Financial Algebra 1st Edition Chapter 4 Consumer Credit

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 202 Problem 1 Answer

Given a spreadsheet

To do: Write the spreadsheet formula to compute the new balance in cell F2

The given spreadsheet is empty there is no entry in any cell

so, we can use zero amount in the calculation.

The formula to compute the new balance we use

A2−B2+C2+D2+2=F2

Therefore,the formula to find the new balance F2 is A2−B2+C2+D2+E2

Cengage Financial Algebra Chapter 4.5 Consumer Credit Guide

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 203 Problem 2 Answer

Given Rhonda balance

To do: Write an algebraic expression that represents her current available credit

Given that there is a previous balance of 567.91 $ and on-time credit card payment is also the same for the last month, there is no balance then the expression will be the subtraction from credit line from purchases then we get x−y as the expression

Therefore,

The algebraic expression that represents her current available credit x−y

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 203 Problem 3 Answer

Given a summary statement

To do: Find the error in the summary

From the given summary the new balance will be 850−560=290 $ and 290+300+3+4.78=597.78 $ but given as 504.78 $ this is the mistake in the summary

Therefore, the error in the summary is in the cell of new balance given as 504.78 $ but the actual new balance should be 597.78 $

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 4 Answer

Given quote is Credit card companies pay college students generously to stand outside dining halls, dorms, and academic buildings and encourage their fellow students to apply for credits cards.– Louise Slaughter, American Congresswoman

To do: Write how might the quote apply to what you have learned

From the given quote we understand that the credit card companies will pay for college students which will generate curiosity among them and apply for credit cards as the students will be more interested to listen to their peers

This will be an example for advertising especially for college students

Therefore, the given quote is applied for advertising for college students

Solutions For Exercise 4.5 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 202 Problem 5 Answer

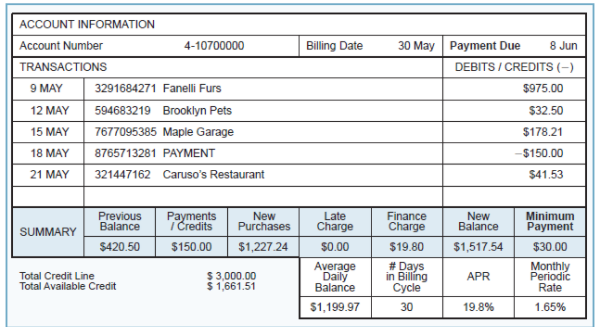

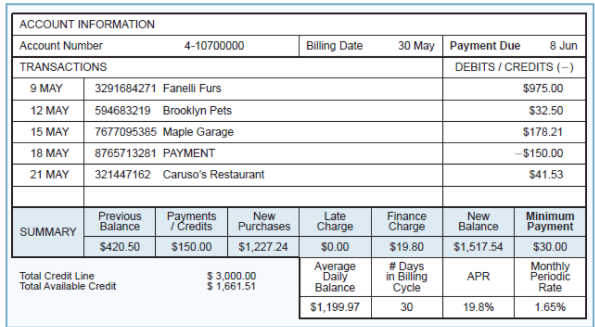

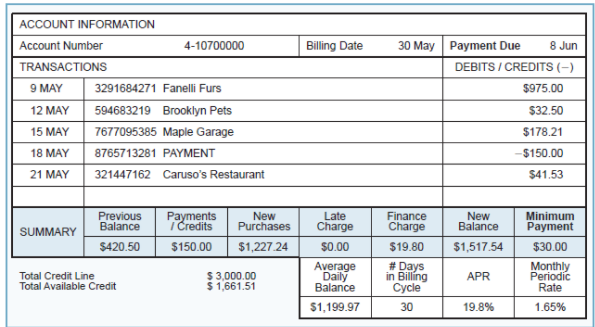

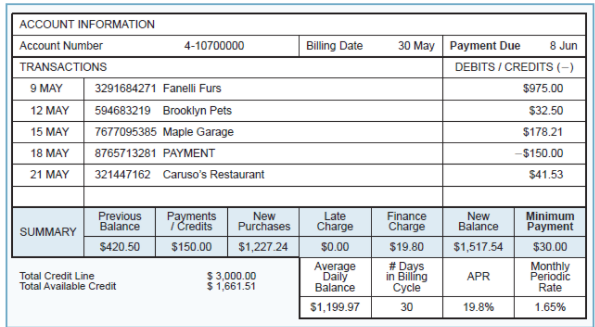

Given the flashcard statement

To do: Find the sum of all purchases made

In the given table we sum of all purchases are given under new purchases i.e.,1,227.24 $

Therefore, the sum of all purchases is 1,227.24 $

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 6 Answer

Given –

The Flash Card : We will determine when is the payment for this statement due.

