CA Foundation Maths Solutions For Chapter 4 Time Value of Money Introduction

People can’t make money or spend it on housing. food, clothing, education, entertainment, etc. Sometimes extra expenditures have also to be met. For example, there might be a marriage in the family; one may want to line house, one may want to set up his or her business, one may want to have a car, and so on.

- Some people can manage to put aside some money for such expected and unexpected expenditures. But most people have to borrow money for such contingencies.

- From where they can borrow money? Money can be borrowed from friends money lenders or Banks.

- If you can arrange a loan from your friend it might be interest-free but if you borrow money from lenders or Banks you will have to pay some charge periodically for using money from money lenders or Banks. This charge is called interest.

- Interest can be defined as the price paid by a borrower for the use of a lender’s money.

Why is Interest Paid?

- Time value of money: The time value of money means that the value of the unity of money is different in different periods. The sum of money received in the future is less valuable than it is today. In other words, the present worth of money received after some time will be less than the money received today. Since money received today has more value rational investors would prefer current receipts to future receipts. If they postpone their receipts, they will certainly charge some money i.e., interest.

- Opportunity Cost: The lender has a choice between using his money in different investments. If he chooses one, he forgoes the return from all others. In other words, lending incurs an opportunity cost due to the possible alternative uses of the lent money.

- Inflation: Most economies generally exhibit inflation. Inflation is a fall in the purchasing power of money. Due to inflation a given amount of money buys fewer goods in the future than it will now. The borrower needs to compensate the lender for this.

- Liquidity Preference: People prefer to have their resources available in a form that can immediately be converted into cash rather than a form that takes time or money to realize.

- Risk Factor: There is always a risk that the borrower will go bankrupt or otherwise default on the loan. Risk is a determinable factor in fixing the rate of interest

Read and Learn More CA Foundation Maths Solutions

CA Foundation Maths Solutions For Chapter 4 Simple Interest

- If the interest on a sum borrowed for a certain period is reckoned uniformly, then it is called Simple Interest.

- Simple interest is the interest computed on the principal for the entire period of borrowing.

- It is calculated on the outstanding principal balance and not on interest previously earned. It means no interest is paid on interest earned during the term of the loan.

Simple Interest – Important Facts and Formulae:

Principal: The money borrowed or lent out for a certain period is called the principal or the sum.

Interest: Extra money paid for using other’s money is called interest.

Simple Interest (S.I.): If the interest on a sum borrowed for a certain period is reckoned uniformly, then it is called simple interest.

Let Principal = P, Rate = R% per annum (p.a.), and Time = T years. Them

⇒ \(\text { S.I. }=\left(\frac{P \times R \times T}{100}\right)\)

⇒ \(\mathrm{P}=\left(\frac{100 \times 5 . I}{R \times T}\right) \)

⇒ \(\mathrm{R}=\left(\frac{100 \times 5 . I}{P \times T}\right)\)

⇒ \(\mathrm{T}=\left(\frac{100 \times 5 . I}{P \times R}\right)\)

If

A = Accumulated amount

[Final value of investment]

P = Principal. [Initial value of an investment]

r= Rate of interest

t = time (years.]

I = Amount interest

A = P + I

I = A – P

⇒ \(\mathrm{A}=\mathrm{P}\left(1+\frac{1 t}{100}\right)\)

CA Foundation Maths Chapter 4 Time Value Of Money Solutions

Solved Sums with Solution:

Question 1. Find the simple interest on Rs. 651000 at \(16 \frac{2}{3} \%\)per annum for 9 months.

Solution:

⇒ \(\mathrm{P}=\mathrm{Rs} 68000, \mathrm{R}=\frac{50}{3} \% \text { p.a and } \mathrm{T}=\frac{9}{12} \text { Years }=\frac{3}{4} \text { years. }\)

⇒ \(\mathrm{S} .1 .=\left(\frac{P \times R \times S}{100}\right)=R s .\left(68000 \times \frac{50}{3} \times \frac{3}{4} \times \frac{1}{100}\right)=R s .8500 \)

Question 2. Find the simple interest on Rs. 3000 at 6ÿ% per annum for the period from 4″’ Fell., 2005 to 18 th April, 2005.

