Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services

Page 167 Problem 1 Answer

To find: Interview a bank representative about trust accounts.

Find out what the abbreviations POD, ATF, and ITF mean.

Prepare questions about FDIC insurance limits and beneficiaries.

Ask for any brochures they offer about trust accounts.

Prepare a report or a poster on trust accounts to present to the class.

FDIC or Federal deposit insurance corporation which gives insurance to the saving account of the people in U.S. Some questions about FDIC insurance limits and beneficiaries –

Q 1) Where can I get to know about insurance rules and limits? Ans- Using electronic deposit insurance estimator.

Q 2) What is the limit of FDIC beneficiaries? Ans- 250000 is the limit up to which you and your family in total can have deposits in your account.

Q 3) what type of accounts are eligible for FDIC insurance?

Trust accounts report Trust account is a savings account deposited in the name of a trustee who controls it during his lifetime, after which the balance is payable to a pre-nominated beneficiary There are two types of Trust Accounts revocable and irrevocable, the extent of FDIC insurance depends on which out of these 2, our account is.

A revocable trust is that, which assigns beneficiaries, receiving the funds of trust after the death of the owner.

But the trust can also be terminated or there can be a change of terms by the owner.

A revocable trust may become an irrevocable trust once the owner dies because effectively there is no longer an option to cancel or change the trust. In a revocable trust, the owner is considered the depositor and the account are only eligible for 250,000 of FDIC insurance coverage.

However, if a bank fails after a trust owner has died but before the trust has been paid out, the beneficiaries are considered the depositors and each is entitled to 250,000 in coverage.

Read and Learn More Cengage Financial Algebra 1st Edition Answers

In an irrevocable trust, the beneficiaries are considered to be the depositors even before the owner dies, as long as there are no conditions the beneficiaries have to meet to remain eligible for trust proceeds.

There are conditions the beneficiary has to meet in order to be eligible for trust proceeds.

Hence the answer is POD− Payable on death, ITF − In trust for, ATF = As Trustee For

Cengage Financial Algebra Chapter 3 Assessment Banking Services Guide

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 167 Problem 2 Answer

To find: Compare and contrast the accounts offered by the same bank.

What are the benefits of each? What are the drawbacks of each?

Who might be better served by each type of checking account?

Explain which account might be best for your financial situation.

When you start looking online at the different types of checking accounts, there are many different types such as:

Free checking account: No monthly maintenance fee, Possible overdrafts fees, Possible transactions/services fees

Online checking account: Checking accounts available online, many online checking accounts have no monthly maintenance fees, often have lower fees.

Second Chance checking account: Checking accounts for people who had there account terminated due to not covering overdrafts;

Low fees, Low minimum balances, Restrict use of certain services

Student checking account: Checking accounts intended for students; Low fees, Low minimum balances

Senior checking account: Checking accounts intended for a certain age group; Breaks in monthly fees.

Joint checking account: At least two people are authorized to make transactions and write checks; Convenient for married couples

Business checking account: Designed to handle a large amount of transactions

Interest-bearing checking account: You receive interest on your money (at a decent rate; even though it will still be quite low)

Money market checking account: A type of interest bearing checking account, higher interest rate, possibly a higher minimum balance, possibly a limited number of monthly transactions

In your case, a student checking account is most likely the most interesting, as you are still a student.

Hence the answer could vary

Page 167 Problem 3 Answer

To find; While the law states that free checking accounts cannot have minimum balances or per-check fees, there are other fees and penalties that are allowable.

Research the allowable fees and penalties on checking accounts. Make a list and explain the purpose and cost of each.

There are many different fees and penalties on checking accounts.

You can find them easily using a search engine and searching for “checking account allowable fees” or something similar.

The most common fees/penalties on checking accounts are:

Monthly maintenance fee: Fee that has to be paid each month

ATM fees: Fee paid for every transaction at an ATM

Overdraft fees

Abandoned account fee: applies when the account is unused for three to five years

Account closed early fee: when you close an account within 90 or 180 days of opening it.

Reconciliation fee: when there is a discrepancy between your records and the bank’s records (tends to be a fee per hour).

Check printing fee: Charge for checks

Counter check fee: Offered when you run out of checks, but only a limited number of counter checks are free.

Hence the answer could vary

Solutions To Chapter 3 Assessment In Financial Algebra 1st Edition

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 167 Problem 4 Answer

To find: What are the penalties for withdrawing money from a CD before it is due?

What are the minimum balances for different types of accounts? What are the fees for insufficient funds?

What are the different types of checking accounts they offer? What are the fees and requirements for these accounts?

What are the hours of service? Think of other questions to ask. Prepare the findings in a report.

When you start looking online at the different types of checking accounts, there are many different types such as:

Free checking account: No monthly maintenance fee, Possible overdrafts fees, Possible transactions/services fees

Online checking account: Checking accounts available online, many online checking accounts have no monthly maintenance fees, often have lower fees.

Second Chance checking account: Checking accounts for people who had there account terminated due to not covering overdrafts;

Low fees, Low minimum balances, Restrict use of certain services

Student checking account: Checking accounts intended for students; Low fees, Low minimum balances

Senior checking account: Checking accounts intended for a certain age group; Breaks in monthly fees.