The data at which the payment for this statement is due is given in the top right corner of the Flash Card Statement.

Payment Due =8Jun

The payment for this statement is due till 8 June.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 7 Answer

Given –

We will find the minimum amount that can be paid.

From the image, the minimum amount that can be paid=$30.

Minimum amount that can be paid=$30.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 8 Answer

Given –

We will find the number of days which are in the billing cycle.

The number of days in the billing cycle is given at the bottom of the FlashCard statement underneath “* Days in Billing Cycle”

Number of Days in Billing Cycle=30

The number of Days in Billing Cycle are 30.

Chapter 4 Exercise 4.5 Consumer Credit Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 9 Answer

Given –

We will determine the previous balance.

We will see the first entry in the summary.

Hence, the previous balance=$420.50

The previous balance is=$420.50

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 10 Answer

Given – Rebecca has a credit line of $6,500 on her credit card. She had a previous balance of $398.54 and made a $250 payment.

The total of her purchases is$1,257.89.

We will find Rebecca’s available credit.

Available credit= Credit line – previous balance−total amount of purchases made+payment

Available credit =6500−398.54−1257.89+250

Available credit =$5,093.57

The available credit is$5,093.57.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 11 Answer

Given -The APR on Leslie’s credit card is currently 21.6%.

We will find the monthly periodic rate.

Given: APR=21.6%

=0.216

The APR is the annual periodic rate.

The monthly periodic rate is the annual periodic rate divided by 12 , because there are12 months in a year.

Monthly periodic rate= APR/Number of months in a year

=21.6%/12

=1.8%

Cengage Financial Algebra Consumer Credit Exercise 4.5 Solutions

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 204 Problem 12 Answer

Given – Sheldon’s monthly periodic rate is 1.95%.

We will determine the APR.

Given: Monthly periodic rate=1.95%

The APR is the annual periodic rate.

The annual periodic rate is the monthly periodic rate multiplied by 12, because there are 12months in a year.

APR=Monthly periodic rate×Number of months in a year

=1.95%×12

=23.4%

The ARN is 23.4%.

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 13 Answer

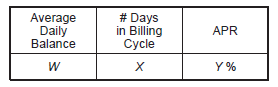

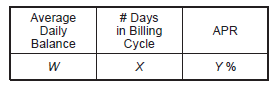

Given –

The credit card summary :

We need to express the sum of the cycle’s daily balances algebraically.

We note that the sum of the cycle’s daily balances=Average daily balance×No. of days in billing cycle

Hence, Sum of the cycle′s daily balances = WX

We conclude that : Sum of the cycle′s daily balances = WX

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 14 Answer

Given –

The credit card summary :

We need to express the monthly periodic rate as an equivalent decimal without the% symbol.

Given: APR=Y%

The APR is the annual periodic rate.

The monthly periodic rate is the annual periodic rate divided by 12, because there are 12 months in a year.

Monthly periodic rate= APR/Number of months in a year

=Y%/12

=Y/100/12

=Y/12×100

=Y/1200

Monthly periodic rate =Y/1200

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 15 Answer

Given – The credit card summary :

We need to express the monthly periodic rate as an equivalent decimal without the % symbol.

Given: APR=Y%

The APR is the annual periodic rate.

The monthly periodic rate is the annual periodic rate divided by 12, because there are 12 months in a year.