Solution:

⇒ \(\text { Time }=(24+31+18) \text { days= } 73 \text { days }=\frac{73}{365} \text { year }=\frac{1}{5} \text { year. }\)

⇒ \(P=\text { Rs. } 3000 \text { and } R=6 \frac{1}{4} \% \text { p.a. }=\frac{25}{4} \% \text { p.a. }\)

⇒ \(\text { S.I. }=\text { Rs. Rs. }\left(3000 \times \frac{25}{4} \times \frac{1}{5} \times \frac{1}{100}\right)=\text { Rs. } 37.50 \)

Remark: the day on which money is deposited is not counted while the day on which money is withdrawn is counted.

Question 3. A sum at simple interest at 131/2% per annum amounts to Rs. 2502.50 after 4 years, find the sum.

Solution:

Let the sum be Rs. X then, S.l. = Rs\(\left(x \times \frac{27}{2} \times 4 \times \frac{1}{100}\right)={Rs} . \frac{27 x}{50}\)

⇒ \(\frac{77 x}{50}=250250 \Leftrightarrow x=\frac{250250 \times 50}{77}=1625 .\)

Question 4. A sum of Rs. 800 amounts to Rs. 920 in 3 years at simple interest. If the interest rate is increased by 3%, it would amount to how much?

Solution:

S.l. =Rs. (920 – 800) = Rs. 120; P=Rs. 800, T= 3 yrs.

⇒ \(\mathrm{R}=\left(\frac{100 \times 120}{800 \times 3}\right) \%=5 \% \)

⇒ \(\text { New rate }=(5+3) \%=8 \%\)

⇒ \(\text { New S.I. }=\text { Rs. }\left(\frac{800 \times 8 \times 3}{100}\right)=\text { Rs. } 192\)

New amount – Rs. (800+192) = Rs. 992.

Question 5. Adam borrowed some money at the rate of 6% p.a. for the first two years, at the rate of 9% p.a. for the next three years, and at the rate of 14% p.a. for the period beyond five years, If he pays a total interest of Rs. 11,400 at the end of nine years, how much money did he borrow?

Solution:

Let the sum borrowed be x. then,

⇒ \(\left(\frac{x \times 6 \times 2}{100}\right)+\left(\frac{x \times 9 \times 3}{100}\right)+\left(\frac{x \times 14 \times 4}{100}\right)=11400\)

⇒ \(\Leftrightarrow\left(\frac{3 x}{25}+\frac{27 x}{100}+\frac{14 x}{25}\right)=11400 \Leftrightarrow \frac{95 x}{100}=11400 \Leftrightarrow\left(\frac{11400 \times 100}{95}\right)=12000\)

Hence, sum borrowed = Rs. 12,000

Question 6. A certain sum of money amounts to Rs. 1008 in 2 years and to Rs. 1164 in 31/2 years find the sum and the rate of interest.

Solution:

⇒ \(\text { S.I. for } 1 \frac{1}{2} \text { years }=\text { Rs. }(1164-1008)=\text { Rs. } 156 .\)

⇒ \(\text { S.I. for } 2 \text { years }=\text { Rs. }\left(156 \times \frac{2}{3} \times 2\right)=\text { Rs. } 208 \text {. }\)

⇒ \(\text { Principal= Rs. }(1008-208)=\text { Rs. } 800 .\)

⇒ \(\text { Now, } P=800, T=2 \text { and S.I. }=208\)

⇒ \(\text { Rate }=\left(\frac{100 \times 208}{800 \times 2}\right) \%=13 \% .\)

Question 7. At what rate present per annum will a sum of money double in 16 years?

Solution:

Let principals P. then, S.l. = P and T = 16yrs.