Joint checking account: At least two people are authorized to make transactions and write checks; Convenient for married couples

Business checking account: Designed to handle a large amount of transactions

Interest bearing checking account: You receive interest on your money (at a decent rate; even though it will still be quite low)

Money market checking account: A type of interest bearing checking account, higher interest rate, possibly a higher minimum balance, possibly a limited number of monthly transactions

The hours of service tend to vary strongly from bank to bank.

However, generally, the opening hours will range from about 9 A.M. to 5 P.M. with a possible break at noon.

Hence the answer could vary

Page 167 Problem 5 Answer

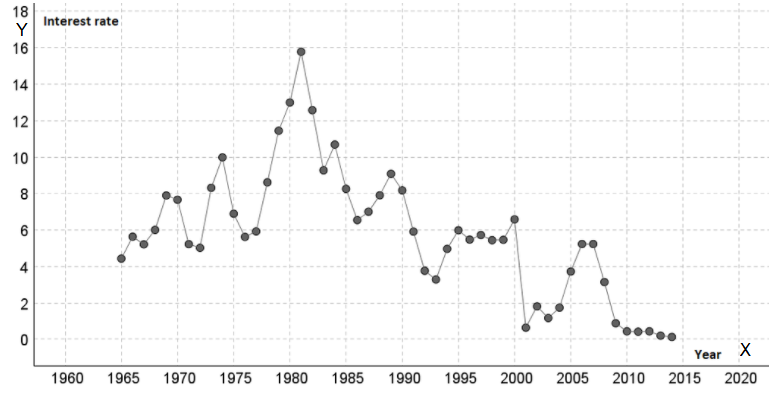

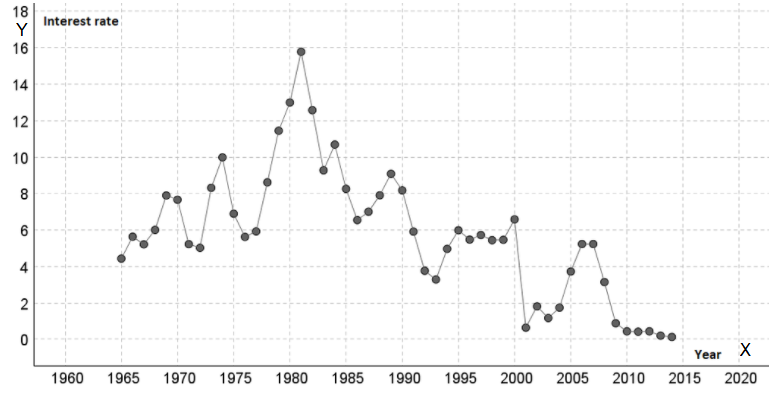

To find: Interest rates have historically fluctuated with the economy.

Go online and/or use the library to find interest rates over the past 50 years. Make a graph to display the information.

The following table contains the average interest rates for a 6 Month CD.

| Year | Percent | Year | Percent | Year | Percent | Year | Percent | Year | Percent |

| 1965 | 4.43 | 1975 | 6.89 | 1985 | 8.25 | 1995 | 5.98 | 2005 | 3.72 |

| 1966 | 5.63 | 1976 | 5.62 | 1986 | 6.51 | 1996 | 5.47 | 2006 | 5.23 |

| 1967 | 5.21 | 1977 | 5.92 | 1987 | 7 | 1997 | 5.72 | 2007 | 5.23 |

| 1968 | 6 | 1978 | 8.61 | 1988 | 7.9 | 1998 | 5.44 | 2008 | 3.14 |

| 1969 | 7.89 | 1979 | 11.44 | 1989 | 9.08 | 1999 | 5.46 | 2009 | 0.88 |

| 1970 | 7.66 | 1980 | 12.99 | 1990 | 8.17 | 2000 | 6.58 | 2010 | 0.44 |

| 1971 | 5.22 | 1981 | 15.77 | 1991 | 5.91 | 2001 | 3.64 | 2011 | 0.42 |

| 1972 | 5.02 | 1982 | 12.57 | 1992 | 3.76 | 2002 | 1.81 | 2012 | 0.44 |

| 1973 | 8.31 | 1983 | 9.27 | 1993 | 3.28 | 2003 | 1.17 | 2013 | 0.2 |

| 1974 | 9.98 | 1984 | 10.68 | 1994 | 4.96 | 2004 | 1.74 | 2014 | 0.13 |

Time plot

Year is on the horizontal axis and the interest rate is on the vertical axis

We connect points corresponding to consecutive years be a straight line.

Hence the graph is

Page 167 Problem 6 Answer

we have to Research how experts memorize long sequences of digits.

Visit a few local businesses to see if they would be willing to donate a prize for the contest. Ask the school newspaper to cover the contest.

Emcee the contest in class.

The decimal representation of the number e is:

2.718281828459045235360287471352662497757247093699959574966….

The decimal representative of e contains no repeating pattern (as $e$ is an irrational number).

There are many different tips on how to memorize a long sequence of digits. A few of these tips could be:

Create associations (such as a birthday, anniversary, number of jersey of favorite football player, etc.)

Break the long sequence into smaller sequences

Check for patterns

When learning the number, speak the words out at loud (which helps you remember better).

Repetition: often repeat the memorized number with some time frame left in between different repetitions (such as an hour)

Visualize the shape of the digits on a keypad

Convert the numbers to words/images

Hence the answer could vary

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 167 Problem 7 Answer

To find: Some employers allow employees to have money deducted from their accounts and automatically placed into a savings account.

Interview three adults working in different professions.

