Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services

Page 125 Problem 1 Answer

Given: We have given a bank statement and monthly cycles of checks.

To find: Name some reason why the check has not been clear.

Many people and businesses hold onto checks and do not deposit or cash them immediately.

Reasons a Bank Balance Will Differ from a Company’s Balance

Some of the reasons for a difference between the balance on the bank statement and the balance on the books include:

Outstanding checks

Deposits in transit

Bank service charges and check printing charges

Errors on the company’s books

Electronic charges and deposits that appear on the bank statement but are not yet recorded in the company’s records

If an outstanding check of the previous month does not clear the bank in the current month, the check will remain on the list of outstanding checks until the month that it does clear the bank.

In the bank reconciliation process, the total amount of the outstanding checks is deducted from the balance appearing on the bank statement.

Hence, we prove that why a check may not have cleared during the monthly cycle and appear on the bank statement.

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Page 126 Problem 2 Answer

Given: outstanding checks.

To find: Write a formula to calculate the sum of the outstanding checks.

In the bank reconciliation process, the total amount of outstanding checks is subtracted from the ending balance on the bank statement when computing the adjusted balance per bank.

(No adjustment is needed to the company’s general ledger accounts, since the outstanding checks were recorded when they were issued.)

Hence, the formula to calculate the sum of the outstanding checks the total amount of outstanding checks is subtracted from the ending balance on the bank statement when computing the adjusted balance per bank.

Cengage Financial Algebra Chapter 3.2 Banking Services Guide

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 126 Problem 3 Answer

Given: Nancy has a balance of $1,078 in her check register. The balance on her bank account statement is $885.84.

Not reported on her bank statement are deposits of $575 and $250 and two checks for $195 and $437.84.

To find: Is her check register balanced? Explain.

Yes; 885.84 + 575 + 250 – 195 – 437.84 = 1078.

Since her revised statement balance equals her check register balance, the check register has been reconciled.

Hence, we prove that her revised statement balance equals her check register balance, the check register has been reconciled.

Page 127 Problem 4 Answer

Given: Ken filled out this information on the back of his bank statement.

To find: Find Ken’s revised statement balance. Does his account reconcile?

Revised Statement Balance = Ending Balance + Deposits – Checks Outstanding

$=197.10+600-615.15$

$=181.95$

which is not equal to check register balance hence the account does not reconcile

Hence, we found Ken’s revised statement balance is 181.95$ which is not equal to check register balance hence the account does not reconcile

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 128 Problem 5 Answer

Given that Donna has a checking account that charges0.15

for each check written and a monthly service charge of 9.75.

We will write a formula that Donna can use each month to find the fees she will be charged. Identify any variable you use in the formula.

Let F be the total fees payable.

Let n be the number of checks written

Fee per check=0.15dollar.

So, total fee of n

checks=0.15n

Also, service charge=9.75 dollars

Then, total fee = service charge+total check fee

So, F=9.75+0.15n

The required formula is :

F=9.75+0.15n

Page 130 Problem 6 Answer

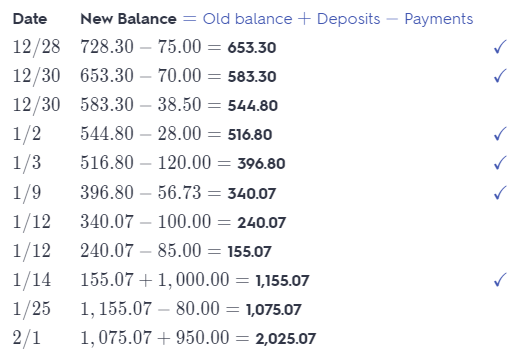

We will fill in the missing balances in Raymond Marshall’s check register.

We will use the spreadsheet from www.cengage.com/school/math/financialalgebra to determine if Raymond’s checking account reconciles with his statement.

We note that all balance totals are missing in the check register and thus we have to calculate these balances for every row of the check register.

The new balance is the previous balance increased by the deposit or decreased by the payment.

We also add a check mark if the check mark is already present in the check register or if the payment/deposit is mentioned in the monthly statement.

In the check register, we note that there are five rows with no check mark and thus these five transactions were not included in the monthly statement.

Payment of$38.50 on 12/30

Payment of$100.00 on1/12

Payment of $85.00 on1/12

Payment of$80.00 on1/25

Deposit of$950.00 on2/1

The ending balance on the monthly statement is$1,378.57.

Ending balance=$1,378.57

The revised statement balance is then the ending balance increased by the outstanding deposits and decreased by the outstanding payments.

Revised statement balance= Ending balance+Outstanding deposits−Outstanding payments

=$1,378.57+$950.00−$38.50−$100.00−$85.00−$80.00

=$2,025.07

We note that the revised statement balance of $2,025.07 is the same as the final balance total of$2,025.07 on the check register, thus the bank statement and check register reconcile.

