Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market

Page 46 Problem 1 Answer

Given: A corporation has a market capitalization of $24,000,000,000 with 250M outstanding shares.

To calculate the price per share. We will have to divide the market capitalization with outstanding shares.

We have the market capitalization as $24,000,000,000

The number of outstanding shares is 250,000,000

Price per share= Market capitalization/ Number of outstanding shares

=$24,000,000,000/250,000,000

=96

The price per share is obtained to be $96.

Page 46 Problem 2 Answer

Given: Qual Comm, Inc. instituted a4−for−1 split in November. After the split, Elena owned 12,800 shares.

To find the number of shares owned before the split.

We will use the fact that 4−for−1split means the number of share after the split gets four times.

There is 4−for−1 split.

Hence the number of share after the split gets four times.

Therefore the number of shares before the split will be:

Number of shares after the split /4

=12800/4

=3200

Read and Learn More Cengage Financial Algebra 1st Edition Answers

The number of shares owned by Elena before the split is 3200.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Solutions

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 48 Problem 3 Answer

Given: A major drugstore chain whose stocks are traded on the New York Stock Exchange was considering a 2-for-5 reverse split.

The pre-split market cap was1.71B

To find: The post-split market cap

Solution: The market cap pre and post split remains the same.

Splitting and reverse splitting only affects the number of shares and the value per share, it does not change the total market capital

A major drugstore chain whose stocks are traded on the New York Stock Exchange was considering a 2-for-5 reverse split.

If the pre-split market cap was1.71B, then the post-split market cap will also be1.71B

Page 48 Problem 4 Answer

Given: Gabriella owned1,045shares of Hollow Corporation at a price of $62.79. The stock split3−for−2

To find: Financial effect of the split for Gabriella

Solution: We will find the following: Post split number of sharesPost split value per shareCash settlement for fractional shares

Post-split number of shares=a/b×Pre-split number of shares

=3/2×1045

=1567.5

Post-split share price=b/a×Pre-split share price

=2/3×62.79

=41.86

Fractional shares are not traded, so the corporation paid him the market value of 0.5 shares.

Fractional part×Market price=0.5×41.86=20.93

Gabriella received$20.93 in cash and 1567 shares worth$41.86 each.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Problem 5 Answer

We have the statement: Perception is strong and sight is weak.

In strategy, it is important to see distant things as if they were close and to take a distanced view of close things.

The given statement implies that the perception of the value per stock is strong and might strongly influence any decision-making of an investor, while the investors don’t tend to notice the true reason of a stock split .

This is way it is important to see distant things as if they are close, such that an investor can see the true reason by stock splits and can take them into account for any decision-making.

A split does not have any meaningful benefit to the investor as the main reason of the split is the perception.

The perception of the value per stock is strong and might strongly influence any decision making of an investor.

Page 49 Problem 6 Answer

Given: In February, Robbins and Myers, Inc. executed a 2-for-1split. Janine had 470 shares before the split.

Each share was worth $69.48.To find the number of shares she hold after the split.

We will use the fact that 2 for one split means the number of share gets doubled.

Now we have that Janine held 470 shares before the split.

It was 2 for one split therefore the number of shares get doubled.

Hence we have the number of shares as: 470×2=940

The number of shares that Janine held after the splits is 940.

Cengage Financial Algebra Chapter 1 Exercise 1.8 Stock Market Answers

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Problem 7 Answer

Given: In February, Robbins and Myers, Inc. executed a 2-for-1 split. Janine had 470 shares before the split.

Each share was worth $69.48.To find the post split price per share. We will use the worth of each share.

Now we have that there was 2−for one split,this will imply that price per share will get halved.

Now each share was originally $69.48

Hence after the split we will have: 69.48/2=$34.74

The post-split price per share is $34.74.

Page 49 Problem 8 Answer

Given: In February, Robbins and Myers, Inc. executed a2−for−1 split. Janine had 470 shares before the split.

Each share was worth $69.48.To show that the split was monetary non-event for Janine.

We will have to show that the Total worth before split=Total worth after split

Now we know that before the split Janine had 470 shares worth $69.48 each.

Hence the total worth before the split was: 470×69.48=$32,655.60

After the split, she had 940 shares worth $34.74. each.

Hence the total worth after the split was: 940× 34.74=$32,655.60

Therefore, Total worth before split=Total worth after split

We have shown that the split was a monetary non-event for Janine.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Problem 9 Answer

Given: In February, Robbins and Myers, Inc. executed a 2-for-1 split. Janine had 470 shares before the split.