Ask them about employer-sponsored savings plans. Prepare a report on the findings.

A employer-sponsored savings plan is used by employees who elect to save a portion of their paycheck in an investment account.

This type of plan is set up by the employers, who often sponsor the plan as well and these plans are often based around retirement.

There are annual contribution limits, but also tax benefits accompanying this type of plan.

It could be possible to withdraw funds early (with some additional fees) or to bottom against your account balance.

The employees are fully responsible in what their money is invested in and the employees can take their employer-sponsored savings plan with them when they change work (change their employer).

Hence the answer could vary

Page 167 Problem 8 Answer

To find: Visit a local bank. Get brochures they offer about their services. If the brochures are two-sided, take two of each so you can cut them out and paste them onto a poster board.

Pick several services to highlight. Cut out the portions of the brochures that explain each service.

Give each service an original, short title, and print out your title.

Organize the titles and descriptions of the banking services onto a poster board.

The answers to this questions will vary very strongly.

You will need to pick up brochures at your local bank about their services.

Per service, you will need to pick a title. However, this could be very easy as the brochures tend to use titles to separate the different (most important) services.

If a title has not been specified, then either use the name of the service as title or use a (very) short description of the service.

Organize the titles in some manner. For example, organize the titles from cheapest to most-expensive service.

Hence the answer could vary

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 167 Problem 9 Answer

To find: The Rule of 72 is a method for quickly estimating how many years it will take principal to double, assuming the interest was compounded.

Go to the library and/or use the Internet to research the Rule of 72 beyond what was presented in Lesson 3-7.

Prepare some examples to illustrate the rule. Discuss the history and the use of the rule. Display your research on a poster board.

The Rule of 72 is used to determine the time it takes for an investment to double.

To use the rule of 72 , you require the knowledge of the annual rate of return (or annual interest rate).

The rule of 72 states that the product of the rate of return and the number of years (time) should be roughly equal to 72 .

On equivalently, the time it takes to double your investment is 72 divided by the annual interest rate

Although, most people attribute the rule of 72 to Albert Einstein.

The Rule of 72 is used to determine the time it takes for an investment to double.

Page 168 Problem 10 Answer

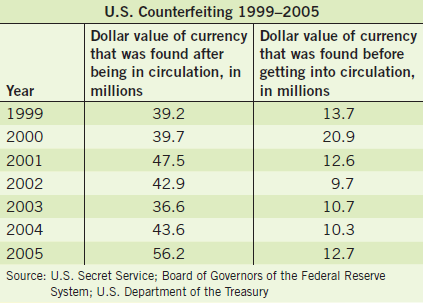

Given: We have been given the following data regarding the occurrences of counterfeit money.

To find: We have to draw the graph for both sets of columns and show them on the same axes

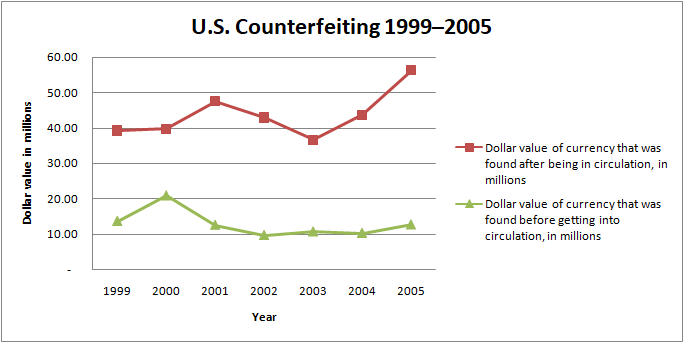

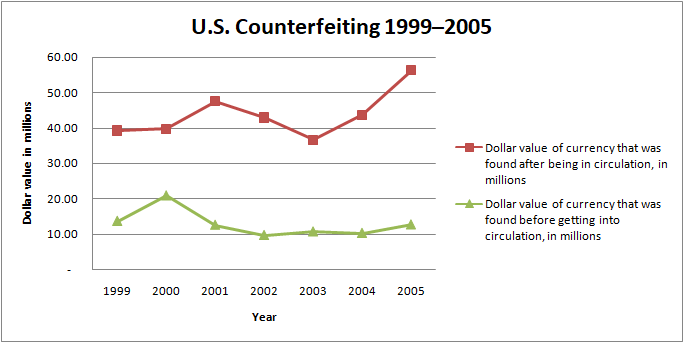

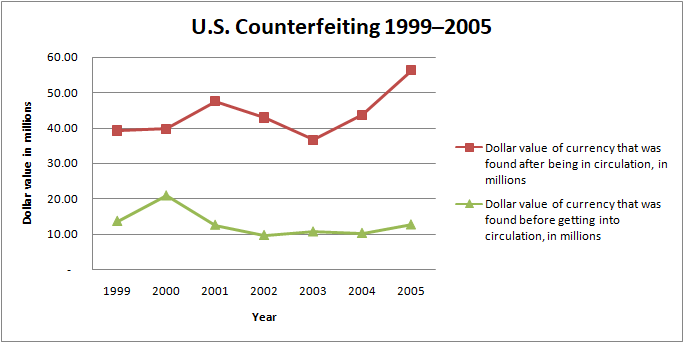

Solution: The graph for the data will be as follows:

The Secret Service drastically reduced the occurrences of counterfeit money since the Civil War but the problem still exists.The graph showing the catching of counterfeit bills in the U.S. is as follows:

Page 168 Problem 11 Answer

Given: The graph showing the catching of counterfeit bills in the U.S. is as follows:

To find: If the pattern of catching counterfeit bills before and after circulation follows the same pattern of increases and decreases.