⇒ \(\text { Rate }=\left(\frac{100 \times P}{P \times 16}\right) \%=6 \frac{1}{4} \% p . a .\)

Question 8. The simple interest on a sum of money is \(\frac{4}{9}\) of the principal, find the rate present and time, if both are numerically equal.

Solution:

Let sum =Rs. x. then, S.L =Rs.\(\frac{4 x}{9}\)

Let rate = R % and time = R years.

Then\(\left(\frac{x \times R \times R}{100}\right)=\frac{4 x}{9} \text { or } R^2=\frac{400}{9} \text { or } R=\frac{20}{3}=6 \frac{2}{3}\)

⇒ \(\text { Rate }=6 \frac{2}{3} \% \text { and time }=6 \frac{2}{3} y \text { rs }=6 \text { yrs } 8 \text { Months. }\)

Question 9. The simple interest on a certain sum of money for 2ÿ years at 12% per annum is Rs.40 less than the simple interest on the same sum for 3 years at 10% per annum. Find the sum.

Solution:

Let the sum be Rs. X. then,\(\left(\frac{x \times 10 \times 7}{100 \times 2}\right)-\left(\frac{x \times 12 \times 5}{100 \times 2}\right)=40\).

⇒ \(\frac{7 x}{20}-\frac{3 x}{10}=40 \Leftrightarrow x=(40 \times 20)=800 \text {. }\)

Hence, the sum is Rs.800.

Question 10. A sum was put at simple interest at a certain rate for 3 years. Had it been put at 2% higher rate, it would have fetched Rs. 360 more. Find the sum.

Solution:

Let sum= P and original rate= R. then,\(\left[\frac{P \times(R+2) \times 3}{100}\right]-\left[\frac{P \times R \times 3}{100}\right]=360\)

3PR + 6P – 3PR =36000« 6P =36000o P =6000

Hence, sum =Rs. 6000.

Time Value Of Money Chapter 4 CA Foundation Answers

CA Foundation Maths Solutions For Chapter 4 Exercise – 1

Question 1. A person borrows Rs. 5000 for 2 years at 4% p.a. simple interest; He immediately lends it to another person at \(6 \frac{1}{4} \%\) p.a. for 2 years. Find his gain in the transaction per year.

- Rs. 112.50

- Rs. 125

- Rs. 150

- Rs. 29

Solution:

⇒ \( \text { Gain in } 2 \text { yrs. }=\text { Rs. }\left[\left(5000 \times \frac{25}{1} \times \frac{2}{100}\right)-\left(\frac{5000 \times 4 \times 2}{100}\right)\right]=\text { Rs. }(625.400)=\text { Rs. } 225\)

⇒ \(\text { Gain in } 1 \text { year }=\text { Rs. }\left(\frac{225}{2}\right)=\text { Rs. } 112.50 .\)

Question 2. How much time will it take for an amount of Rs. 450 to yield Rs.81 as interest at 4.5% per annum of simple interest?

- 3.5 years

- 4 years

- 4.5 years

- 5 years

Solution:

⇒ \(\text { Time }=\left(\frac{100 \times 81}{150 \times 4.5}\right) \text { years }=4 \text { years. }\)

Question 3. A sum of Rs. 12,500 amounts to Rs.15, 500 in 4 years at the rate of simple interest what is the rate of interest?

- 5%

- \(6 \frac{1}{4} \%\)

- \(6 \frac{1}{4} \%\)

- \(6 \frac{3}{4} \%\)

Solution:

S.l.= Rs. (15500-12500] =Rs.3000.

⇒ \(\text { Rate }=\left(\frac{100 \times 3000}{12500 \times 4}\right) \%=6 \% \% .\)

Question 4. Reena took a loan of Rs. 1200 with simple interest for as many years as the rate of interest. If she paid Rs. 432 as interest at the end of the loan period, what was the rate of interest?