Each share was worth $69.48.To find the number of shares she hold after the split.

We will use the fact that 2 for one split means the number of share gets doubled.

Now we have that Janine held 470 shares before the split.

It was 2 for one split therefore the number of shares get doubled.

Hence we have the number of shares as: 470×2=940

The number of shares that Janine held after the splits is 940.

Page 49 Problem 10 Answer

Given: In February, Robbins and Myers, Inc. executed a 2-for-1 split. Janine had 470

shares before the split. Each share was worth $69.48.To find the post split price per share.We will use the worth of each share.

Now we have that there was 2−for one split,this will imply that price per share will get halved.

Now each share was originally $69.48

Hence after the split we will have: 69.48/2

=$34.74

The post-split price per share is $34.74.

Solutions For Cengage Financial Algebra Chapter 1 Exercise 1.8 The Stock Market

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Problem 11 Answer

Given: In February, Robbins and Myers, Inc. executed a 2-for-1 split. Janine had 470

shares before the split. Each share was worth $69.48.To show that the split was monetary non-event for Janine.

We will have to show that the Total worth before split=Total worth after split

Now we know that before the split Janine had 470 shares worth $69.48 each.

Hence the total worth before the split was: 470×69.48=$32,655.60

After the split she had 940 shares worth $34.74. each.

Hence the total worth after the split was: 940× 34.74=$32,655.60

Therefore, Total worth before split=Total worth after split

We have shown that the split was a monetary non-event for Janine.

Page 49 Problem 12 Answer

Given: Vilma owns 750 shares of Aeropostale. On August 22, the corporation instituted a 3−for−2 stock split.

Before the split, each share was worth $34.89.To find the number of shares that Vilma hold after the split.

We will use the fact that three for two stock split means we will have to multiply the shares with 3/2.

Now we know that there is 3−for−2 share split.

Before the split the number of shares were 750.

Hence after the split it will be multiplies by 3/2 that is:3/2×750=1125

The number of shares that Vilma hold after the split is 1125.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Problem 13 Answer

Given: Vilma owns 750 shares of Aeropostale. On August 22, the corporation instituted a 3−for−2 stock split.

Before the split, each share was worth $34.89.To find the post-price per split after the split. We will use the worth of each share.

There is a three for two split share.Hence the price will get two third of the price before the split.

Now each share was originally $34.89

Hence after the split it will be:2/3×34.89=23.26

The post-price per share after the split is $23.26.

Page 49 Problem 14 Answer

Given: Vilma owns 750 shares of Aeropostale. On August 22, the corporation instituted a 3−for−2

stock split. Before the split, each share was worth $34.89.To show that the split was a monetary non-event for Vilma.

We will have to show that the Total worth before split=Total worth after split

Now we know that before the split there were 750 shares worth $34.89 per share

Hence the total worth before the split was: 750×34.89=$26167.50

After the split there were 1125 shares worth $23.26

Hence the total worth after the split was: 1125×23.26=$26167.50

Therefore Total worth before split=Total worth after split

We have shown that the split was a monetary non-event for Vilma.

Page 49 Exercise 1 Answer

Given: Versant Corporation executed a 1−for−10 reverse split on August 22.

At the time, the corporation had 35,608,800 shares outstanding and the pre-split price per share was $0.41

.To find the number of shares that were outstanding after the split.

We will use the fact that one for ten stock split means we will have to multiply the shares with 1/10

Now we know that there is1−for−10 share split.

Before the split the number of shares were 35,608,800 shares Hence after the split it will be multiplies by1/10

Hence we get: 1/10×35608800=3,560,880

The number of shares that were outstanding after the split were 3,560,880.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 49 Exercise 2 Answer

Given: Versant Corporation executed a 1−for−10 reverse split on August 22.

At the time, the corporation had 35,608,800 shares outstanding and the pre-split price per share was $0.41.

To find the post-price per share after the split.We will use the worth of each share.

There is a one for ten split share. Hence the price will get ten times the price before the split.

Now each share was originally $0.41

Hence after the split it will be: 10×0.41=$4.10

The post price per share after the split was $4.10.

Page 49 Exercise 3 Answer

Given: Versant Corporation executed a 1−for−10 reverse split on August 22.

At the time, the corporation had 35,608,800 shares outstanding and the pre-split price per share was $0.41.