Solution: In the year2000 and2005, the dollars found before and after circulation both increased from the year before but at a different rate.

In the year2001 and 2004, compared to their respective previous years the dollars found after circulation increased but dollars found before circulation decreased the year 2002, both the dollars found before and after circulation decreased but at a different rate.

Similarly, in the year2003, dollars found after circulation decreased whereas dollars found before circulation increased.

Hence we can see that the pattern of catching counterfeit bills before and after circulation do not follow the same pattern of increases and decreases

On examining the graph drawn in the previous part of the question we can observe that the graph showing the catching of counterfeit bills before and after they enter circulation are not similar nor are they completely opposite.

It is a mixture of increases and decreases and both the graph does not show any relation between them.

Thus, the pattern of catching counterfeit bills before and after circulation does not follow the same pattern of increases and decreases.

Page 169 Problem 12 Answer

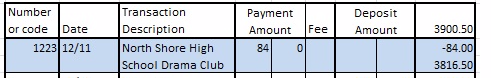

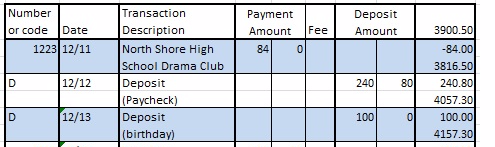

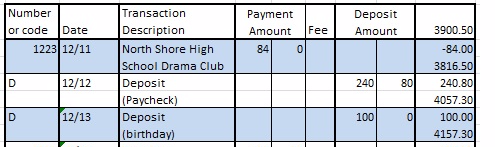

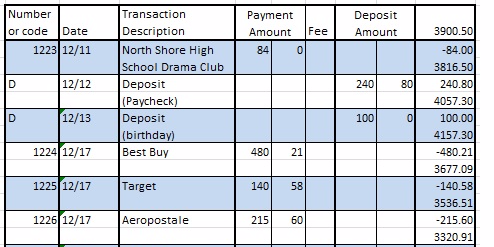

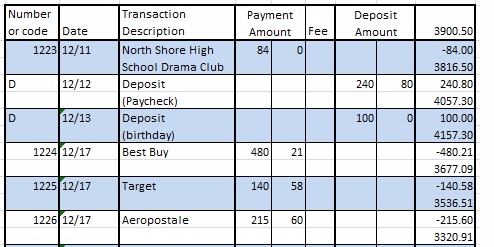

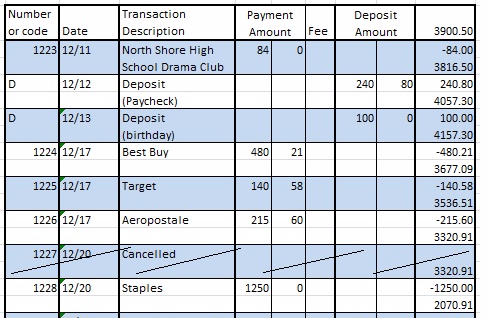

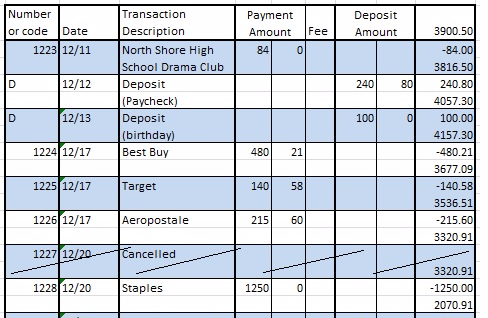

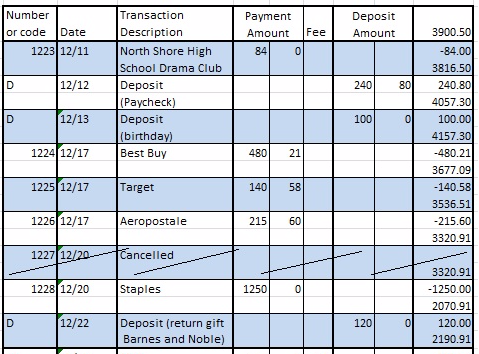

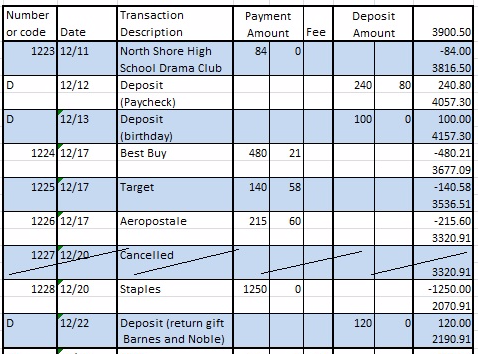

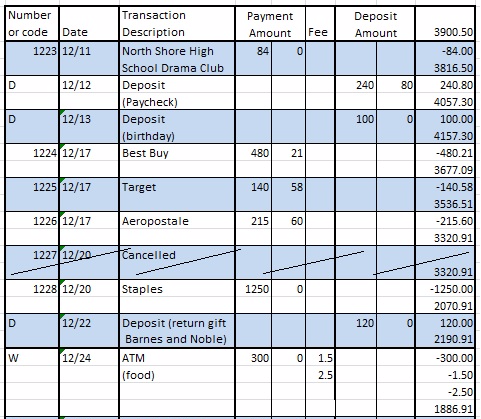

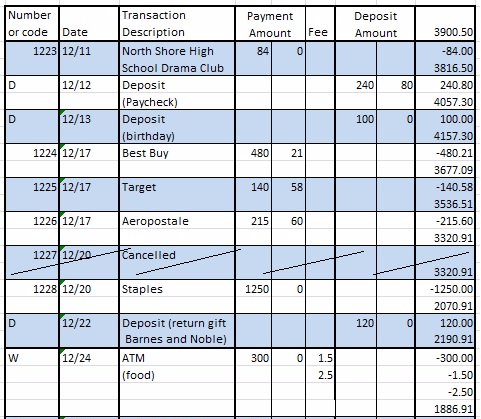

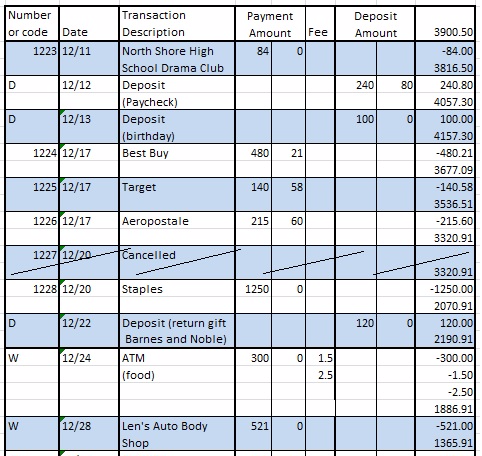

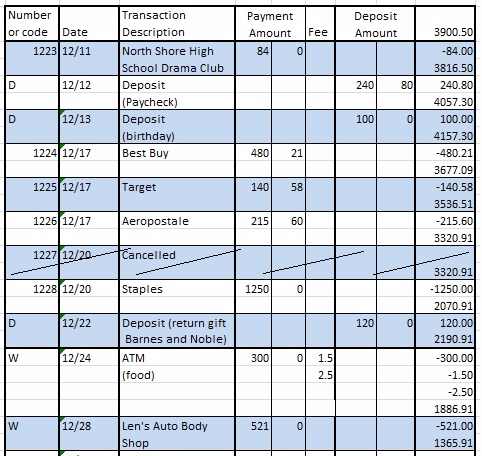

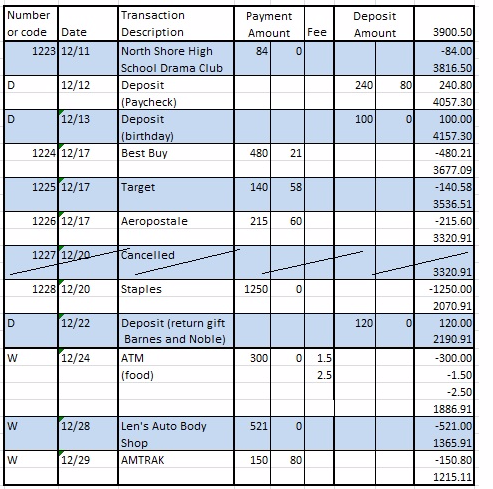

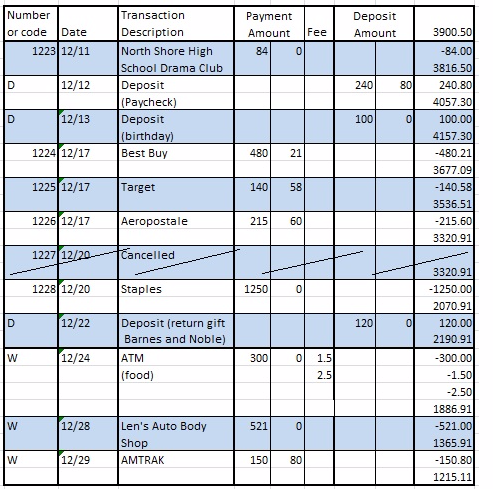

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