The bank statement and check register reconcile.

We obtain :

653.30583.30544.80516.80396.80340.07240.07155.071155.071,075.072,025.07

Page 127 Problem 7 Answer

Given: We have given a bank statement and monthly cycles of check.

To find: Name some reason why check has not been clear.

Gross income means income before expenses and tax etc.

Net income means income after expenses and tax etc. Everyone must reconcile their gross and net incomes every year.

Errol Lynn says he needs to reconcile his ‘gross’ habits, drinking, smoking, womanizing against his actual income, which of course would never be enough.

Hence, we conclude that Errol Lynn says he needs to reconcile his ‘gross’ habits, drinking, smoking, womanizing against his actual income, which of course would never be enough.

Solutions For Exercise 3.2 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 127 Problem 8 Answer

Given: We have given a bank statement.

To find: write a formula and a statement for Hannah.

S=B+D-C

Revised Statement Balance = Ending Balance + Deposits – Checks Outstanding if S is equal to R then the account reconcile

Hence, the formula is Revised Statement Balance = Ending Balance + Deposits – Checks Outstanding if S is equal to R then the account reconcile

Page 127 Problem 9 Answer

Given: we have given a bank statement.

To find: What is the mean number of checks Jill wrote per month during the last four months?

Checks per month = total checks / no of months

Total checks. =14+19+23+24=80

No of months =4

So, checks written per month. =80 / 4=20 checks

Hence, the mean number of checks Jill wrote per month during the last four months is 20.

Page 127 Problem 10 Answer

Given: Given a check statement.

To find: estimate how much Jill expects to pay in per-check fees each month after she switches to the new account.

Mean checks per month. $=20 ( from Q. 5a) Fees per check $= 0.2

So fees estimated to be paid in per check fees each month = no of checks times fee per check 20\0.2$= 4

Hence, Jill expects to pay in per-check fees each month after she switches to the new account is $4.

Chapter 3 Exercise 3.2 Banking Services Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 127 Problem 11 Answer

Given: We have given a check statement.

To find: Estimate the total monthly fees Jill will pay each month for the new checking account.

Monthly maintenance fees $= 12.50

Fees paid for checks written per month $= 4( Q.5B)

So, total fees paid. $=12.50+4=16.50 dollars

Hence, he total monthly fees Jill will pay each month for the new checking account is $16.50

Page 127 Problem 12 Answer

Given: Rona filled out this information on monthly statement.

To find: Find Rona’s revised statement balance. Does account reconcile?

Revised Statement Balance = Ending Balance + Deposits – Checks Outstanding

$=725.71+610.00-471.19$

$=864.52$ which is equal to check register balance hence the account reconcile

Hence, we found Rona’s revised statement balance is 864.52$ which is equal to check register balance hence the account reconcile

Page 130 Problem 13 Answer

When comparing his check register to his bank statement, Donté found that he had failed to record deposits of55.65,103.50,and25.00.

We will determine the total of these amounts and how will he use this information to reconcile his account.

We will use the known facts.

Deposits that were not recorded:$55.65,$103.50,$25.00

Let us first determine the total of all unrecorded deposits:55.65+103.50+25.00=184.15

Thus we note that the total of all unrecorded deposits is$184.15.

We will then reconcile his account by subtracting$184.15 from the ending balance and also noting this in the check register.

The total of these amounts is$184.15.

We will reconcile his account by subtracting$184.15 from the ending balance and also noting this in the check register.

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 130 Problem 14 Answer

Given -d>c

Alisha has a February starting balance of $678.98 in her checking account.

During the month, she made deposits that totaled d dollars and wrote checks that totaled cdollars.

Here E=her ending balance on February28. We will write an inequality using E and the starting balance to show the relationship of her starting and ending balances for each condition.

If d>c, then that means that the February starting balance will increase because total deposits are greater than total withdrawals.

Thus,E should be greater than the February starting balance.

For example, letd=$100 and c=$50:

Ending balance

=$678.98+$100−$50

=$728.98

Ending balance is greater than starting balance.

We get E>$678.98

The required inequality is :

E>$678.98

Cengage Financial Algebra Banking Services Exercise 3.2 Solutions

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.2 Banking Services Page 130 Problem 15 Answer

Given -d<c Alisha has a February starting balance of$678.98 in her checking account.

During the month, she made deposits that totaled d dollars and wrote checks that totaled d dollars. Here,E= her ending balance on February 28.

We will write an inequality using E and the starting balance to show the relationship of her starting and ending balances for each condition.

If d<c, then that means that the February starting balance will decrease because total deposits are lower than total withdrawals.

Thus,E should be lower than the February starting balance.

For example, let d=$50 and c=$100:

Ending balance

=$678.98+$50−$100

=$628.98

Ending balance is lower than starting balance.

Hence, E<$678.98

The required inequality is : E<$678.98