Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services

Page 119 Problem 1 Answer

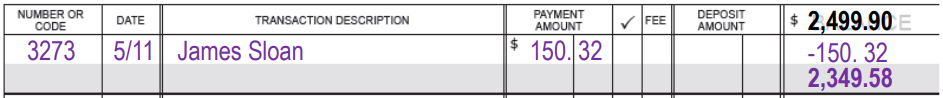

Given: Nick friend James Sloan on May 11 for $150.32.

To find: What should he write in the check register and what should the new balance be?

Here is

Hence, We have checked register the new balance be $2349.58.

Page 119 Problem 2 Answer

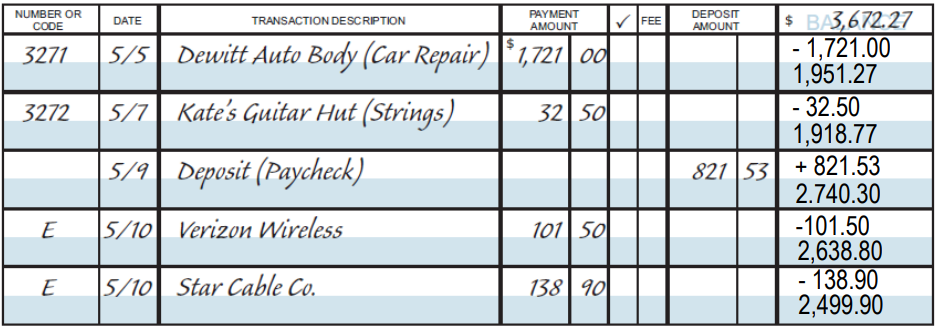

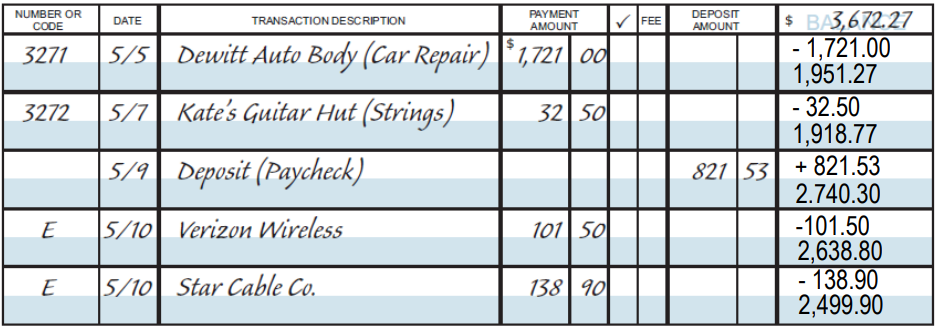

Given: Nick friend James Sloan on May 11 for $150.32.

To find: We need to determine the balance in his account after star Cable co.

So here is the solution as

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Hence, the balance in his account is

Page 120 Problem 3 Answer

Given: Will Rogers quotation is “There have been three great inventions since the beginning of time: fire, the wheel, and central banking”.

To find: What is the Outline in this lesson?

Fire is an essential part of our daily life, because we need to fire to cook food and we also need fire to create warmth (during cold seasons).

The wheel is also an essential part of our daily life, because the wheel made it possible to travel great distances in a short amount of time and vehicles that use wheel have become an essential part of our daily lives.

Similarly, Central banking is also an essential part of our daily life, because most transactions and payment are done by banks.

So, here is lesson is Central banking is also an essential part of our daily life, because most transactions and payment are done by banks.

Cengage Financial Algebra Chapter 3.1 Banking Services Guide

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 120 Problem 4 Answer

Given: Jackie deposited an $865.98 paycheck, a $623 stock dividend check, a $60 rebate check and $130 cash into her checking amount.

Her original balance was $278.91

To find: We need to assume that the checks clear, how many was in her amount after the deposit made ?

This is the starting balance indicated in the problem.

$278.91

278.91+865.98+623+60+130=1,957.89

The values 865.98,623,60 and 130 are added since these amounts which are deposited in Jackie’s account which gives monetary value.

Hence, There was in her amount after the deposit made is $1,957.89

Page 120 Problem 5 Answer

Given: Rich has t dollars in his checking account. On jane 3, he deposited w, h and v dollars and cashed a check for k dollars.

To find: We need to write an aglebraic expression that represents the amount of money in his account after the transactions.

Lets

Balance account: t dollars

First deposit: w dollars

Second deposit: h dollars

Third deposit: v dollars

Cashed check: k dollars.

Cashing a check implies that you take the amount of the check out of your account and thus your balance of the account will decrease.

The new balance is the old balance of the account increased by all deposits and decreased by the cashed check:

New balance

= Previous balance + Deposits − Cashed check

=t+(w+h+v)−k

=t+w+h+v−k

Hence, The aglebraic expression of he amount of money in his account after the transactions is

t+w+h+v−k

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 120 Problem 6 Answer

Given : John cashed a check for : $ 630

The teller gave him three fifty-dollar bills, eighteen twenty-dollar bills, t ten-dollar bills.

To find: We need to determine the value of t

So here is

Total amount cashed =$630

No. of 50 dollar bills =3

So, total amount of 50 dollar bills =3×50=$150

Number of 20 dollar bills $=18$

So, total amount of 20 dollar bills =18×20 =$360

No of 10 dollar bills =t

So, total amount of 10 dollar bills =t×10 =10t

Now, 150+360+10t=630

5t=120

i.e. t=12

Hence, We got the value of t is t=12

Page 120 Problem 7 Answer

Given: Monthly maintenance fee of $13 Check writing fee is $0.07 Last balance check is $289

To find: What was the total of all fees he paid on that account last year ?