![]()

Hence the answer is

![]()

Page 169 Problem 13 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 169 Problem 14 Answer

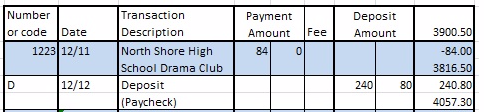

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Problem 15 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Problem 16 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Problem 17 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Financial Algebra Cengage Chapter 3 Banking Services Assessment Solutions

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 169 Problem 18 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Problem 19 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 169 Problem 20 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Problem 21 Answer

we have to Go to www.cengage.com/school/math/financialalgebra and download a blank check register. Complete all of the necessary information in the check register

Hence the answer is

Page 169 Exercise 1 Answer

we have to Use the check register from Exercise 1. It is now one month later, and the checking account statement has arrived. Does the account balance?

The ending balance is given on the last line of the statement which is $2,495.91.

Hence the answer is $2,495.91.

Cengage Financial Algebra Banking Services Practice Problems

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 169 Exercise 2 Answer

we have to Use the check register from Exercise 1. It is now one month later, and the checking account statement has arrived. Does the account balance?

In question 1(g) there is deposit made on 12/22 which is not recorded so that is the deposits outstanding and it is $120

Hence the answer is $120

Page 169 Exercise 3 Answer

we have to Use the check register from Exercise 1. It is now one month later, and the checking account statement has arrived. Does the account balance?

