Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market

Page 31 Problem 1 Answer

Given: Toni purchased 15,000 shares of stock of Target Corporation at $54.88 per share. So, the value of trade was$823,200

Her trade appeared on the stock ticker as [email protected]▼0.17.

To find The difference in the value of trade if the trading was done at the previous day’s closing price.

Solution: We will first find the value of the previous day’s closing price from the ticker.Then we will find the value of trade at that price and check the difference.

We will first find the previous day’s closing price

Previous day’s closing price=54.88+0.17

=$55.05

If Toni had purchased the shares at the previous day’s closing price, then

Value of trade= Number of shares× Price per share

=15,000×55.05

=$825,750

Toni has purchased shares at present for$823,200, so if the purchase was done at the previous day’s closing the difference would be$2550(825,750−823,200)

Toni purchased15,000 shares of stock of Target Corporation at$54.88 per share i.e for$823,200

If she purchased those shares at the previous day’s closing of $55.05, the trading price would be$825,750 and the difference between this trade and the original trade would be$2,550

Read and Learn More Cengage Financial Algebra 1st Edition Answers

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Solutions

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 32 Problem 2 Answer

Given: Let,H=day’s High, L=day’s Low, C=day’s close, V=day’s volume

To find A formula that can be used to determine the day’s money flow.

Solution: Day’s money flow=Day′s high+Day′s Low+Day′s Close/3×Day′s Volume

=H+L+C/3×V

Let H represent a day’s High, L represent a day’s Low, C represent a day’s close, and V represent the day’s volume.

Then, day’s money flow=H+L+C/3×V

Page 33 Problem 3 Answer

Given ;

To find; How might a large trade “move the market”? How might those words apply to what you have learned?

Here the author wants to convey that Large trades involve bigger purchases, usually by institutions.

They have a major effect on the market The number of shares traded in a single day can be greater than the number of a company’s outstanding shares, but this is relatively rareLonger-term traders, on the other hand, are buying or selling off of the news, which also contributes to the increased stock activity.

The day traders or short-term investors provide the liquidity required to trade more shares than the actual shares outstanding.

Hence we conclude that Large trades involve bigger purchases, usually by institutions. They have a major effect on the market

Page 33 Problem 4 Answer

Given: The stock symbol representing Exxon Mobil Corp is XOMThe stock ticker [email protected]▼1.58

To find: The numbers of shares bought by Jessica

Solution: The volume of shares traded by Jessica are0.66K

This can be written as660(0.66×1000) shares

Jessica bought 660 shares of Exxon Mobil Corp

Page 33 Problem 5 Answer

Given: Stock ticker for Exxon Mobil Corp [email protected]▼1.58

To find: Cost of each share

Solution: The amount following the@ symbol in the ticker shows the price of each shareSo, the price of each share of Exxon Mobile Corp is$92.67

Each share of Exxon Mobile Corp cost$92.67

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 33 Problem 6 Answer

Given: The ticker for Exxon Mobile [email protected]▼1.58

To find: Value of trade for Jessica

Solution: From the ticker we get the following information:

Number of shares=0.66K

=660shares

Price of each share=$92.67

So, the Value of trade=660×92.67

=$61,162.2

The value of Jessica’s trade was$61,162.2

Page 33 Problem 7 Answer

Given: Phil sold his shares of Verizon Communications IncThe ticker showing that information is [email protected]▲2.27

To find: Number of shares sold by Phil Solution:

Number of shares sold=3.32K

=3.32×1000

=3320 shares

Phil sold 3320 shares of Verizon Communications Inc

Cengage Financial Algebra Chapter 1 Exercise 1.5 Stock Market Answers

Page 33 Problem 8 Answer

Given: The ticker showing sale of shares of Verizon Communications Inc [email protected]▲2.27

To find: Sale price of each share

Solution: The trade price of each share is shown after the@ symbol in the tickerThus, for this ticker sale price of each share was$38.77

Phil sold shares of Verizon Communications Inc at$38.77 each

Page 33 Problem 9 Answer

Given: The ticker showing sale of shares of Verizon Communications Inc [email protected]▲2.27

To find: The total value of all the shares sold by Phil

Solution: From the ticker, we know that,

Number of shares=3320

Price per share=$38.77

So, value of trade=3320×38.77

=$128,716.4

The total value of all the shares of Verizon Communications Inc sold by Phil is$128,716.40

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 33 Problem 10 Answer

Given: The ticker for Home Depot Inc [email protected]▲1.13

To find: Number of shares of Home Depot that are indicated on the ticker

Solution: Number of shares=32.3M

=32.3×1,000,000

=32,300,000 shares

32,300,000 shares of Home Depot are indicated on the ticker.