Monthly periodic rate = APR/ Number of months in a year

=Y%/12

=Y/100/12

=Y/12×100

=Y/1200

Monthly periodic rate =Y/1200

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 16 Answer

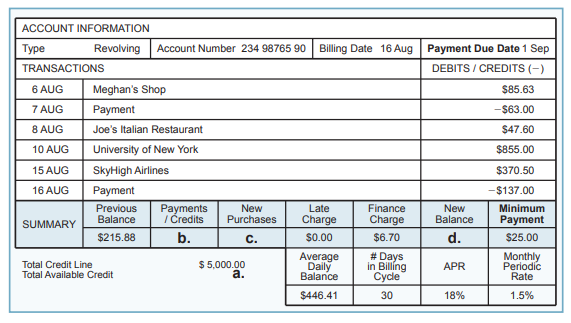

Given –

We will find the amounts a,b,c, and d.

The previous balance is given in the SUMMARY of the FlashCard statement underneath “Previous balance”.

Previous balance=$215.88

The finance charge is given in the SUMMARY of the FlashCard statement underneath “Finance charge”.

Finance charge=$6.70

The total credit line is given in the bottom left corner of the FlashCard statement next to “Total Credit Line”.

Total credit line=$5,000.00

The amounts of the transactions (debits and credits) are given in the column “DEBITS/CREDITS” (where the debits are the positive amounts and the credits are the negative amounts).

The new balance is then the previous balance increased by the debits, decreased by the credits and increased by the finance charge.

New balance =Previous balance +Debits−Credits+Finance charge

=215.88+(85.63+47.60+855.00+370.50)−(63.00+137.00)+6.70

=215.88+1358.73−200.00+6.70

=1381.81

The total available credit is the total credit line decreased by the new balance:

Total available credit=Total credit line−New balance

=5000−1381.81

=3618.19

The payments/credits are the negative amounts in the column “DEBITS/CREDITS” of the FlashCard summary.

First payment: $63.00

Second payment:$137.00

The summary should contain the sum of all payments/credits underneath “Payments/Credits”.

Payments/Credits=First payment+ Second payment

=63.00+137.00

=200.00

The new purchases are the positive amounts in the column “DEBITS/CREDITS” of the FlashCard summary.

First purchase:$85.63

Second purchase:$47.60

Third purchase: $855.00

Fourth purchase: $370.50

The summary should contain the sum of all purchases underneath “New Purchases”.

New Purchases= First purchase+Second purchase+Third purchase+ Fourth purchase

=85.63+47.60+855.00+370.50

=1358.73

The previous balance is given in the SUMMARY of the FlashCard statement underneath “Previous balance”.

Previous balance=$215.88

The finance charge is given in the SUMMARY of the FlashCard statement underneath “Finance charge”.

Finance charge=$6.70

The total credit line is given in the bottom left corner of the FlashCard statement next to “Total Credit Line”.

Total credit line=$5,000.00

The amounts of the transactions (debits and credits) are given in the column “DEBITS/CREDITS” (where the debits are the positive amounts and the credits are the negative amounts).

The new balance is then the previous balance increased by the debits, decreased by the credits and increased by the finance charge.

New balance= Previous balance + Debits − Credits + Finance charge

=215.88+(85.63+47.60+855.00+370.50)−(63.00+137.00)+6.70

=215.88+1358.73−200.00+6.70

=1381.81

We obtain :

a=3618.19

b=200.00

c=1358.73

d=1381.81

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 17 Answer

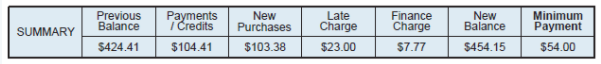

Given –

We need to check the new balance entry on the monthly statement below by using the first five entries.

If the new balance is incorrect, we will write the correct amount.

The previous balance is given in the SUMMARY of the FlashCard statement underneath “Previous balance”.

Previous balance=$424.41

The total payments is given in the SUMMARY of the FlashCard statement underneath “Payments/Credits”.

Total payments=$104.41

The total of the new purchses is given in the SUMMARY of the FlashCard statement underneath “New Purchases”.

New Purchases=$103.38

The late charge is given in the SUMMARY of the FlashCard statement underneath “Late charge”.

Late charge=$23.00

The finance charge is given in the SUMMARY of the FlashCard statement underneath “Finance charge”.

Finance charge=$7.77

The amounts of the transactions (debits and credits) are given in the column “DEBITS/CREDITS” (where the debits are the positive amounts and the credits are the negative amounts).

The new balance is then the previous balance increased by the new purchases, decreased by the total payments and increased by the finance charge.