- 3.6

- 6

- Cannot be determined

- None of these

Solution:

Let rate = R% and time = R years. Then,

⇒ \(\left(\frac{1200 \times R \times R}{100}\right)=432 \Leftrightarrow \quad 12 R^2=432 \quad \Leftrightarrow \quad R^2=\quad 36 \Leftrightarrow \mathrm{R}=6\)

Question 5. A man took a loan from a bank at the rate of 12% p.a. simple interest. After 3 years he had to pay Rs.5400 interest only for the period. The principal amount borrowed by him was:

- Rs 2000

- Rs 10,000

- Rs 15,000

- Rs. 20,000

Solution:

⇒ \(\text { Principal }=\text { Rs. }\left(\frac{100 \times 5100}{12 \times 3}\right)=\text { Rs. } 15000 .\)

Question 6. What is the present worth of Rs.132 due in 2 years at 5% simple interest per annum?

- Rs. 112

- Rs. 118.80

- Rs. 15,000

- Rs. 122

Solution:

Let the present worth be Rs. x, then, S.l. =Rs. (132-x).

⇒ \( \left(\frac{x \times 5 \times 2}{100}\right) 132-x \Leftrightarrow 10 x=13200-100 x \Leftrightarrow 110 x=13200 \Leftrightarrow x=120 \)

Question 7. A sum fetched a total simple interest of Rs. 4016.25 at the rate of 9 p. c. p.a. in 5 years. What is the sum?

- Rs. 4462.50

- Rs. 8032.50

- Rs. 8900

- Rs. 8925

- None of these

Solution:

⇒ \(\text { principal }=\text { Rs. }\left(\frac{100 \times 4016.25}{9 \times 5}\right)={Rs} .\left(\frac{401625}{45}\right)={Rs} .8925 .\)

Question 8. Rs. 800 becomes Rs. 956 in 3 years at a certain rate of simple interest, if the rate ofinterest is increased by 4%, what amount will Rs. 800 become in 3 years?

- Rs. 1020.80

- Rs 1025

- Rs. 1052

- Data inadequate

- None of these

Solution:

S.l. = Rs. (956-800) = Rs. 1 56.

⇒ \(\text { Rate }=\left(\frac{100 \times 156}{800 \times 3}\right) \%=6 \frac{1}{2} \%\)

⇒ \(\text { New rate }=\left(6 \frac{1}{2}+4\right) \%=10 \frac{1}{2} \%\)

⇒ \(\text { New S.I. }=\text { Rs. }\left(800 \times \frac{21}{2} \times \frac{3}{100}\right)=\text { Rs. } 252\)

New amount =Rs.(800+252)= Rs.1052

Question 9. A certain amount earns a simple interest of Rs.1750 after 7 years. Had the interest been 2% more, how much more interest would it have earned?

- Rs. 35

- Rs. 245

- Rs. 350

- Cannot be determined

- None of these

Solution:

We need to know the S.I. principal and time to find the rate since the principal is not given, so data is inadequate.

Question 10. In how many years, Rs. 150willproduce the same interest @ 8%as Rs.800 produce in 3 years \(\text { @ } 4 \frac{1}{2} \% \text { ? }\)

- 6

- 8

- 9

- 12

Solution:

P= Rs 800, R=4ÿ% = %, T = 3 years, then,

\(\text { S.I. }=\text { Rs. }\left(800 \times \frac{9}{2} \times \frac{3}{100}\right)=R s .108 .\)Now, P =Rs. 150, S.l. = Rs. 108, R= 8%

⇒ \(\text { Time }=\left(\frac{100 \times 108}{150 \times 8}\right) \text { years }=9 \text { years. }\)

Question 11. A sum invested at 5% simple interest per annum grows to Rs. 504 in 4 years. The same amount at 10% simple interest per annum in 2ÿyears will grow to:

- Rs. 420

- Rs. 450

- Rs. 525

- Rs. 550

Solution:

let the sum be Rs. X. then, S.l. = Rs.(504-x).