Page 33 Problem 11 Answer

Given: The ticker for Sprint Nextel Corporation [email protected]▼0.78

To find: The total value of all of the Sprint Nextel Corporation shares traded.

Solution: From the ticker we get the following information:

Number of shares traded=1.1K

=1.1×1000

=1100 shares

Price per share=$9.14

Value of shares=1100×9.14

=$10,054

The total value of all of the Sprint Nextel Corporation shares traded was$10,054

Solutions For Cengage Financial Algebra Chapter 1 Exercise 1.5 The Stock Market

Page 33 Problem 12 Answer

Given: The ticker for Home Depot Inc [email protected]▲1.13

To find: Interpretation [email protected]

Solution: @29.13 shows that each share of Home Depot Inc was traded at$29.13

@29.13 in the ticker for Home Depot Inc shows that each share of Home Depot Inc was traded at$29.13

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 33 Problem 13 Answer

Given ; [email protected]▲[email protected]▼[email protected]▲[email protected]▼1.58

Given message

To find; How can XOM.66K be interpreted?

We have code given [email protected]▲[email protected]▼[email protected]▲[email protected]▼1.58

Value written just after the company symbol represents the trading volume

XOM 0.66K can be interpreted that 0.66 thousand (or 660 ) shares were traded in a single transaction

Hence the code can interpreted as XOM0.66k can be interpreted that 0.66 thousand or 660 shares were traded in a single transaction

Page 33 Problem 14 Answer

Given: Ticker for Exxon Mobil Corp [email protected]▼1.58

To find: Interpretation of▼1.58

Solution: The downward arrow indicates that the trading price is lower than the closing price of the previous day.

For Exxon Mobil Corp, indicates that the trading price was lower by from the previous day’s closing price.

Page 33 Problem 15 Answer

Given: The ticker for all four stocks are:

[email protected]▲1.13

[email protected]▼0.78

[email protected]▲2.27

[email protected]▼1.58

To find: The previous day’s closing price for each stock

Solution: To find the previous day’s closing price, we will add the value after the downward arrow to the trading price, or we will subtract the value after the upward arrow from the trading price

Previous day’s closing price:

Home Depot Inc=29.13−1.13

=$28

Sprint Nextel Corporation=9.14+0.78

=$9.92

Verizon Communications Inc=38.77−2.27

=$36.5

Exxon Mobil Corp=92.67+1.58

=$94.25

The previous day’s closing price for each stock is:

Home Depot Inc=$28

Sprint Nextel Corporation=$9.92

Verizon Communications Inc=$36.50

Exxon Mobil Corp=$94.25

Page 33 Exercise 1 Answer

Given: The ticker for Procter & Gamble Co: [email protected]▼0.39

To find: Number of shares of PG that were traded

Solution: Number of shares=4.5K

=4.5×1000

=4500 shares

4500 shares of PG were traded as per the information given in the [email protected]▼0.39

Cengage Financial Algebra Exercise 1.5 The Stock Market Key

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 33 Exercise 2 Answer

Given: The ticker for Procter & Gamble Co: [email protected]▼0.39

To find: Cost of each share

Solution: The cost of each share is$66.75

The cost of each share of Procter & Gamble Co was$66.75

Page 33 Exercise 3 Answer

Given: The ticker for Procter & Gamble Co: [email protected]▼0.39

To find: The value of the Procter & Gamble Co trade

Solution: From the ticker, we get the following information:

Number of shares=4.5K

=4.5×1000

=4500 shares

Price per share=$66.75

Value of trade=4500×66.75

=$300,375

The value of the Procter & Gamble Co trade was$300,375

Page 33 Exercise 4 Answer

Given: The ticker information for Procter & Gamble Co

Given code [email protected]▼[email protected]▲[email protected]▼[email protected]▲0.04

To find; Use the following ticker to answer PG [email protected] ∇0.39

Now number of shares =23600=23.6K and price previous day’s closing price=66.75+0.39=67.14

now price increased0.18 from last transaction ie. +0.18−0.39=−0.21

Therefore current price should be 67.14−0.21=66.93

Hence Michele will see scrolling across her screen for this transaction will be PG [email protected] ∇0.21

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 34 Exercise 5 Answer

Given ; [email protected]▼[email protected]▲[email protected]▼[email protected]▲0.04

Sarah sold her Disney shares as indicated on the ticker.

To find ; How many shares did she sell?

here we know that Value before @ symbol represents the number of shares traded DIS [email protected]

Number of shares traded 2.55´=2.55∗1000 =2550

Hence sarah sold 2.55K(2550) shares of Disney

Page 34 Exercise 6 Answer

Given ; [email protected]▼[email protected]▲[email protected]▼[email protected]▲0.04

Sarah sold her Disney shares as indicated on the ticker.To find ; How much did each share sell for?

Here we know that Value before @ symbol represents the number of shares traded

DIS 2.55K @34.90 1.08

Hence sarah has sold each share at a price of $34.90

Page 34 Exercise 7 Answer

Given; [email protected]▼[email protected]▲[email protected]▼[email protected]▲0.04 Sarah sold her Disney shares as indicated on the ticker.

To find: What was the total value of all the shares Sarah sold?

Here we see that 2.55K are the number of shares $34.90 is the cost of each share DIS 2.55K @34.90 ∇1.08

Value of trade = no. of shares ∗ cost of each share

Hence the value of shares sold =2.55100034.9=88995

Hence we conclude that sarah sold all her share at a price of $88,995

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 34 Exercise 8 Answer

Given ; [email protected]▼[email protected]▲[email protected]▼[email protected]▲0.04

Sarah sold her Disney shares as indicated on the ticker.

To find; What will Sarah see scrolling across her screen for this transaction of DIS?

DIS 2.55K @34.90 1.08 Now number of shares 7600=7.6´ and price previous day’s closing price34.9+1.08=35.98 now price increased 0.98 from last transaction ie. +0.98−1.08=−0.1

Therefore current price should be 35.98−0.1=35.88

Hence Sarah see scrolling across her screen for this transaction of DIS will be DIS 7.6K @35.88 ∇0.1

Page 34 Exercise 9 Answer

Given: The stock symbols represent the corporations.

To find: How many shares of Kellogg Co. are indicated on the ticker.

Values before at the rate symbol will give traded shares.

Using the values, we can say that shares of Kellogg Co. are indicated on the ticker will be

0.76k=0.76⋅1000

=760

Thus, we can say that 760 shares of Kellogg Co. are indicated on the ticker where the stock symbols represent the corporations.

Page 34 Exercise 10 Answer

Given: The stock symbols represent the corporations.

To find: How can @36.17 be interpreted.Values before at the rate symbol will give traded shares.

Since, we know that values before @ symbol will give traded shares.

Thus, @36.17 can be interpreted that trading occur at $36.17.

Thus, we can say that @36.17 can be interpreted that trading occur at$36.17.

Page 34 Exercise 11 Answer

Given: The stock symbols represent the corporations.

To find: How can0.76k can be interpreted.Values before at the rate symbol will give traded shares.

Since, we know that values before@ symbol will give traded shares.

Also, we know that k=1000 that can be interpreted which gives us the value of 076k=0.76⋅1000 =760

Thus, we can say that 0.76K be interpreted as the trade share will be 760.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 34 Exercise 12 Answer

Given: The stock symbols represent the corporations.

To find: How can ▲0.04 be interpreted.Direction of arrows tells us about the change in price.

Since we know that direction of arrows tells us about the change in price.

Thus, we can say that ▲0.04 means that price gets increased on comparing with previous days closing price.

