Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.8 Banking Services

Page 162 Problem 1 Answer

To find: How many years would it take for $10,000 to grow to $20,000 in the same account?

P=B(1+r/n)nt

10000=20000

(1+0.5/1)1(t)

1=2/(1.5)t/(1.5)t

=2log(1.5)t

=log 2 t log(1.5)=log2

t=log2/log1.5

t=1.70

Hence the answer is 1.7 years

Page 163 Problem 2 Answer

To find: How does the equation from Example 2 change if the interest is compounded weekly?

Use the formula for the present value of a single deposit investment. Let B=100,r=0.038,t=10, and n=52.

Substitute.

P=B(1+r/n)n1

P=100,000

(1+0.038/52)52(10)

Calculate.P=68,395.632

Ritika must deposit approximately$68,395632.

Hence the answer is $68,395632.

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Page 164 Problem 3 Answer

To find: Write the formula to find the present value of an x-dollar balance that is reached by periodic investments made semiannually for y years at an interest rate of r.

PV=X×(1−1

(1+(r/2))yx2)/(r/2)

Periodic payment (PMT) = X

Time (n) =yx2

Interest rate (r) =r/2

PV=PMT×(1−1/(1+r)/n)/r

=X×(1−1(1+(r/2))yx2)/(r/2) on simplifying

=X⋅(1−1(1+(r/2))2y)/r/2

Hence the present value is X⋅(1−1(1+(r/2))/2y)/r/2

Cengage Financial Algebra Chapter 3.8 Banking Services Guide

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.8 Banking Services Page 165 Problem 4 Answer

To find: How might those words apply to what has been outlined in this lesson?

In order to start setting financial goals, you need to take into account what you can currently afford to save (thus determine how much money you have left over after you have paid all bills and bought all necessary items such as food and clothes).

This is necessary, because else you will start making debts to pay for your food or bills, which will not aid your overall financial situation.

Moreover, it is also useful to look ahead at the future value savings, such that you know what you will earn from these future value savings in the future and also such that you can determine what you will do with this money in the future.

Hence the answer is In order to start setting financial goals, you need to take into account what you can currently afford to save.

Page 165 Problem 5 Answer

To find: Complete the table to find the single deposit investment amounts.

1)P=B(1+r/n)nt

=1,000(1+0.04/1)1×3

=1,000(1.04)3≈889.00

2)P=B(1+r/n)nt

=2,500(1+0.03/2)2×5

=2,500(1.015)10

≈2,154.17

3)P=B(1+r/n)nt

=10,000(1+0.05/4)4×10

=10,000/(1.0125)40

≈6,084.13

4)P=B(1+r/n)nt

=50,000(1+0.0275/12)12×8

≈40,136.04

Hence the answers are

(1) $889.00

(2) $2,154.17

(3) $6,084.13

(4) $40,136.04

Page 165 Problem 6 Answer

To find: Complete the table to find the periodic deposit investment amounts.

a)P=B×r/n(1+r/n)nt−1

=50,000×0.02/1(1+0.02/1)1×8−1

≈5,825.49

b)P=B×r/n(1+r/n)nt−1

=25,000×0.015/2(1+0.015/2)2×4−1

≈3,043.89

c)P=B×r/n/(1+r/n)nt−1

=10,000×0.05/4(1+0.05/4)4×10−1

≈194.21

d)P=B×r/n(1+r/n)nt−1

=1,000,000×0.04/12(1+0.04/12)12×20−1

≈2,726.47

Hence the answer is

(1) $5,825.49

(2) $3,043.89

(3) $194.21

(4) $2,726.47

Page 165 Problem 7 Answer

To find; how much must he deposit each year in order to reach his goal?

P=B×r/n/(1+r/n)nt−1

=50,000×0.042/1/(1+0.042/1)1×7-1

≈6,292.16

Hence the answer is $6292.16

Solutions For Exercise 3.8 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.8 Banking Services Page 165 Problem 8 Answer

To find; How much must he deposit now into an account that yields 2.75% interest, compounded monthly, so he can be assured of reaching his goal?

P=B×r/n/(1+r/n)nt−1

=80,000/(1+0.0275/12)12×20

≈46,185.05

Hence the answer is $46185.04

Page 165 Problem 9 Answer

To find: She sets a goal of saving $10,000 by the time she is 24 years old. How much must she deposit each month?

P=B×r/n/(1+r/n)nt−1

=10,000×0.044/12/(1+0.044/12)12/3-1

≈260.36

Hence the answer is $260.36

Page 165 Problem 10 Answer

To find: Suni needs to repay her school loan in 4 years. How much must she semiannually deposit into an account that pays 3.9% interest, compounded semiannually, to have $100,000 to repay the loan?

P=B×r/n/(1+r/n)nt−1

=10,000×0.039/2/(1+0.039/2)2×4-1

≈11671.58

Hence the answer is $11671.58

Chapter 3 Exercise 3.8 Banking Services Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.8 Banking Services Page 165 Problem 11 Answer

To find: Rich needs $50,000 for a down payment on a home in 5 years. How much must he deposit into an account that pays 6% interest, compounded quarterly, in order to meet his goal?