⇒ \(\left(\frac{x \times 5 \times 4}{100}\right)=504 \cdot \mathrm{x} \Leftrightarrow 20 \mathrm{x}=50400-100 \mathrm{x} \Leftrightarrow 120 \mathrm{x}=50400 \Leftrightarrow \mathrm{x}=420\)

Now, P= Rs. 420, R= 10%. \(\mathrm{T}=\frac{5}{2} \text { years. }\)

⇒ \({\text { S.I. }=Rs} .\left(\frac{420 \times 10}{100} \times \frac{5}{2}\right)={Rs} .105\)

Amount = Rs, (420+105] = Rs. 525.

Question 12. What will be the ratio of simple interest earned by a certain amount at the same rate of interest for 6 years and that for 9 years?

- 1 : 3

- 1: 4

- 2 : 3

- Data inadequate

- None Of these

Solution:

Let the principal boI’ ami rale ol interest be R%

Required ratio \(=\left\lfloor\frac{\frac{P \times R \times 6}{100}}{\frac{P\times R\times 9}{100}}\right\rfloor=\frac{6 PR}{9 P R}=\frac{6}{9}=2: 3\)

Question 13. Nitin borrowed some money at the rate of 6% p.a. for the first three years, 9% p.a. for the next five years, and 13% p.a. for the period beyond eight years, If the total interest paid by him at the end of eleven years is Rs. 8160, how much money did he borrow?

- Rs. 8000

- Rs. 10,000

- 12,000

- Data inadequate

Solution:

let the sum to Its. X. Then,

⇒ \(\left(\frac{x \times 6 \times 3}{100}\right)+\left(\frac{x \times 9 \times 5}{100}\right)+\left(\frac{x \times 13 \times 3}{100}\right)=8160\)

18x+45x+39x=(8 1 60 x 100) <=> 102x = 816000 <=> x = 8000.

Question 14. An automobile financier claims to be lending money at simple interest, but he includes the interest every six months for calculating the principal. If he is charging an interest of 10% the effective rate of interest becomes:

- 10%

- 10. 25%

- 10.5%

- None of these

Solution:

Let the sum be Rs. 100 then

S.I. for first 6 months Rs.\(\text { Rs. }\left(\frac{100 \times 10 \times 1}{100 \times 2}\right)={Rs} .5\)

S.l. for last 6 months= Rs.\(\left(\frac{105 \times 10 \times 1}{100 \times 2}\right)=Rs .5 .25\)

So, the amount at the end of 1 year is Rs. (100+5+5.25)= Rs.110.25.

Effective rate = (110.25-100)= 10.25 %

Question 15. A sum of money at simple interest amounts to Rs. 815 in 3 years and to Rs.854 in 4 years. The sum is:

- Rs. 650

- Rs. 690

- Rs. 698

- Rs 700

Solution:

S.l. for 1 year= RS. (854-815)=Rs.39.

S.l. for 3 Years= RS.(39 x 3) = Rs.117.

Principal = Rs.( 815 -117) = Rs. 698.

Question 16. A sum of money lent out at simple interest amounts to Rs. 720 after 2 years and to Rs. 1020 after a further period of 5 years. The sum is:

- Rs. 500

- Rs. 600

- Rs. 700

- Rs. 710

Solution:

S.I. for 5 years RS. (1020-720)=Rs.300

S.I. for 2 Years=\(\text { RS. }\left(\frac{300}{5} \times 2\right)={Rs} .120\)

Principal = Rs.( 720 -120) = Rs. 600.