All the checks are mentioned in the statement except the one written on dec 20 and the one written on dec 29 for the amounts 1250 and 150.8 respectively hence total checks outstanding is $1,250+$150.8=$1,400.80

Hence the answer is $1,400.80

Page 169 Exercise 4 Answer

we have to Use the check register from Exercise 1. It is now one month later, and the checking account statement has arrived.

Does the account balance?

Revised statement balance = Ending balance – Checks outstanding + deposits outstanding

$2,495.91+$1,400.80−$120=$1,215.11

Hence the answer is $1,215.11

Page 169 Exercise 5 Answer

we have to Use the check register from Exercise 1. It is now one month later, and the checking account statement has arrived.

Does the account balance?

The balance from the checkbook is given in exercise lj at the bottom right corner of the checkbook register, which contains $1,215.11.

Hence the answer is $1,215.11.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 6 Answer

Given: Ruth has a savings account at a bank .To find: her balance in five months if her account balance never reaches 1,500?

Interest will be the difference of amount and the principle value.

Since, we know that interest will be the difference of amount and the principle value.

So, we get the balance before the withdrawal is$1,722−$400=$1,322.

Hence, the balance in five months will be 1322−(3.50)⋅5=1304.50.

Thus, we can say that her balance in five months if her account balance never reaches 1,500,will be $1304.50.

Page 170 Exercise 7 Answer

Given: Nine months ago Alexa deposited 7,000 in a three-year CD.

To find her balance after the withdrawal.Interest will be the difference of amount and the principle value.

On performing the algebraic operations, we get the value as$7,000+$224.16−$1,000−$250=$5,974.16.

Thus, we can say that when Nine months ago Alexa deposited 7,000 in a three-year CD then her balance after the withdrawal will be $5,974.16.

Page 170 Exercise 8 Answer

Given: Ralph deposited 910 in an account that pays 5.2% simple interest, for3.5 years.

To find: How much interest did the account earn Simple interest is given as the product of principal amount with rate and the time for the interest.

Since, we know that simple interest is given as the product of principal amount with rate and the time for the interest.

So. we get the value as

$910×5.2%×31/2

=$910×0.052×3.5

=$165.62

Thus, we can say that the interest did the account earn will be $165.62.

Page 170 Exercise 9 Answer

Given: Ralph deposited 910 in an account that pays 5.2% simple interest.

To find: What is the ending balance.Interest will be the difference of amount and the principle value.

On performing the algebraic operations, we get the value as

$910+$165.62=$1,075.62

Thus, we can say that when Ralph deposited 910 in an account that pays 5.2% simple interest then the ending balance will be $1075.62.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 10 Answer

Given: Ralph deposited 910 in an account that pays 5.2% simple interest.

To find: How much interest did the account earn the first year?

Simple interest is given as the product of principal amount with rate and the time for the interest.

Since, we know that simple interest is given as the product of principal amount with rate and the time for the interest.

So. we get the value as

$910×5.2%×1

=$910×0.052×1

=$47.32

Thus, we can say that $47.32 interest did the account earn the first year.

Page 170 Exercise 11 Answer

Given: Ralph deposited 910 in an account that pays 5.2% simple interest.

To find: How much interest did the account earn the third year.

Simple interest is given as the product of principal amount with rate and the time for the interest.

Since, we know that simple interest is given as the product of principal amount with rate and the time for the interest.

So. we get the value as

$910×5.2%×1

$910×0.052×1

=$47.32

Thus, we can say that $47.32 interest did the account earn the third year.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 12 Answer

Given: Matt has two single accounts at Midtown Bank.To find: sum of Matt’s balances.

Interest will be the difference of amount and the principle value.

On performing the algebraic operations, we get the value as

74112.09+77,239.01=151,350.10

Thus, we can say that $151,350.10 is the sum of Matt’s balances when Matt has two single accounts at Midtown Bank.

Page 170 Exercise 13 Answer

Given: Matt has two single accounts at Midtown Bank.To find: Is all of Matt’s money insured by the FDIC?

We will insure the total value is less than or greater than 250,000 or not.

Since, we know that $151,350.10 is the sum of Matt’s balances which is less than 250,000.

Thus, we can say that all of Matt’s money insured by the FDIC.

Thus, we can say that Matt’s money insured by the FDIC when Matt has two single accounts at Midtown Bank.

Page 170 Exercise 14 Answer

Given: Rhonda deposits 5,600 in a savings account that pays4.5%.

To find: How much interest does the account earn in the first six months. Interest will be the difference of amount and the principle value.

On using the compound interest formula, we can get the value as

A=5600(1+0.045/2)1

=5726

Hence, we get the interest as 5726−5600=126.

Thus, we can say that 126$ interest does the account earn in the first six months.

How To Solve Chapter 3 Banking Services Assessment Cengage” Informational

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 15 Answer

Given: Rhonda deposits 5,600 in a savings account that pays4.5%

To find: What is the ending balance after six months.We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A=5600(1+0.045/2)1

=5726

Thus, we can say that $5726 is the ending balance after six months.

Page 170 Exercise 16 Answer

Given: Rhonda deposits 5,600 in a savings account.

To find: How much interest does the account earn in the second six months

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A1=5600(1+0.045/2)1

=5726

A2=5600(1+0.045/2)2

=5854.84

Hence, interest does the account earn will be

A2−A1

=5854.84−5726

=128.84

Thus, we can say that interest does the account earn in the second six months will be $128.84.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 17 Answer

Given: Rhonda deposits 5,600 in a savings account.To find: What is the balance after one year.