Maintenance fee: $13 per month

Check writing fee: $0.07 per check 289 checks We are interest in the total fees in 1 year.

Since there are 12 months in a year, the total maintenance fee is the product of the fee per month and the number of months.

Total maintenance fee = Monthly maintenance fee × Number of months

=13×12 =156

The total check writing fee is the product of the check writing fee per check and the number of checks.

Total check writing fee = Check writing fee per check × Number of checks

=0.07×289

=20.23

The total fees is then the sum of the total maintenance fee and the total check writing fee:

Total fee = Total maintenance fee + Total check writing fee

=156+20.23

=$176.23

Hence, In the last year the total of all fees he paid on that account is =$176.23

Page 120 Problem 8 Answer

Given: Joby had $421.56 in her account. after deposit g twenty-dollar and k quarters.

To find: We need to write the expression of the amount of money in her account after the deposit.

So here, Previous balance account: $421.56

Deposits: g20-dollar bills and k quarters

The total value of g20-dollar bills is 20g as each bill is worth 20 dollars.

The total value of k quarters is 0.25k as each quarter is worth 25 cents or 0.25 dollars.

The new balance is the old balance of the account increased by all deposits and the earned interest, and decreased by the written check and the fees that need to be paid:

New balance

= Previous balance + Deposits + Interest − Written checks − Fee

=421.56+(20g+0.25k)

=421.56+20g+0.25k

Hence, The expression of the amount of money in her account after deposit is

421.56+20g+0.25k

Solutions For Exercise 3.1 Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 120 Problem 9 Answer

Given: Hector had y dollars in his saving account, Deposit amount twenty-dollar bills and dollar coins.

Total of twenty dollar bills was $60

To find: We need to write the expression for the balance in hector’s account after deposit.

Let’s,Previous balance account: y Deposits: 4 times as many dollar coins as twenty dollar bills Total twenty dollar bills =$60

Let x be the number of twenty dollar bills, then there are 4x dollar coins in the deposit.

The total of the twenty dollar bills is then the product of the number of twenty dollar bills x and the value per bill (20 dollars).

Total twenty dollar bills = Number of twenty dollar × Value per bill

60=x×20

Divide each side by 20/3=x

Thus we know that x=3.

We can then determine the number of dollars coins deposited.

4x=4(3) =12

Thus the total of the twenty dollars bills was $60,

while the total of the dollar coins is 12$ (as there are 12 dollar coins and each dollar coin is worth 1$ ).

The new balance is the old balance of the account increased by all deposits and the earned interest, and decreased by the written check and the fees that need to be paid:

New balance = Previous balance + Deposits + Interest – Written checks – Fee

=y+(60+12)

=y+72

Hence, We got the expression is y+72.