Question 17. A sum of money amorist to Rs. 9800 after 5 years and Rs. 12005 after 8 years at the same rate of simple interest, the rate of interest per annum is:

- 5%

- 8%

- 12%

- 15%

Solution:

S.I. for 3 years RS. (12005-9800)=Rs.2205

⇒ \(\text { S.I. for } 5 \text { Years }=\text { RS. }\left(\frac{2205}{3} \times 5\right)=\text { Rs. } 3675 \text {. }\)

⇒ \(\text { Principal }=\text { Rs. }(9800-3675)=\text { Rs. } 6125 \text {. }\)

⇒ \(\text { Hence, rate }=\left(\frac{100 \times 3675}{6125 \times 5}\right) \%=12 \%\)

Question 18. At what rate present of simple interest will a sum of money double itself in 12 years?

- \( 8 \frac{1}{4} \%\)

- \( 8 \frac{1}{3} \%\)

- \( 8 \frac{1}{2} \%\)

- \( 9 \frac{1}{2} \%\)

Solution:

Letsum=x. then, S.l. = x

⇒ \(\text { Rate }=\left(\frac{100 \times S . J}{P \times T}\right)=\left(\frac{100 \times x}{x \times 12}\right) \%=\frac{25}{3} \%=8 \frac{1}{3} \%\)

Question 19. At what rate present per annum will the simple interest sum of money be \(\frac{2}{5}\) of the amount in 10 years?

- 4%

- \(5 \frac{2}{3} \%\)

- 6%

- \(6 \frac{2}{3} \%\)

Solution:

Let sum= x. then, S.I. =\(\frac{2 x}{5} \text { Time }=10 \text { Years. }\)

⇒ \(\text { Rate }=\left(\frac{100 \times 2 x}{x \times 5 \times 10}\right) \%=4 \%\)

Question 20. In how much time would the simple interest on a certain sum be 0.125 times the principal at 10% per annum?

- \(1 \frac{1}{4}years\)

- \(1 \frac{3}{4}years\)

- \(2 \frac{1}{4}years\)

- \(2 \frac{3}{4}years\)

Solution:

Let sum= x. then, S.l. = 0.125x=\(\frac{1}{8} x, R=10 \%\)

⇒ \(\text { Time }=\left(\frac{100 \times x}{x \times 8 \times 10}\right) \text { Years }=\frac{5}{4} \text { Years }=1 \frac{1}{4} \text { Years }\)

Question 21. A sum of money becomes of itself in 3 years at a certain rate of simple interest the rate annum is:

- \(5 \frac{5}{9} \%\)

- \( 6 \frac{5}{9} \%\)

- 18%

- 25%

Solution:

Let sum= x. then, Amount=\(\frac{7 x}{6}, \mathrm{~S} . \mathrm{I}=\left(\frac{7 x}{6}-x\right)=\frac{x}{6} ;\)

Time = 3 Years

⇒ \(\text { Rate }=\left(\frac{100 \times x}{x \times 6 \times 3}\right) \%=\frac{50}{9} \%=5 \frac{5}{9} \%\)

Question 22. Simple Interest on a certain amount is \(\frac{9}{16}\)of the principal. If the numbers representing principal are lent out, is:

- \(5 \frac{1}{2}years\)

- \( 6 \frac{1}{2}years\)

- 7 years

- \(7 \frac{1}{2}years\)

Solution:

let sum = x. tlum, S.l. \(=\frac{9}{16} x\)

Let rate= R % and Time = R years

⇒ \(\left(\frac{x \times R \times R}{100}\right)=\frac{9 x}{16} \Leftrightarrow R^2=\frac{900}{16} \Leftrightarrow R=\frac{30}{4}=7 \frac{1}{2}\)

Hence, time = \(7 \frac{1}{2} \text { Years. }\)

Question 23. A lends Rs. 2500 to B and a certain sum to C at the same time at 7% p.a. simple Interest. If after 4 years, A altogether receives Rs. 1120 as interest from B and C, then the sum lent to C is:

- Rs. 700

- Rs. 1500

- Rs. 4000

- Rs. 6500

Solution:

Let the sum lent to C he Rs. X. then,\(\left(\frac{2500 \times 7 \times 4}{100}\right)+\left(\frac{x \times 7 \times 4}{100}\right)=1120\)