To show that this split was a monetary non-event for the corporation.

We will have to show that the Total worth before split=Total worth after split

Now we know that before the split there were35,608,800 shares worth $0.41.

Hence the total worth before the split was: 35608800×0.41=$14,599,608

After the split there were3,560,880 shares worth $4.10.

Hence the total worth after the split was: 3560880×4.10= $14,599,608

Therefore Total worth before split=Total worth after split

We have shown that the split was a monetary non-event for the corporation.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 50 Exercise 4 Answer

Given: Jon noticed that most traditional splits are in the form of x−for−1

He says that in those cases, all you need do is multiply the number of shares held by x

and divide the price per share by x to get the post-split numbers.

To verify Jon’s method works to determine the post-split price and shares outstanding for Hansen Natural Corporation which executed a 4−for−1 split on July 10 with 22,676,800 outstanding shares and a market price of $203.80 per share before the split.

We will have to find the number of shares after the split.

Now we have four for one split.

This implies that the number of shares will become four times.

Now before the split there were 22,676,800 shares.

Hence after the split there will be: 22,676,800×4=90,707,200 shares Now the price will get one fourth of the before the split.

Hence the price per share after the split will be:

1/4×203.80=$50.95

Hence the number of shares were multiplied by x=4

whereas the price was divided by it after the split.

We have verified that Jon’s method works to determine the post-split price and shares outstanding for Hansen Natural Corporation which executed a 4−for−1 split on July 10 with 22,676,800 outstanding shares and a market price of $203.80 per share before the split.

Page 50 Exercise 5 Answer

Given: Jon also noticed that every traditional split ratio can be written in the form x−for−1.

Examine how the 3−for−2 traditional split can be expressed as 1.5−for1.

Given split:5−for−4 To express the given split ratios as x−for−1.

We will use one of the given example in the question.

5−for−4

5/4=x/1

⇒5=4x

⇒x=1.25

Hence 1.25−for−1

The traditional split ratio 5−for−4 can be expressed as 1.25−for−1.

Page 50 Exercise 6 Answer

Given: Jon also noticed that every traditional split ratio can be written in the form x−for−1.

Examine how the 3−for−2 traditional split can be expressed as 1.5−for−1 .

Given split:6−for−5

To express the given split ratios as x−for−1. We will use one of the given example in the question.

6-for-5

6/5=x/1

=>6=5x

=>x=1.2

Hence 1.2 – for 1

The traditional split ratio6−for−5 can be expressed as 1.2−for−1.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 50 Exercise 7 Answer

Given: Jon also noticed that every traditional split ratio can be written in the form x−for−1.

Examine how the 3−for−2 traditional split can be expressed as 1.5−for−1 .Given split: 5−for−2

To express the given split ratios as x−for−1. We will use one of the given example in the question.

5-for-2

5/2=x/1

=> 5=2x

=>x=2.5

Hence 2.5 -for- 1

The traditional split ratio5−for−2 can be expressed as 2.5−for−1.

Given: Jon also noticed that every traditional split ratio can be written in the form x−for−1.

Examine how the 3−for−2 traditional split can be expressed as 1.5−for−1.

Given split:8−for−5

To express the given split ratios as x−for−1.

We will use one of the given example in the question.

8-for-5

8/5=x/1

=>8=5x

=>x=1.6

Hence 1.6 -for-1

The traditional split ratio8−for−5 can be expressed as 1.6−for−1.

Cengage Financial Algebra Exercise 1.8 The Stock Market Key

Page 50 Exercise 8 Answer

Given: Monarch Financial Holdings, Inc. executed a 6−for−5 traditional split on October 5.

Before the split there were approximately 4,800,000 shares outstanding, each at a share price of $18.00.

To determine the post-split share price and the number of shares.We will use the worth of each share.

Now we know that there is6−for−5 share split.

Before the split the number of shares were 4,800,000 shares Hence after the split it will be multiplies by 6/5 Hence we get: 6/5×4800000=5,760,000

There is a6−for−5 split share.Hence the price will get 5/6 the price before the split.

Now each share was originally$18.00

Hence after the split it will be : 5/6×18=$15.00

The post-split share price is $15.00 The number of shares outstanding is 5,760,000.

Page 50 Exercise 9 Answer

Given: Monarch Financial Holdings, Inc. executed a 6−for−5 traditional split on October 5.