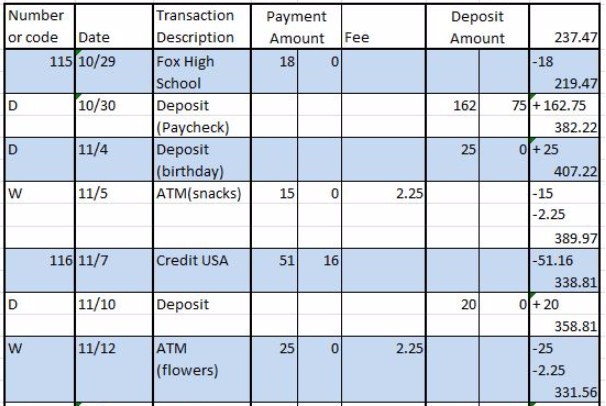

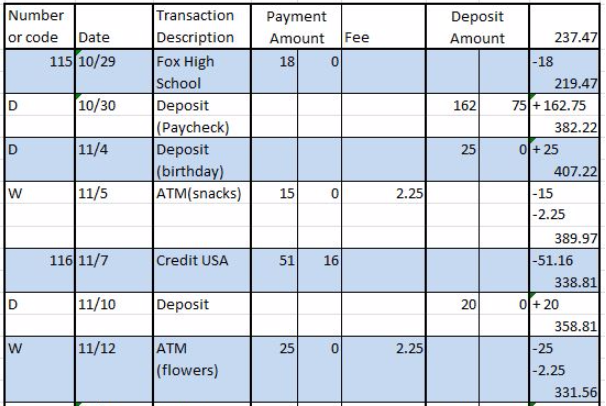

Page 121 Problem 10 Answer

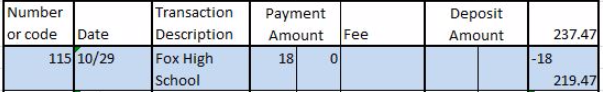

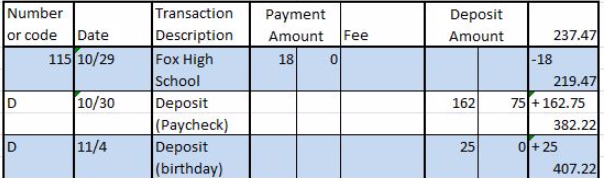

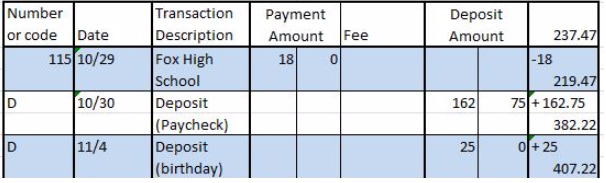

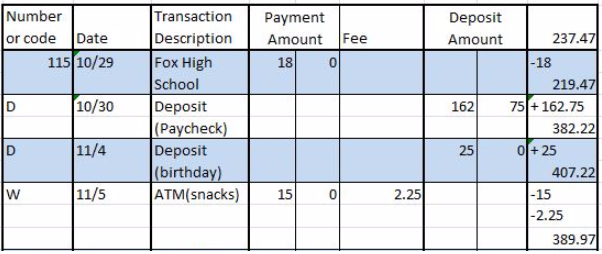

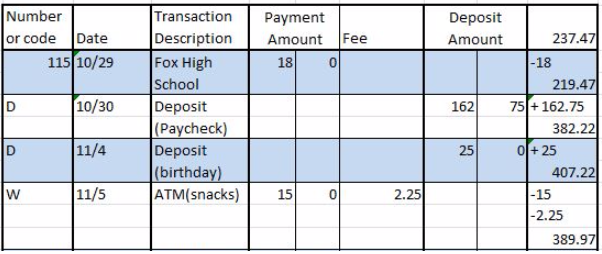

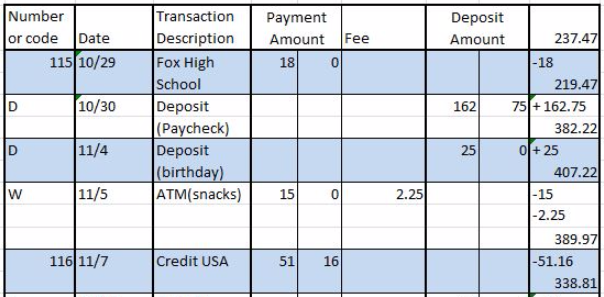

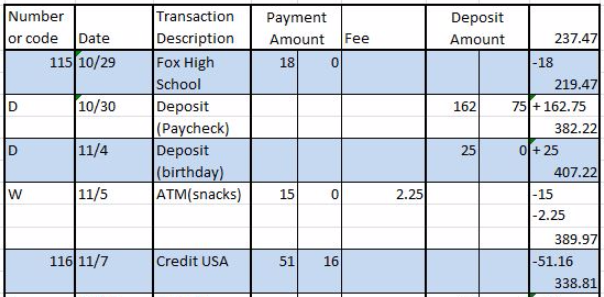

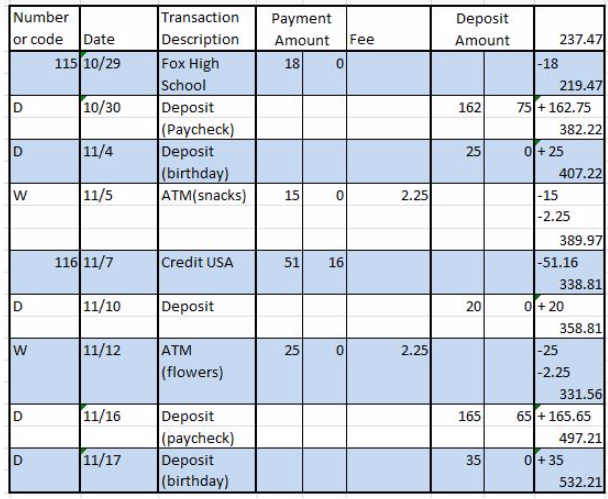

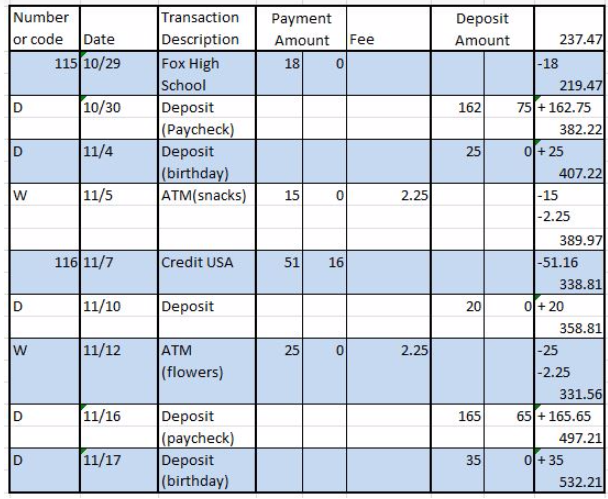

Given: Your balance on 10/29 is $237.47

To find: We need to create a check register for the transactions listed.

So here is

![]()

Hence, the register transactions listed as

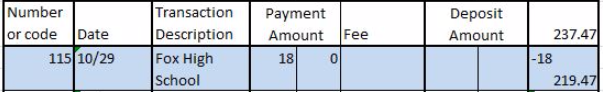

Page 121 Problem 11 Answer

Given: Check 115 on 10/29 for $18.00 to Fox high school.

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

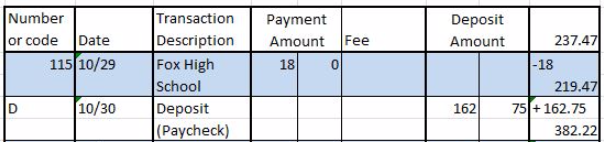

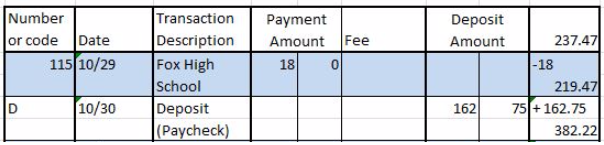

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 121 Problem 12 Answer

Given: Deposit a paycheck for $162.75 on 10/30

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

Page 121 Problem 13 Answer

Given: Your deposit a $25 check for your birthday on 11/4.