⇒ \( \Leftrightarrow \quad \frac{7}{25} x=(1120-700) \Rightarrow x=\left(\frac{420 \times 25}{7}\right)=1500\)

CA Foundation Maths Chapter 4 Detailed Solutions

Question 24. A lent Rs.5000 for 2 years and Rs. 300 for 4 years on simple interest at the same rate of interest and received Rs. 2200 in all from both of them as interest. The rate of interest per annum is:

- 5%

- 7%

- 71 %

- 10%

Solution:

Let the rate be R% p.a. then,\(\left(\frac{5000 \times R \times 2}{100}\right)+\left(\frac{3000 \times R \times 4}{100}\right)=2200\)

⇒ \(\Leftrightarrow \quad 100 R+120 R=2200 \Leftrightarrow R=\left(\frac{2200}{220}\right)=10 \text { Rate }=10 \%\)

Question 25. A sum of Rs 725 is lent at the beginning of a year at a certain rate of interest. After 8 months, a sum of Rs. 362.50 more is lent but at the rate twice the former at the end of the year, Rs.33.50 is earned as interest from both the loans. What was the original rate of interest?

- 3.6%

- 4.5%

- 5%

- 6%

- None

Solution:

Let the original rate be R% then, the new rate = (2R) %.

⇒ \(\left(\frac{725 \times R \times 1}{100}\right)+\left(\frac{36250 \times 2 R \times 1}{100 \times 3}\right)=33.50\)

(2175+725) R= 33.50x 100 x 3=10050 \(\Leftrightarrow \quad R=\frac{10050}{2900}=3.46\)

Original rate = 3.46%

Question 26. The difference between the simple interest received from two different sources on Rs. 1500 for 3 years is Rs. 13.50 the difference between their rates of interest is:

- 0.1%

- 0.2%

- 0.3%

- 0.4%

- None

Solution:

⇒ \(\left(\frac{1500 \times R_1 \times 3}{100}\right)-\left(\frac{1500 \times R_2 \times 3}{100}\right)=13.50\)

4500 (R1 – R2) = 1350o (R1 – R2)=\(=\frac{1350}{4500}=0.3 \%\)

Question 27. Peter invested an amount of 12000 at the rate of 10 p.c.p.a. simple interest and another amount at the end of 20 p.c.p.a. simple interest. The total interest earned at the end of one year on the total amount invested became 14 p.c.p.a. Find the total amount invested.

- Rs. 20,000

- Rs. 22,000

- Rs 24,000

- Rs. 25,000

- None

Solution:

Let the second amount be RS. X. Then,

⇒ \(\left(\frac{12000 \times 10 \times 1}{100}\right)+\left(\frac{x \times 20 \times 1}{100}\right)=\left[\frac{(12000+x) \times 14 \times 1}{100}\right]\)

12000+20x=1 68000+14x ⇔ 6x= 48000 ⇔ x = 8000

Total investment = Rs. (12000+8000) = Rs. 20000

Question 28. If the annual rate of simple interest increases from 10 % to \(12 \frac{1}{2}\) % a man’s yearly income increases by Rs. 1250 His principal (in Rs.) is:

- 45,000

- 50,000

- Rs. 24,600

- Rs. 26,000

Solution:

Let the sum be Rs. X, then,\(\left(x \times \frac{25}{2} \times \frac{1}{100}\right)-\left(\frac{x \times 10 \times 1}{100}\right)=1250\)

⇔ 25x-20x = 250000 ⇔ 5x = 250000 o x = 50000

Question 29. A moneylender finds that due to a fall in the annual rate of interest from 8% to 7- %, his 4 yearly income diminishes by Rs. 61.50 His capital is:

- Rs. 22,400

- Rs. 23,800

- Rs. 24,600

- Rs. 26,000

Solution:

Let the capital be Rs. X, then,\(\left(\frac{x \times 8 \times 1}{100}\right)-\left(x \times \frac{31}{4} \times \frac{1}{100}\right)=61.50\)

32x- 31x = 6150x 4 o x = 24600

Question 30. The price of a T.V. set worth Rs. 20,000 is to be paid in 20 installments of Rs. 1000 each. If the rate of interest is 6 per annum, and the first installment is paid at the time of purchase, then the value of the last instalment covering the interest as well will be:

- Rs. 1050

- Rs. 2050

- Rs. 3000

- None of these

Solution:

Money paid in cash = Rs. 1000. Balance payment = Rs. (20000-1000) = Rs. 19000.