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A=5600(1+0.045/2)2

=5854.84

Thus, we can say that the balance after one year will be $5854.84.

Page 170 Exercise 18 Answer

Given: Rhonda deposits 5,600 in a savings account.To find: How much interest does the account earn the first year.

Interest will be the difference of amount and the principle value.

On using the compound interest formula, we can get the value as

A=5600(1+0.045/2)2

=5854.84

Hence, we get the interest as5854.84−5600=254.84.

Thus, we can say that $254.84 interest does the account earn the first year.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 170 Exercise 19 Answer

Given: Nick deposited 3,000 in a three-year CD account.To find: What is the ending balance?

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A=3000(1+0.0408/52)52×3

=3390.46

Thus, we can say that $3390.46 is the ending balance when Nick deposited 3,000 in a three-year CD account.

Page 170 Exercise 20 Answer

Given: three years compounded daily.

To find: How much more would 10,000 earn in three years compounded daily at 4.33%?

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value for daily as

A=10000(1+0.0433/365)365×3

=11,387.06

On using the compound interest formula, we can get the value for semiannually as

A=10000(1+0.0433/2)2×3

=11,371.37

Hence, we get the interest as $11,387.06−$11,371.37=$15.69.

Thus, we can say that$15.69 more would $10,000 earn in three years compounded daily at 4.33%, than compounded semiannually at 4.33%.

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 171 Exercise 21 Answer

Given: Austin deposits 2,250 into a one-year CD.To find: What is the ending balance after the year.

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A=2250(1+0.053/365)365×1

=2372.46

Thus, we can say that $2372.46 is the ending balance after the year.

Page 171 Exercise 22 Answer

Given: Austin deposits 2,250 into a one-year CD .To find: How much interest did the account earn during the year.

We will use the formula of compound interest to get the result.

On using the compound interest formula, we can get the value as

A=2250(1+0.053/365)365×1

=2372.46

Hence, we get the interest as 2372.46-2250=122.46.

Thus, we can say that$122.46 interest did the account earn during the year.

Page 171 Exercise 23 Answer

Given: Austin deposits 2,250 into a one-year CD.To find: What is the annual percentage yield.

We will use the formula of annual percentage yield to get the result.

On using the annual percentage yield formula, we can get the value as

APY=(1+0.053/365)365−1

=0.0544

=5.44%

Thus, we can say that 5,44% the annual percentage yield when Austin deposits 2,250 into a one-year CD.

Page 171 Exercise 24 Answer

Given: interest earned compounded continuously.

To find: interest earned on a 25,000 deposit .

Interest will be the difference of amount and the principle value.

On using the compounded continuously interest formula, we can get the value as

A=25000e0.047×2.5

=28117.04

Hence, we get the interest as

I=A−P

=28117.04−25000

=3117.04

Thus, we can say that $3117.04 interest earned on a 25,000 deposit for21/2years .

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 171 Exercise 25 Answer

Given: You want to put a $40,000 down payment on a store front for a new business that you plan on opening in 5 years.

To find: Identify which of the three cases below applies.

We will try to estimate the values based on the investment done.

Since, we can see that we have a monthly investment.

So. we can say that investment will be present value of a periodic deposit investment.

Thus, we can say that investment of a 40,000 down payment on a store front for a new business that you plan on opening in five years then the investment will be present value of a periodic deposit investment.

Page 171 Exercise 26 Answer

Given: You deposit $3,000 into an account that yields 3.2% interest compounded semiannually.

To find: Identify which of the three cases below applies.

We will try to estimate the values based on the investment done.

Since, we can see that there is single deposit in an account.

So, we get investment as future value of a single deposit investment.

Thus, we can say that when deposit of $3,000 into an account that yields 3.22% interest compounded semiannually then we can say that investment will be future value of a single deposit investment.

Page 171 Exercise 27 Answer

Given: You want to save for a new car that you will buy when you graduate college in 4 years.

To find: How much will you be able to afford.

We will try to estimate the values based on the investment done.

As, we know that we have a deposit in every quarter. So, we get investment that will be a future value of a periodic deposit investment.

Thus, we can say that when saving is done for a new car that you will buy when you graduate college in four years then the future value of a periodic deposit investment is being done.

Page 171 Exercise 28 Answer

Given: Santos deposited 1,800 in an account that yields 2.7% interest, compounded semiannually.

To find: How much is in the account after 54 months.

Interest will be the difference of amount and the principle value.

On using the compound interest formula, we can get the value as

A=1800(1+0.027/2)54÷6

=2030.89

Thus, we can say that$2030.89 is in the account after 54 months when Santos deposited 1,800 in an account that yields 2.7% interest, compounded semiannually.

Banking Services In Cengage Financial Algebra Chapter 3 Explained Informational

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 171 Exercise 29 Answer

Given: Stephanie signed up for a direct deposit transfer into her savings account from her checking account.

To find: How much will be in the account at the end of 6.5 years.

We will use the formula of Future value of a investment to get the result.

On using the formula for Future value of a investment, we get the value as

B=P((1+r/n)nt−1)/r/n

=150((1+0.026/12)12×6.5−1)/0.026/12

≈12,731.79

Thus, we can say that $12,731.79 be in the account at the end of 6.5 years when Stephanie signed up for a direct deposit transfer into her savings account from her checking account.