Before the split there were approximately 4,800,000 shares outstanding, each at a share price of $18.00.To compare the results from part a. with that obtained by using Jon’s method.

Jon’s method says that 6−for−5 is the same as 1.2−for−1. We will find the answer using 1.2-for-1 and then compare.

Now we know that there is1.2−for−1 split Before the split the number of shares were 4,800,000 shares

Hence after the split it will be multiplies by1.2

Hence we get:

1.2×4800000=5,760,000

There is a 1.2−for−1 split. Hence the price will get divided by 1.2

Now each share was originally$18.00

Hence after the split it will be: 18/1.2=15.00

Hence we get the same answers.

We obtain the same answers by using both the methods of that in part a and by John’s method.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 50 Exercise 10 Answer

Given: On June 19 California Pizza Kitchen, Inc. instituted a 3−for−2 split.

At that time Krista owned 205 shares of that stock. The price per share was $33.99.

After the split, Krista received a check for a fractional part of a share.To find the amount of the check.We will use the fact that 3−for−2

split means we will have to multiply two third for the original price.

Now we know that there is3−for−2 share split.

Before the split the number of shares were205 Hence after the split it will be multiplies by 3/2

Hence we get 3/2×205=307shares. there is 3 -for-2-share split

Hence the price will get two third of the original price Hence after the split it will be:2/3×33.99=22.66

Now the fractional part .5 is exchanged for the monetary.

Hence the amount of the check was $11.33.

Krista received a check of $11.33.

Page 50 Exercise 11 Answer

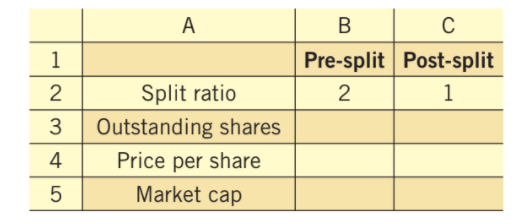

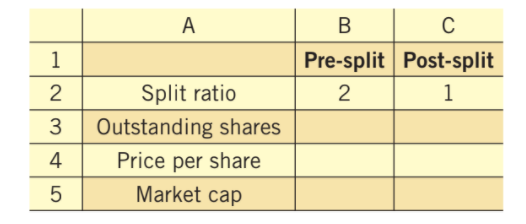

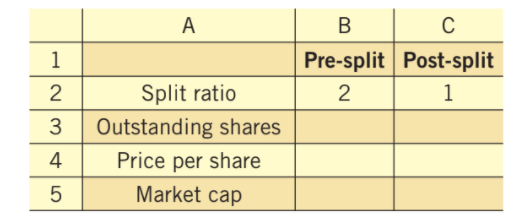

Given spreadsheet:

Write a spreadsheet formula that will calculate the post-split number of outstanding shares in C3.

We will use the formula: Post−split number of shares =a/b× Pre−split number of shares

In general for any a−for−b split the formula which is applied is: Post−split number of shares =a/b× Pre−split number of shares

Hence applying that here we get: the formula on cell C3=(B2/C2)×B3

The formula that calculates the post-split number of outstanding shares in C3 is: (B2/C2)×B3

Page 50 Exercise 12 Answer

Given spreadsheet:

Write the spreadsheet formula that will calculate the post-split price per share in C4.

We will use the formula: Post−split number of shares =b/a× Pre−split number of shares

In general, for any a−for−b split, the formula which is can be applied is: Post−split share price =b/a× Pre−split share price

Hence applying that here we get: the formula of cell C4=(C2/B2)×B4

The spreadsheet formula that will calculate the post-split price per share in C4 is: (C2/B2)×B4

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market Page 50 Exercise 13 Answer

Given spreadsheet:

To write the pre-split market cap formula in cell B9 and the post-split market cap formula in C9.

We will use the formula Market cap = outstanding shares price per share

Now we know that that market cap is given by: Market cap = outstanding shares per share

Hence we get:

Formula on B5=B3×B4

Formula on C5=C3×C4

The pre-split market cap formula in cell B5 is B3×B4 and the post-split cap formula for cell C5 is C3×C4.

Detailed Solutions For Cengage Financial Algebra Chapter 1 Exercise 1.8

Chapter 1 Solving Linear Equations

- Cengage Financial Algebra 1st Edition Chapter 1 Assessment The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.1 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.2 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.3 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.4 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.6 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.7 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.9 The Stock Market