To find: We need to create a check register for the transactions listed.

So here

Hence, the register transactions listed

Page 121 Problem 14 Answer

Given: On 11/5, sporting event and run out of money, you use the ATM in the lobby to get $15 for snacks.

To find: Hence, the register transactions listed

So here,

Hence, the register transactions listed

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 121 Problem 15 Answer

Given: Your credit card bill is due on 11/10, so on 11/7 you write check 116 to Credit USA for $5.16.

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

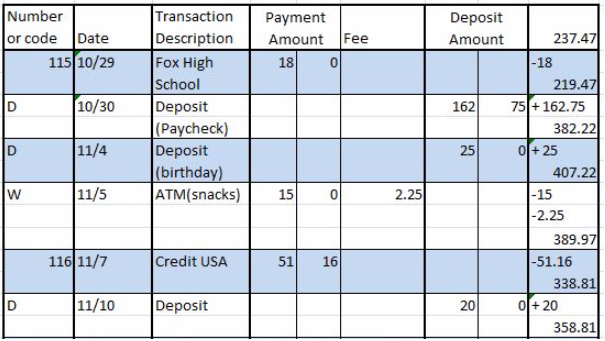

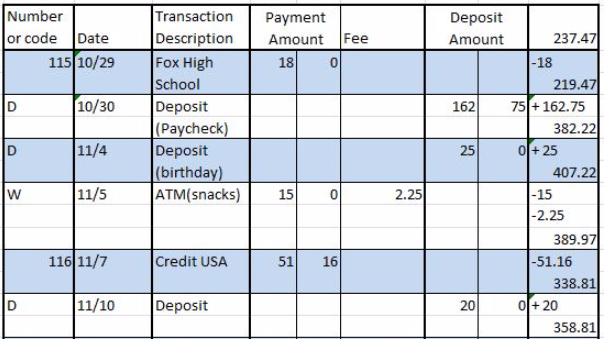

Page 121 Problem 16 Answer

Given: Your sister repays you $20 on 11/10. you deposit it.

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 121 Problem 17 Answer

Given: You withdraw $25 from the ATM to buy flowers on 11/12.

To find: We need to create a check register for the transactions listed.

So here

Hence, the register transactions listed

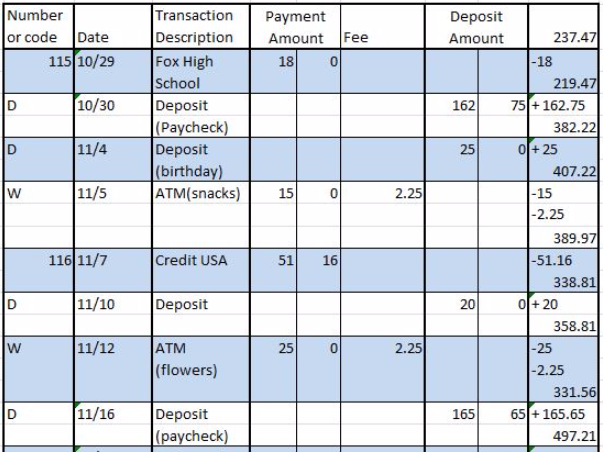

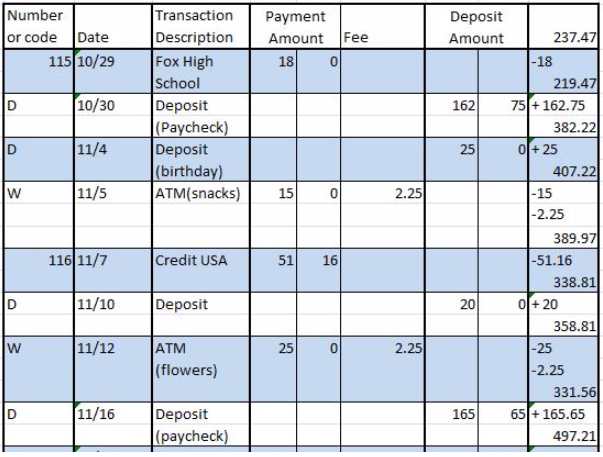

Page 121 Problem 18 Answer

Given: You deposit your paycheck for $165.65 on 11/16.

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

Chapter 3 Exercise 3.1 Banking Services Walkthrough Cengage

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 121 Problem 19 Answer

Given: Your deposit a late birthday check for $35 on 11/17.

To find: We need to create a check register for the transactions listed.

So here,

Hence, the register transactions listed

Page 121 Exercise 1 Answer

Given: Ridge wood Saving bank charges a $27

Nancy had $1,400 in her account

July 9, $1,380.15, July 10 $670 and $95.67 July 12

To find: How much will she owe the bank after July 12.

Lets, Overdraft occurs when there are insufficient funds.

Checks are drawn in excess of the remaining funds in the account.

Ddit Balance $1,400.00

July 9 check $1,380.15

Balance $19.85

July 9check −$745.82

Balance (670+95.67)

July 10 check $765.67(670+95.67)

Balance $765.67

We can see that the July 10 check is overdrawn.

There is no sufficient funds to clear the check.

There is an overdraft.

Thus, the bank will start charging $27 for every check drawn thereafter, including the two July 10 checks.

There are 2 more checks drawn after July 10:

(total of 4 checks)

Overdraft fee =$27×4

=$108

Balance −$745.82

July 11 Check $130.00

−−−−−−−−−−

Balance −$875.82

July 12 check 87

−−−−−−−−−−−−

Ending balance − $963.42

Overdraft fee $108.00

Total obligation −$1,071

Answer: $1,071.42

Hence, The She will owe after 12 July is $1,071.42

Page 121 Exercise 2 Answer

Given: Saving and loan charges a monthly fee of $8.

