.73×12×5=$8,923.80

$8,923.80−$7,000=$1,923.80

Therefore, the solution is considered as first national bank.

Solutions For Exercise 4.3 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 8 Answer

The given data is, P=$25000

r=7.7 %

t=2 to 10 yrs

Find the monthly payment formula for this loan situation.

Let t represent the number of years from 2 to 10 inclusive.

Hence the monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{25,000\left(\frac{0.077}{12}\right)\left(1+\frac{0.077}{12}\right)^{12 \times t}}{\left(1+\frac{0.077}{12}\right)^{12 \times t}-1}\)

⇒ \(M=\frac{160.417 \times 1.00642^{12 \times t}}{1.00642^{12 \times t}-1}\)

Therefore, the solution is calculated as, M=160.417×1.0064212×t/1.0064212×t−1

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 9 Answer

The given data is,P=$25000

r=7.7%

t=2 to 10 yrs

Find the total interest formula for this loan situation.

Let t represent the number of years from 2 to 10 inclusive.

⇒ \(M=\frac{160.417 \times 1.00642^{12 \times t}}{1.00642^{12 \times t}-1}\)

⇒ \(\frac{160.417 \times 1.00642^{12 \times t}}{1.00642^{12 \times t}-1} \times 12 \times t\)

⇒ \(\frac{160.417 \times 1.00642^{12 \times t}}{1.00642^{12 \times t}-1} \times 12 \times t-25,000\)