P=B×r/n/(1+r/n)nt−1

=50,000/(1+0.06/4)4×5

≈37123.52

Hence the answer is $37123.52

Cengage Financial Algebra Banking Services Exercise 3.8 Solutions

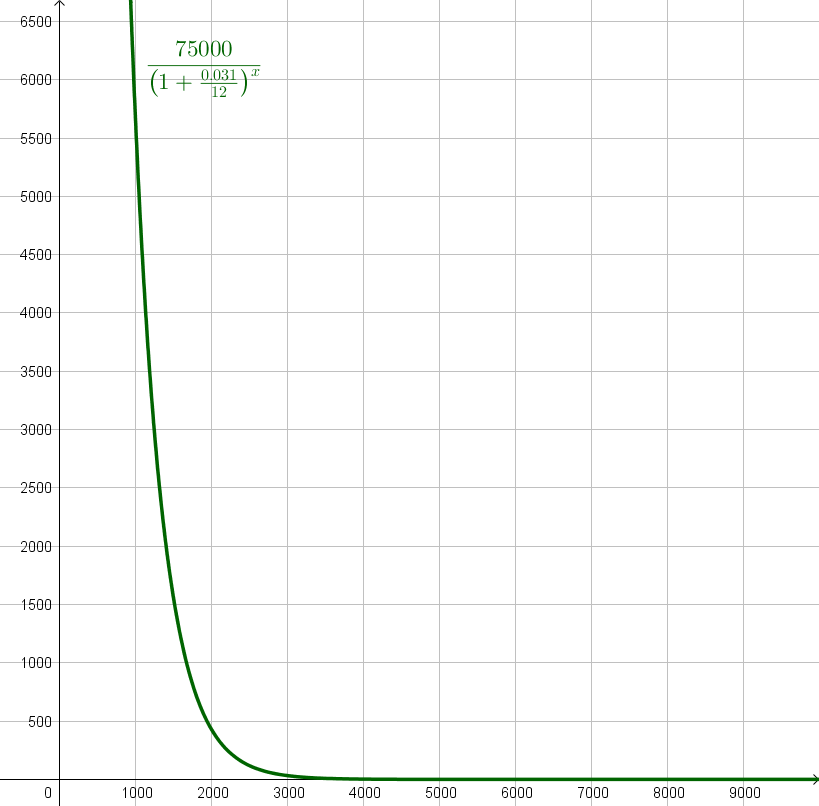

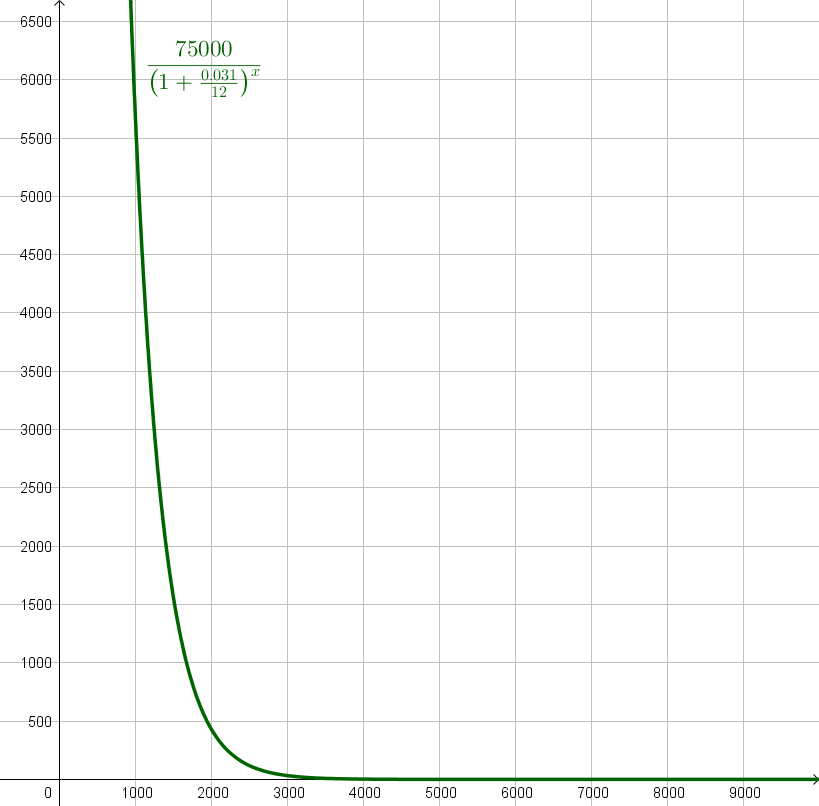

Page 165 Problem 12 Answer

To find: Marcy wants to have $75,000 saved sometime in the future. How much must she deposit into an account that pays 3.1% interest, compounded monthly? Use a graphing calculator to graph the present value function.

P=B×r/n/(1+r/n)nt−1

=75,000/(1+0.031/12)12xr/12

75,000/(1+0.031/12)x

Hence the answer is 75,000/(1+0.031/12)x where x represent the number of months