Overdraft protection fee is $33

Neela’s had balance is $456

Transfer the amount $250

To find: We need to find the statement of her account.

Here is, Overdraft protection fee. =33 dollar

Monthly savings fee. =8 dollar

Total fee charged. =33+8

= 41dollars

actual balance in the account. =256 dollar

Amount deposited. =250 dollar

So, Final balance in the account. =506 dollar

Check amount. =320 dollar

Now, the amount of check and total fees will be deducted from the account

So, final account balance. =506−41−320

=153 dollars

Hence, The account statement show the amount =153 dollars in her account.

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 122 Exercise 3 Answer

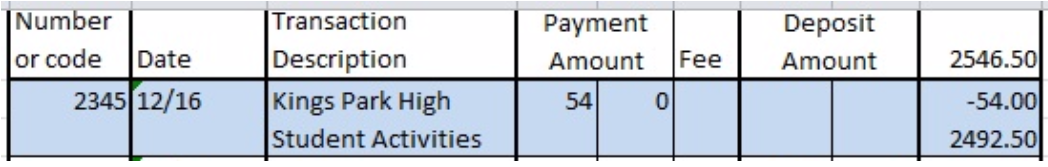

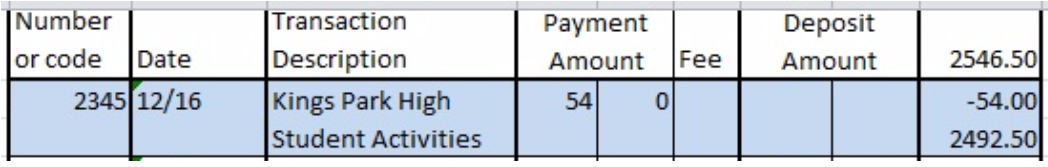

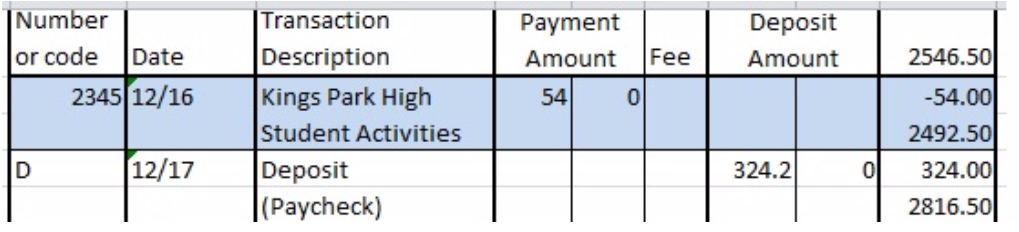

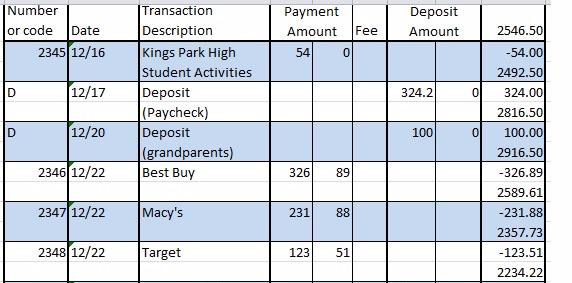

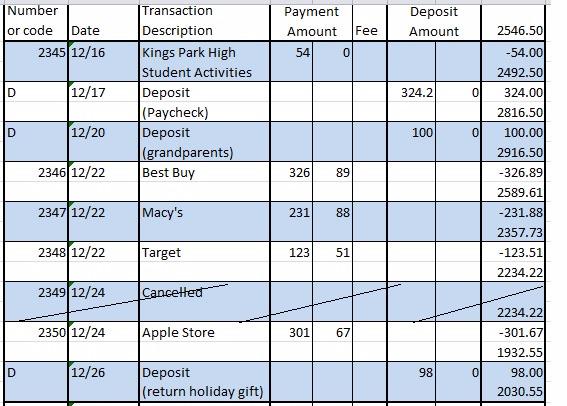

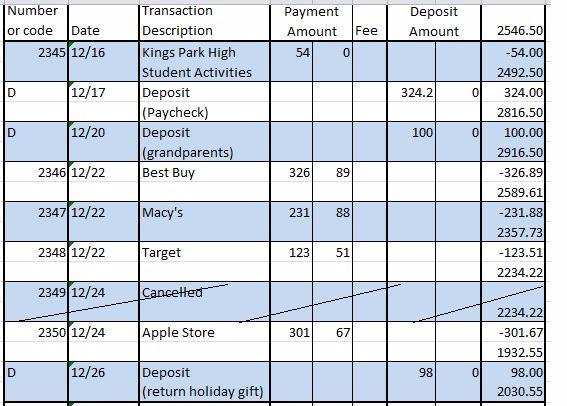

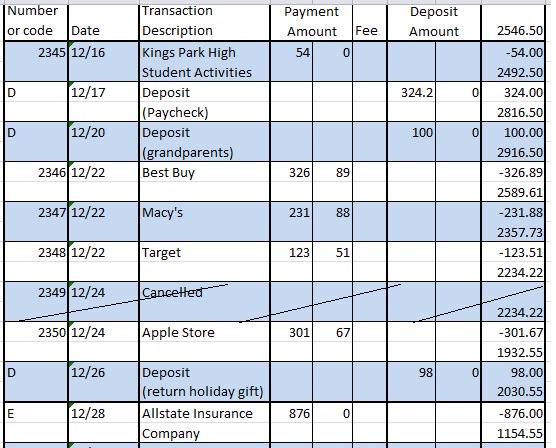

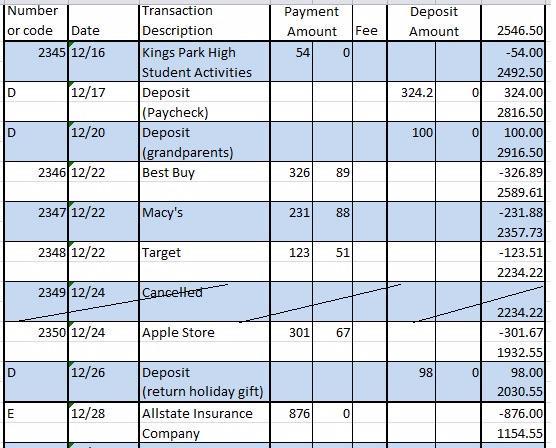

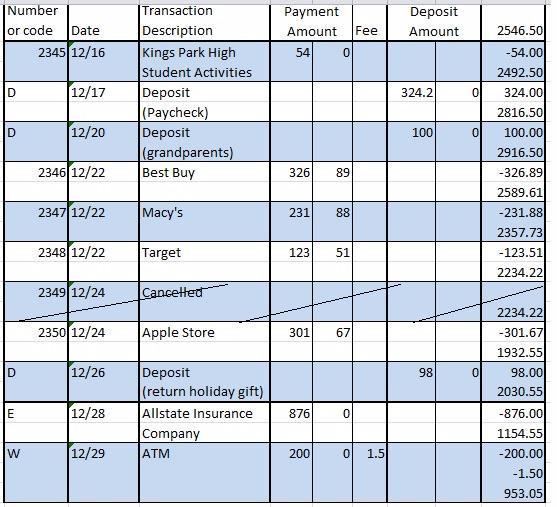

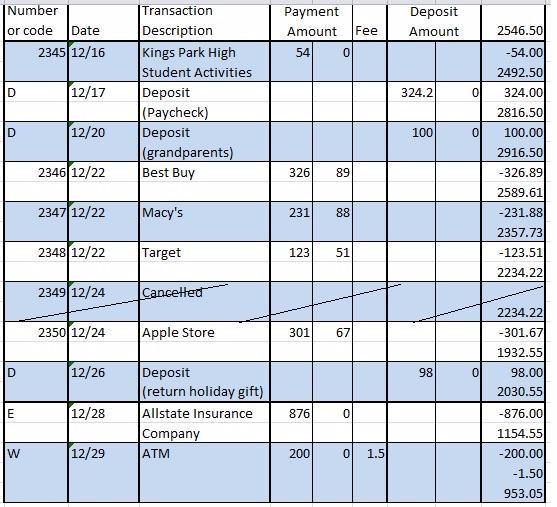

Given: Your Balance on 12/15 is $2,546.50

To find: We need to create a check register for the transactions listed.

So here is the first line of transactions

![]()

Hence, The first line of the transactions register is

![]()