Therefore, the solution is 160.417×1.0064212×t/1.0064212×t−1×12×t−25,000

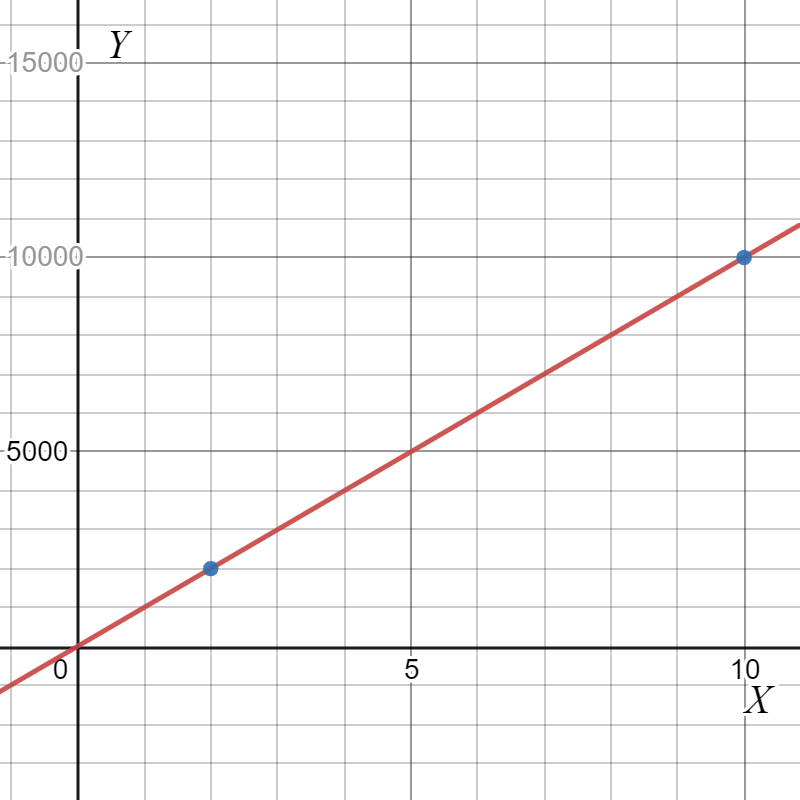

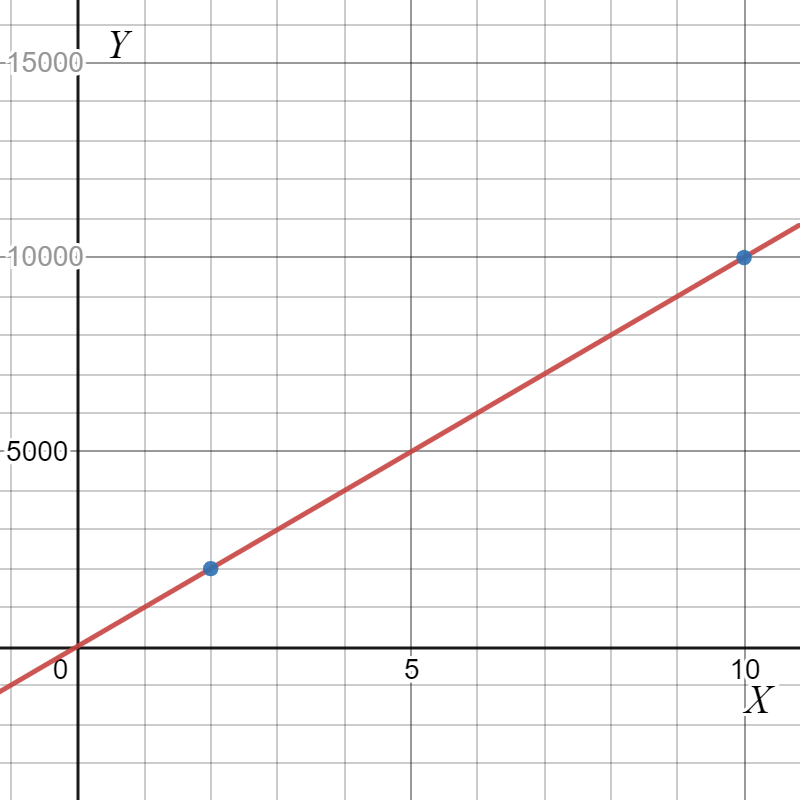

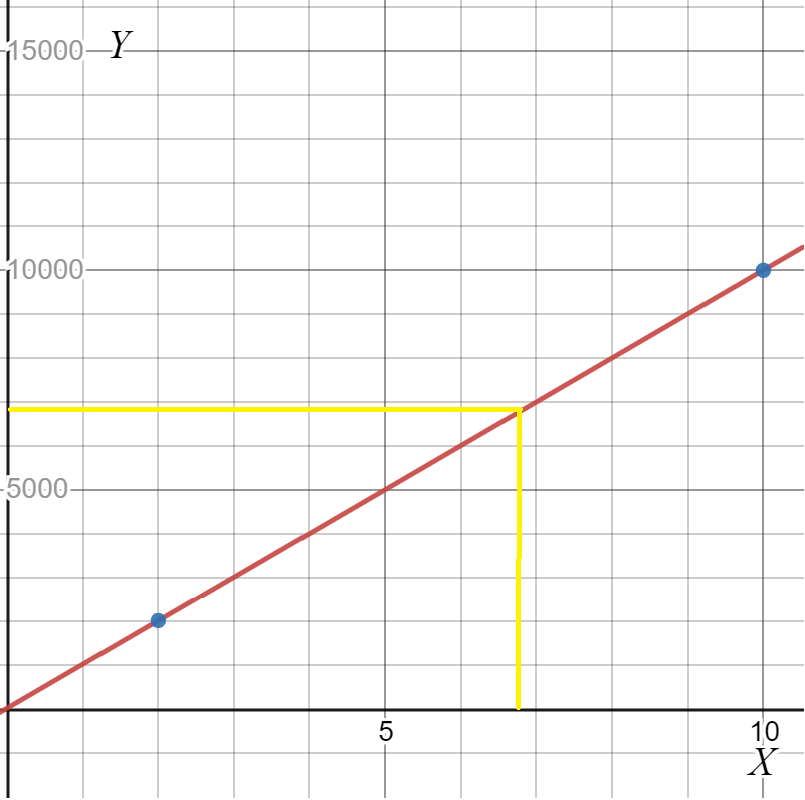

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 10 Answer

The given data is,P=$25000

r=7.7%

t=2 to 10yrs

Construct a graph

The graph is drawn as,

Therefore, the graph is drawn as, x is horizontal and y is vertical axis.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 11 Answer

The given data is, P=$25000

r=7.7 %

t=2 to10 yrs

Use your graph to estimate the interest for a 6×1/2-year loan.