Page 171 Exercise 30 Answer

Given: Jazmine needs 30,000 to pay off a loan at the end of 5 years.

To find: How much must she deposit monthly into a savings account.

We will use the formula of present value of a investment to get the result.

On using the formula for present value of a investment, we get the value as

P=B×r/n(1+r/n)nt−1

=30,000×0.03/12(1+0.03/12)12×5−1

≈464.06

Thus. we can say that $464.06 must she deposit monthly into a savings account that yields 3% interest, compounded monthly.

Cengage Financial Algebra Banking Assessment Step-By-Step Solutions

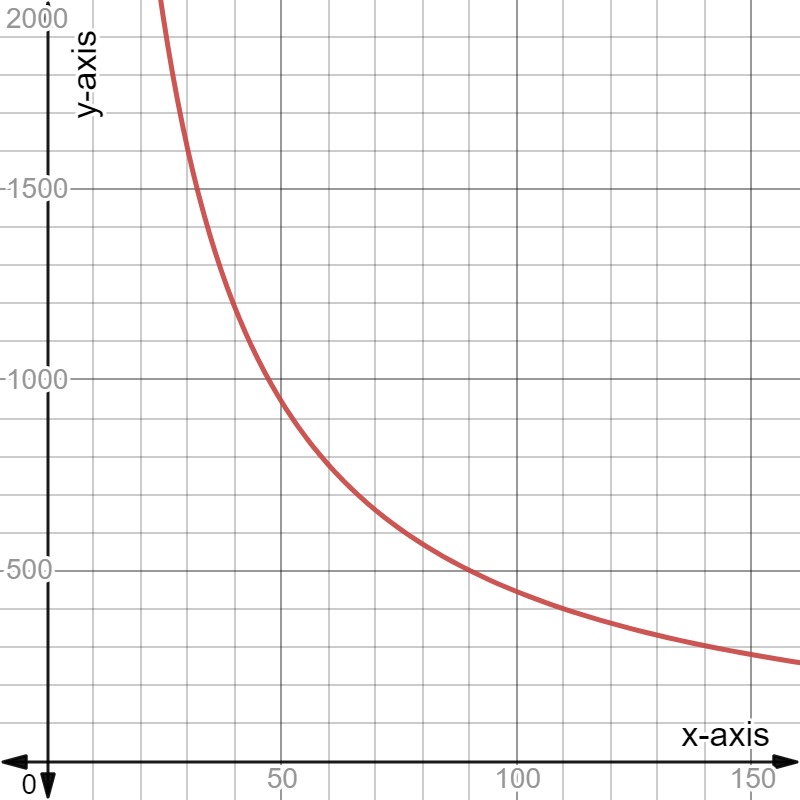

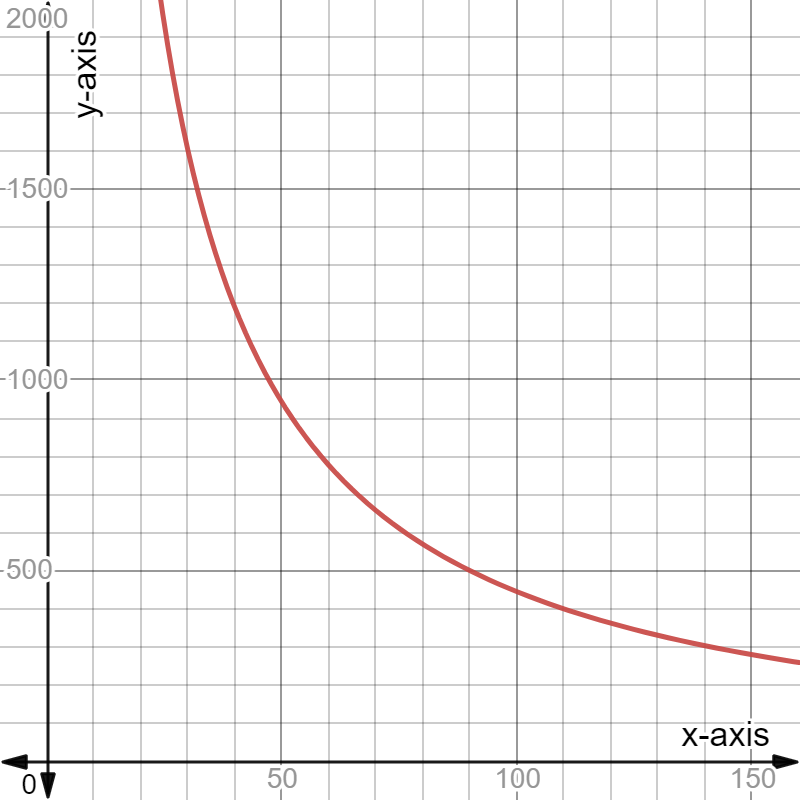

Cengage Financial Algebra 1st Edition Chapter 3 Assessment Banking Services Page 171 Exercise 31 Answer

Given: Tom wants to have50,000 saved sometime in the future.

To find: How much must he deposit every month into an account .We will use the formula of present value of a investment to get the result.

On using the formula for present value of a investment, we get the value as

P=B×r/n(1+r/n)nt−1

=50,000×0.028/12(1+0.028/12)12×x/12−1

=50,000×0.028/12(1+0.028/12)x−1

that give us the graph as

interest, compounded monthly that gives us the graph as