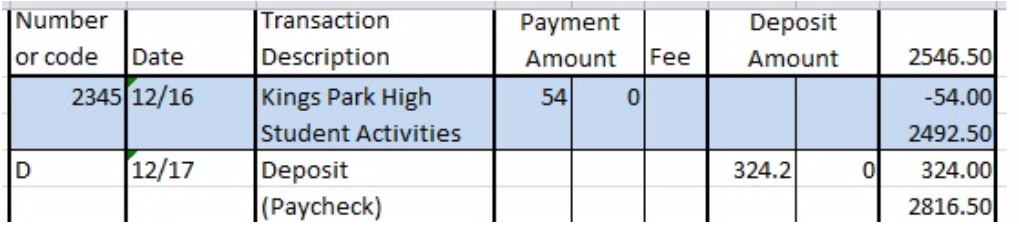

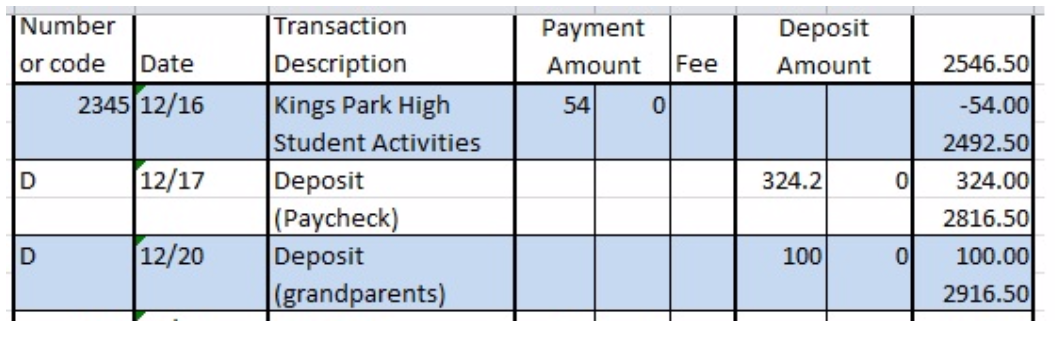

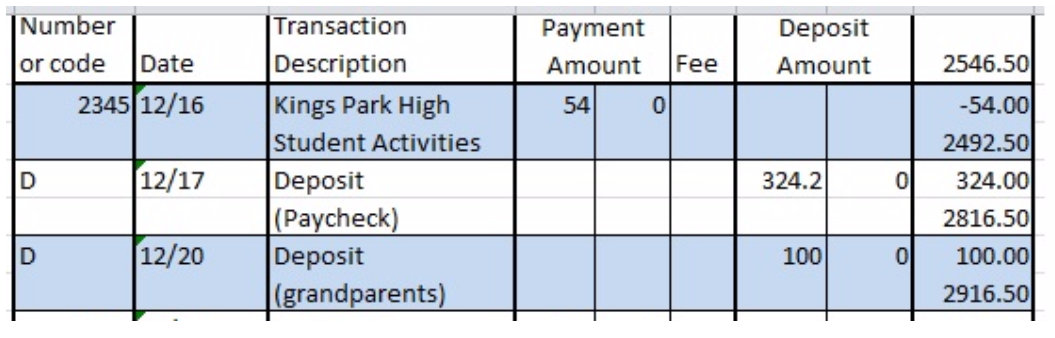

Page 122 Exercise 4 Answer

Given: On 12 / 16, you write check 2345 for }$ 54 to Kings Park High School Student Activities.

To find: We need to create a check register for the transactions listed.

So here is the transactions Listed as

Hence, The first line of the transactions register is

Page 122 Exercise 5 Answer

Given: On 12 / 17, you deposit your paycheck in the amount of 324.20 .

To find: We need to create a check register for the transactions listed.

So here the transactions listed as

Hence, The first line of the transactions register is

Page 122 Exercise 6 Answer

Given: Your grandparents send you a holiday check for $ 100 which you deposit into your account on 12 / 20 .

To find: We need to create a check register for the transactions listed.

So here is the transactions as

Hence, The first line of the transactions register

Page 122 Exercise 7 Answer

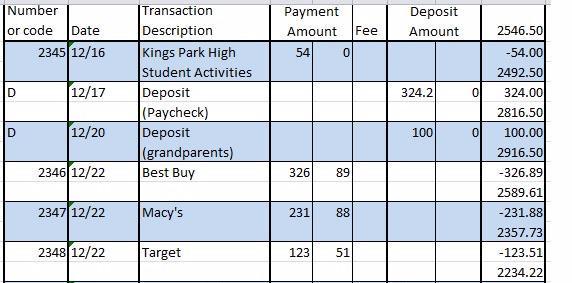

Given: 2346 to Best Buy in the amount of $326.89, 2347 to Macy’s in the amount of $231.88, and 2348 to Target in the amount of $123.51.

To find: Create a check register for the transactions listed.

Thus, we created the transactions listed.

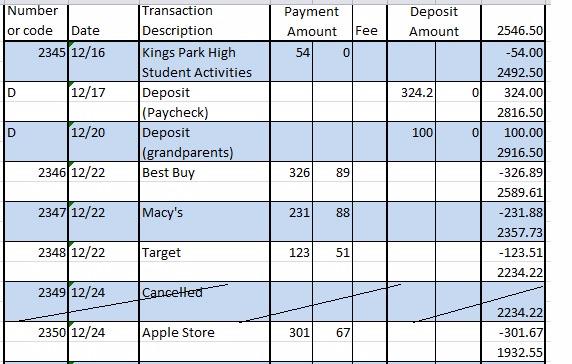

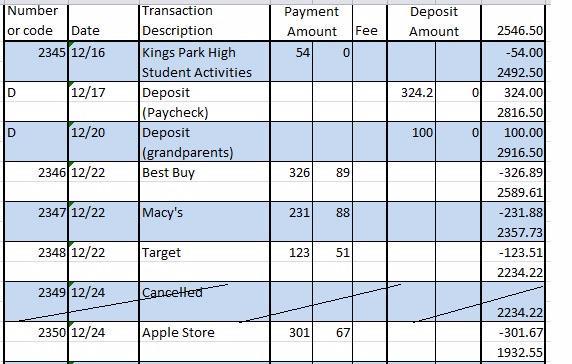

Page 122 Exercise 8 Answer

Given: As you are writing the check for $301.67, you make a mistake and must void that check. You pay with the next available check in your checkbook.

To find: Create a check register for the transactions listed.

Hence, we created the transactions listed.

Cengage Financial Algebra Banking Services Exercise 3.1 Solutions

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 122 Exercise 9 Answer

Given: On 12/26, you return a holiday gift. The store gives you $98. You deposit that into your checking account.

To find: Create a check register for the transactions listed.

Hence, we created the transactions listed.

Page 122 Exercise 10 Answer

Given: On 12/28, you write an e-check to Allstate Insurance Company in the amount of $876.00 to pay your car insurance.

To find: Create a check register for the transactions listed.

Hence, we created the transactions listed.

Page 122 Exercise 11 Answer

Given: On 12/29, you withdraw $200 from an ATM. There is a $1.50 charge for using the ATM.

To find: Create a check register for the transactions listed.

Hence, we created the transactions listed.

How To Solve Cengage Financial Algebra Chapter 3.1 Banking Services

Cengage Financial Algebra 1st Edition Chapter 3 Exercise 3.1 Banking Services Page 122 Exercise 12 Answer

Given: The data given.

To find: Complete items a through y.

(1) We note that the Item no. for transaction code was 622 in the previous row and 624 in the following row, thus the Item no. for transaction code in this row should be 623 .

(2) We note that the Item no. for transaction code was 628 in the previous row, thus the Item no. for transaction code in this row should be 629 (integer directly following 628 ).

(3) We note that the Item no. for transaction code was 629 in the last row with an Item no. for transaction code, thus the Item no. for transaction code in this row should be 630 (integer directly following 629 ).