After plotting the graph, if t is an amount of 6 and a half, then the interest is about $6900.

Therefore, the graph was plotted and the solution was $6900.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 12 Answer

The given data is, P=$20000

r=7.1 %

t=1/10 yr

Find the length of the loan.

Substituting the values,ln500

20000−(ln(500/20000−0.071/12))/12ln(1+0.071/12)

t=3.8 years

Therefore, the solution is calculated as nearly 3.8 years.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 13 Answer

The given data is, M=$350

p=14,000

r=6.8

Calculate the number of years.

⇒ \(t=\frac{\ln \left(\frac{M}{p}\right)-\ln \left(\frac{M}{p}-\frac{r}{12}\right)}{12 \ln \left(1+\frac{r}{12}\right)}\)

⇒ \(=\frac{\ln \left(\frac{350}{14000}\right)-\ln \left(\frac{350}{14000}-\frac{0.068}{12}\right)}{12 \ln \left(1+\frac{0.068}{12}\right)}\)

⇒ \(≈3.8 years\)

Therefore, decreasing the monthly payments by $50, increased the length of the loan by 0.5 years.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 191 Problem 14 Answer

The given data is,P=$22000

t=15 years

r=4.85 %

Calculate how much will he pay the bank in interest over the life of the loan.

The monthly payment formula is,

⇒ \(M=\frac{p\left(\frac{r}{12}\right)\left(1+\frac{r}{12}\right)^{12 t}}{\left(1+\frac{r}{12}\right)^{12 t}-1}\)

⇒ \(M=\frac{22,000\left(\frac{0.0485}{12}\right)\left(1+\frac{0.0485}{12}\right)^{12 \times 15}}{\left(1+\frac{0.0485}{12}\right)^{12 \times 15}-1}\)

M= $172.26

The total paid is the product of the monthly payment,

⇒ \(\$ 172.26 \times 12 \times 15=\$ 31,006.80\)

⇒ \(\$ 31,006.80-\$ 22,000=\$ 9,006.80\)

≈$9000.

Therefore, the solution is calculated as, $9000.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 1 Answer

Considering the table for the given yearly payment schedule. Calculate the loan amount.

Therefore, the value under the loan balance in the payment schedule is calculated as, $10000.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 2 Answer

Considering the table for the given yearly payment schedule. Calculate the length of the loan.

Therefore, the last value under the year column is 10 years.

Chapter 4 Exercise 4.3 Consumer Credit Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 3 Answer

Considering the table for the given yearly payment schedule. Calculate the monthly payment.

The principal is considered as, 1455.93.

Dividing it by 12 to get the monthly pay,

1455.93/12≈121.33

Therefore, the solution is 121.33.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 4 Answer

Considering the table for the given yearly payment schedule. Calculate the total interest paid.

Therefore, the total interest is calculated as, $4559.31, added from the entries under interest paid.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 5 Answer