New balance=Previous balance+New purchases−Total payments+Late charge+Finance charge

=424.41+103.38−104.41+23.00+7.77

=454.15

We then note that the new balance is $454.15 as claimed by the summary of the credit card statement.

The new balance is $454.15 as claimed by the summary of the credit card statement.

How To Solve Cengage Financial Algebra Chapter 4.5 Consumer Credit

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 18 Answer

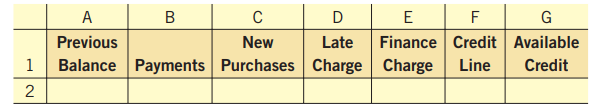

Given –

A credit card statement is modeled using the following spreadsheet. Entries are made in columns A–F.

We will write the formula to calculate the available credit in cell G2.

The previous balance is given underneath “Previous balance”, which is thus cell A2.

Previous balance=A2

The total payments are given underneath “Payments/Credits”, which is thus cell B2.

Total payments=B2

The total of the new purchases is given underneath “New Purchases”, which is thus cell C2.

New Purchases=C2

The late charge is given underneath “Late charge”, which is thus cell D2.

Late charge=D2

The finance charge is given underneath “Finance charge”, which is thus cell E2.

Finance charge=E2

The credit line is given underneath “Credit line”, which is thus cell F2.

Credit line=F2

The available credit needs to be given underneath “Available Credit”, which is thus ce llG2

Available credit=G2

The new balance is then the previous balance increased by the new purchases, decreased by the total payments and increased by the finance charge

New balance = Previous balance − Total payments + New purchases + Late charge + Finance charge

=A2−B2+C2+D2+E2

The available credit is then the credit line decreased by the new balance:

Available= Credit line−New balance

G2 G2=F2−(A2−B2+C2+D2+E2)

=F2−A2+B2−C2−D2−E2

We conclude that :

G2=F2−A2+B2−C2−D2−E2

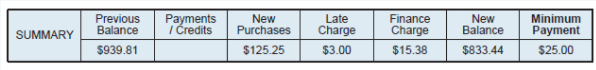

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 19 Answer

Given –

We need to determine the amount

The previous balance is given in the SUMMARY of the FlashCard statement underneath “Previous balance”.

Previous balance=$939.81

The total payments is given in the SUMMARY of the FlashCard statement underneath “Payments/Credits”. Let us name the total payments ASAP.

Total payments=x

The total of the new purchases is given in the SUMMARY of the FlashCard statement underneath “New Purchases”.

New Purchases=$125.25

The late charge is given in the SUMMARY of the FlashCard statement underneath “Late charge”.

Late charge=$3.00

The finance charge is given in the SUMMARY of the FlashCard statement underneath “Finance charge”.

Finance charge=$15.38

The New Balance is given in the SUMMARY of the FlashCard statement underneath “new balance”.

New balance=$833.44

The new balance is then the previous balance increased by the new purchases, decreased by the total payments and increased by the finance charge.

New balance=Previous balance+New purchases−Total payments+ Late charge+Finance charge

833.44+x/x

x=939.81+125.25−x+3.00+15.38

=1083.44−x

=1083.44

=1083.44−833.44

=250

We then note that the total payment is$250.

The amount of the payment made on this credit card is$250.

Step-By-Step Solutions For Chapter 4.5 Consumer Credit Exercise

Cengage Financial Algebra 1st Edition Chapter 4 Exercise 4.5 Consumer Credit Page 205 Problem 20 Answer

Given – The previous balance after the last billing cycle is represented by A, recent purchases by B, payments by C, finance charge by D, and late charge by E.

We need to express the relationship among the variables that must be true for the new balance to be zero.

Given: Previous balance =A

Total payments =C

New Purchases =B

Late charge=E

Finance charge=D

New balance=0

The new balance is then the previous balance increased by the new purchases, decreased by the total payments, and increased by the finance charge.

New balance=Previous balance+New purchases−Total payments+ Late charge+ Finance charge

0=A+B−C+E+D

C=A+B+D+E

Thus we then note that the equation is0=A+B−C+E+D needs to be true when the balance is zero, or equivalently C=A+B+D+E

The relationship among the variables is: C=A+B+D+E