(4) We note that the last column of this row contains ” -71|10″, which implies that a payment was made of $ 71.10 and thus we should enter 71 |10 in the cells of (d).

Note: you write -71 at the position of “d.” and 10 in the cell directly to its right. lcolor{default}

(5) We note that this row contains a value in the column “amount of payment or withdrawal” of 500|00, which implies that a payment of $500.00 was made and then we should enter -500|00 in the cells of (e)

(6) This cell should contain the new balance, which is the previous balance of $ 1,792.80 (in previous row/transaction) decreased by the payment of $ 500.00 (part (e)). $ 1,792.80- $ 500.00= $ 1,292.80 Thus we should then enter 1,292|80 into the cells of (f).

(7) We note that this row contains a value in the column “amount of payment or withdrawal” of 51|12, which implies that a payment of $ 51.12 was made and then we should enter -51|12$ in the cells of{g}.

(8) This cell should contain the new balance, which is the previous balance of $ 1,292.80 (result part ()) decreased by the payment of $ 51.12 (part {g}).

$ 1,292.80- $ 51.12= $ 1,241.68

Thus we should then enter 1,241|68 into the cells of {h}.

(9) We note that this row contains a value in the column “amount of payment or withdrawal” of 25|00, which implies that a payment of $ 25.00 was made and then we should enter -25|00 in the cells of (i).

(10) This cell should contain the new balance, which is the previous balance of $ 1,241.68 (result part (11)) decreased by the payment of $ 25.00 (part (i)).

$ 1,241.68- $ 25.00= $ 1,216.68

Thus we should then enter 1,216|68 into the cells of {j}.

(12) We note that this row contains a value in the column “Amount of deposit or interest” of 650|00, which implies that a deposit of $ 650.00 was made and then we should enter +650|00 in the cells of {k}.

(1) This cell should contain the new balance, which is the previous balance of $ 1,216.68 (result part (j)) increased by the deposit of $ 650.00 (part (k)).

$ 1,216.68+ $ 650.00= $ 1,866.68

Thus we should then enter 1,866|68 into the cells of (l).

(13) We note that this row contains a value in the column “amount of payment or withdrawal” of 200|00, which implies that a payment of $ 200.00 was made and then we should enter -200|00 in the cells of {m}.

(14) This cell should contain the new balance, which is the previous balance of $ 1,866.68 (result part (1)) decreased by the payment of $ 200.00 (part {m}).

$ 1,866.68- $ 200.00= $ 1,666.68

Thus we should then enter 1,666|68 into the cells of {n}. Note: you write 1,666 at the position of “n.” and 68 in the cell directly to its right.

(15) We note that this row contains a value in the column “amount of payment or withdrawal” of 90|00, which implies that a payment of $ 90.00 was made and then we should enter -90|00 in the cells of {p}.

(16) This cell should contain the new balance, which is the previous balance of $ 1,666.68 (result part (n)) decreased by the payment of $ 90.00 (part (p)).

$ 1,666.68- $ 90.00= $ 1,576.68

Thus we should then enter 1,576|68 into the cells of {q}.

(17) We note that this row contains a value in the column “amount of payment or withdrawal” of 49|00, which implies that a payment of $ 49.00 was made and then we should enter -49|00 in the cells of {r}.

(18) We note that this row contains a value in the column “amount of payment or withdrawal” of 65|00 which implies that a payment of $ 65.00 was made and then we should enter-65|00 in the cells of (t).

(19) This cell should contain the new balance, which is the previous balance of $ 1,527.68 (result part (20)) decreased by the payment of $ 65.00 (part (t)). $ 1,527.68- $ 65.00= $ 1,462.68 Thus we should then enter 1,462|68 into the cells of (u)

(21) We note that this row contains a value in the column “amount of payment or withdrawal” of 300|00, which implies that a payment of $ 300.00 was made and then we should enter -300|00 in the cells of (v)

(22) This cell should contain the new balance, which is the previous balance of $ 1,462.68 (result part (u)) decreased by the payment of $ 300.00 (part (v)). } $ 1,462.68- $ 300.00= $ 1,162.68 Thus we should then enter 1,162|68 into the cells of (w).

(23) We note that this row contains a value in the column “Amount of deposit or interest” of 400|00, which implies that a deposit of $ 400.00 was made and then we should enter +400|00 in the cells of {x}.

(24) This cell should contain the new balance, which is the previous balance of $ 1,162.68 (result part (w)) increased by the deposit of $ 400.00 (part {x}).

$ 1,162.68+ $ 400.00= $ 1,562.68

Thus we should then enter 1,562|68 into the cells of {y}.

(25) This cell should contain the new balance, which is the previous balance of $ 1,562.68 (result part (y)) decreased by the payment of $ 371.66(3-71|66 is given in the cells directly above the cells of z.).

$ 1,562.68- $ 371.66= $ 1,191.02

Thus we should then enter 1,191|02 into the cells of {z}.

Hence, a complete items is found to be

(1) 623

(2) 629

(3) 630

(4) 71 | 10

(5) -500 | 00

(6) 1,292 | 80

(7) -51 | 12

(8) 1,241 | 68

(9) -25 | 00

(10) 1,216 | 68

(11)+650 | 00

(12) 1,866 | 68

(13) -200 | 00

(14) 1,666 | 68

(15) -90 | 00

(16) 1,576 | 68

(17) -49 | 00

(18) 1,527 | 68

(19) -65 | 00

(20) 1,462| 68

(21) -300| 00

(22) 1,162 | 68

(23)+40

(24) 1,562 | 68

(25) 1,191 | 02