Thus, we can say that when the stock symbols represent the corporations then ▲0.04

can be interpreted as price gets increased on comparing with previous days closing price.

Page 34 Exercise 13 Answer

Given: 36,000 shares of ABC at a price of 37.15 which is $0.72 higher than the previous day’s close.

To find: Write the ticker symbols for each situation. We will try to find the change in the price with the relative days.

Since we know that the price increases with the previous day. So, we can write▲0.72.

Also, the price can be written as

36,000/1000

=36K.

Hence, we can write the ticker symbols as [email protected]▲0.72.

Thus, we can write the ticker symbols as [email protected]▲0.72.

Page 34 Exercise 14 Answer

Given: 1,240 shares of XYZ at a price of $9.17, which is $1.01 lower than the previous day’s close.

To find: Write the ticker symbols for each situation. We will try to find the change in the price with the relative days.

Since we know that the price decreases with the previous day. So, we can write▼1.01. Also, the price can be written as 1240/1000=1.24K.

Hence, we can write the ticker symbols as [email protected]▼1.01.

Thus, we can write the ticker symbols as [email protected]▼1.01.

Page 34 Exercise 15 Answer

Given: Maria is a stock broker and has been following transactions for Ford Motor Co.

To find: Write the stock ticker symbols that would appear on the scroll for the last trade of the day on Wednesday for Ford.

We will try to find the change in the price with the relative days.

Since, the price on previous day can be written as 5600/1000=5.6K.

As, we know that the last trade of the day was $0.56 higher than Tuesday’s close, which gives us the present value as8.11+0.56=$8.67.

Thus, we can write the ticker symbols as [email protected]▲0.56.

Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.5 The Stock Market Page 34 Exercise 16 Answer

Given: Dorothy purchased x thousand shares of Macy’s Inc (M) at y dollars per share.

To find: Express the ticket symbols algebraically.

We will try to find the change in the price with the relative days.

Since the price on current day can be written as$y.Also, we can write the shares price as x⋅1000/1000=x K.

So, the decrease in price will be z.Thus, we can say that the ticket symbols algebraically will be MxK@y▼z.

Page 34 Exercise 17 Answer

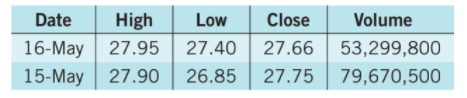

Given:

To find: Do numbers reflect a positive or negative money flow?

We will multiply the volume to get the net flow.

On the very first day, we get average as(27.90+26.85+27.75)/3=27.5and

for the second day, we get average as (27.95+27.40+27.66)/3=27.67.

So, for the first day we get the net flow as 79,670,500×27.5=2,190,938,750 and for the second day, we get the net flow as 53,299,800×27.67=1,474,805,466.

Thus, we can say that there will be negative money flow of May−16 for

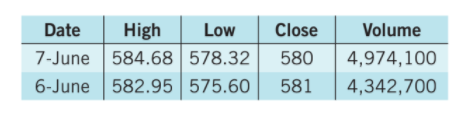

Page 34 Exercise 18 Answer

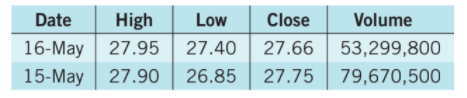

Given:

To find: Do numbers reflect a positive or negative money flow.

We will multiply the volume to get the net flow.

On the very first day, we get average as (582.95+575.60+581)/3=579.85

And for the second day, we get average as(584.68+578.32+580)/3=581

So, for the first day we get the net flow as4,342,700×579.85=2,518,114,595

And for the second day, we get the net flow as4,974,100×581=2,889,952,100.

Thus, we can say that there will be positive money flow of June 7 for

Detailed Solutions For Cengage Financial Algebra Chapter 1 Exercise 1.5

Chapter 1 Solving Linear Equations

- Cengage Financial Algebra 1st Edition Chapter 1 Assessment The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.1 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.2 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.3 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.4 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.6 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.7 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.8 The Stock Market

- Cengage Financial Algebra 1st Edition Chapter 1 Exercise 1.9 The Stock Market