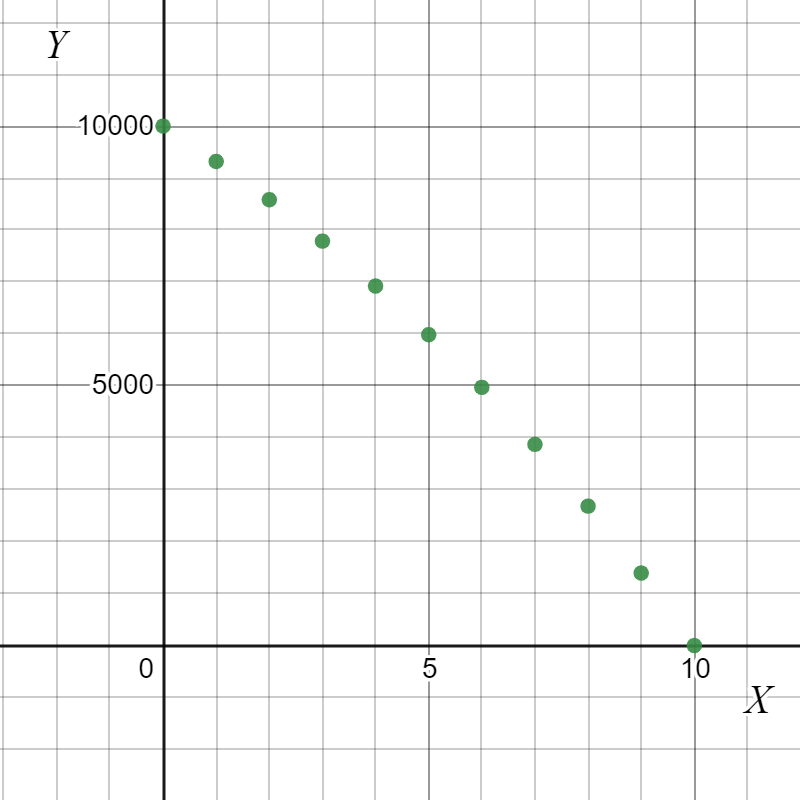

Considering the table for the given yearly payment schedule. Construct a scatterplot using the data points (year, loan balance).

The graph was plotted as shown,

Therefore, the given graph was plotted as,

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 6 Answer

Given a yearly payment schedule

To do: Write a linear regression

Determining the regression using STAT> CALC>4:LinReg(ax+b)L1,L2 then we get the following

y=ax+b

a≈−992.49

b≈10554.14

Substituting in the equation y=ax+b

we get y=−992.49x+10554.14

Therefore, the linear regression equation is y=−992.49x+10554.14

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 7 Answer

Given a yearly payment schedule

To do: Write a quadratic regression

Determining the regression using STAT> CALC>5:QuadReg L1,L2 then we get the result as follows

y=ax2+bx+c

a≈−39.35

b≈−599.01

c≈9963.93

Substituting in the form of the quadratic equation we get

y=−39.35x2−599.01x+9963.93

Therefore, the quadratic regression equation is y=−39.35x2−599.01x+9963.93

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 8 Answer

Given a yearly payment schedule

To do: Write a cubic regression

Determining the regression equation using STAT>CALC>6: CubicReg L1,L2 then we get the results as

y=ax3+bx2+cx+d

a≈−1.04

b≈−23.71

c≈−658.64

d≈−10001.46

substituting in the equation we get

y=−1.04x3−23.71x2−658.64x+10001.46

Therefore, the cubic regression equation is y=−1.04x3−23.71x2−658.64x+10001.46

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 9 Answer

Given a payment schedule

To do: Find the loan amount

The first number given in the column of the loan balance is 35,000.00 $ then the loan amount will be this

Therefore, the loan amount is 35,000.00 $

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 10 Answer

Given the payment schedule

To do: Find the length of the loan

The starting year is 2009 and the ending year is 2027 the difference between them is 18

so, the length of the loan is 18 years

Therefore, the length of the loan is 18 years

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 11 Answer

Given a payment schedule

To do: Find the approximate monthly payment

The summation of principal paid and interest paid for the value of 4065.23 then

4065.23/12≈338.77

so, the monthly payment will be 338.77 $

Therefore, the monthly payment is 338.77 $

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 12 Answer

Given a payment schedule

To do: Find the total interest paid

Summation of all the year’s interests we get=3291.90+3215.15+3130.78+3038.04+2936.10+2824.03+2700.85+2565.44+2416.59+2252.96+2073.10+1875.39+1658.05+1419.14+1156.53+867.84+550.51+201.69

=$38,174.09

Therefore, the total interest paid 38,174.09 $

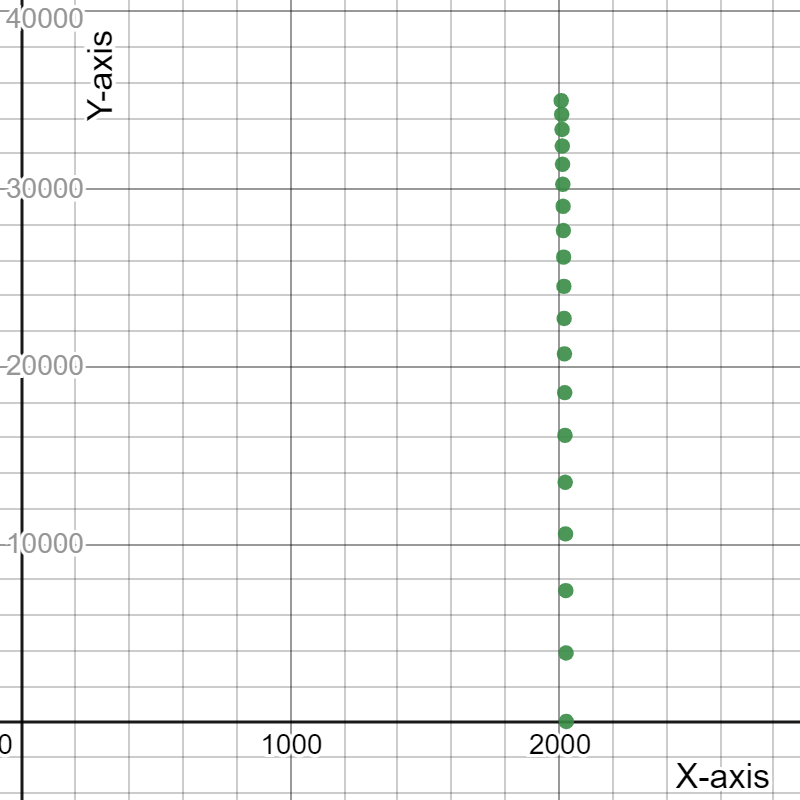

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 13 Answer

Given a payment schedule

To do: Construct a scatter plot

The graph of the year-to-load balance is as

Therefore, the scatter plot is as

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 14 Answer

Given a payment schedule

To do: Find the linear regression

Determining the regression using STAT> CALC>4: Lin Reg(ax+b) L1,L2 then we get the result as

y=ax+b

a≈−1870.62

b≈3796896.07

Substituting in the line equation we get y=−1870.62x+3796896.07

Therefore, the linear regression is y=−1870.62x+3796896.07

Cengage Financial Algebra Consumer Credit Exercise 4.3 Solutions

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 15 Answer

Given a payment schedule

To do: Write a quadratic regression

Determining the regression using STAT> CALC>5: QuadRegL1,L2 using these we get

y=ax2+bx+c

a≈−76.07

b≈−305369.01

c≈306434730.37

Substituting the values in the quadratic equation we get

y=−76.07x2−305369.01x+306434730.37

Therefore, the quadratic regression is y=−76.07x2−305369.01x+306434730.37

How To Solve Cengage Financial Algebra Chapter 4.3 Consumer Credit

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.3 Consumer Credit Page 192 Exercise 16 Answer

Given a payment schedule

To do: Write a cubic regression

Determining the regression using STAT> CALC>6: CubicReg L1, L2 and the results using this are

y=ax3+bx2+cx+d

a≈−2.81

b≈16936.85

c≈−34,006,808.68

d≈2.2760898E10≈22,760,898,000

substituting the values in the general equation we get

y=−2.81×3+16936.85x2−34,006,808.68x+22,760,898,000

Therefore, the cubic regression equation is y=−2.81×3+16936.85x2−34,006,808.68x+22,760,898,000