Question 31. Mr. Thomas invested an amount of Rs. 13900 divided into two different schemes A and B at the simple interest earned in 2 years Rs. 3508, what was the amount invested in scheme B?

- Rs. 6400

- Rs. 6500

- 7200

- Rs. 7500

- None

Solution:

Let the sum invested in scheme A be Rs. X and that in scheme B be Rs. (13900 – x).

⇒ \(\text { Then, }\left(\frac{x \times 14 \times 2}{100}\right)+\left[\frac{13900-x) \times 11 \times 2}{100}\right]=3508\)

28x- 22x = 350800 – (13900 x 22) cs 6x = 45000 ⇔ x = 7500.

Question 32. An amount of Rs. 100000 is invested in two types of shares. The first yields an interest of 9% p.a. and the second, 11% p.a. If the total interest at the end of one year is, 9% then the amount invested in each share was:

- Rs. 52,500; Rs. 47,500

- Rs. 62,500; Rs. 37,500

- Rs. 72,500; Rs. 27,500

- Rs. 82,500; Rs. 17,500

Solution:

Let the sum invested at 9% be Rs. X and that invested at 11% be Rs. (100000 – x)

Then, \(\left(\frac{x \times 9 \times 1}{100}\right)+\left[\frac{(100000-x) \times 11 \times 1}{100}\right]=\left(100000 \times \frac{39}{4} \times \frac{1}{100}\right)\)

⇒ \(\Leftrightarrow \frac{9 x+1100000-11 x}{100}=\frac{39000}{4}=9750\)

2x = (1100000-975000) = 125000 ox = 62500.

The sum invested at 9%= Rs. 62500. The sum invested at 1 1% = Rs. (100000- 62500) = Rs. 37500.

Question 33. David invested a certain amount in three different schemes A, B, and C with the rate of interest of 10 % p.a. 12% p.a., and 15% P.a. Respectively. If the total interest. Accrued in one year was Rs. 3200 and the amount invested in scheme C was 150% of the amount invested in scheme B.

- Rs. 5000

- Rs. 6500

- Rs. 8000

- Cannot be determined

- None of these

Solution:

let x,y, and z be the amounts invested in schemes A, B, and C respectively. Then,

⇒ \(\left(\frac{x \times 10 \times 1}{100}\right)+\left(\frac{y \times 12 \times 1}{100}\right)+\left(\frac{z \times 15 \times 1}{100}\right)=3200\)

10x+12y+15z= 320000

Now, z=240% of y\(=\frac{12}{5} y\)

And,z= 150% of x\(x=\frac{3}{2} x \Rightarrow x=\frac{2}{3} z=\left(\frac{2}{3} \times \frac{12}{5}\right) y=\frac{8}{5} y\)

From (1), (2) and (3), we have

16y+ 12y + 36y= 320000 o 64y = 320000 ⇔y = 5000

Question 34. A person invested in all Rs. 2600 at 4%, 6%, and 8% per annum simple interest, and at the end of the year, he got the same interest in all three cases, the money invested at 4% is:

- Rs. 200

- Rs. 600

- Rs. 800

- Rs. 1200

Solution:

Let the parts be x, y, and [2600-(x + y)]. Then,

⇒ \(\frac{x \times 4 \times 1}{100}=\frac{y \times 6 \times 1}{100}=\frac{[2600-(x+y)] \times 8 \times 1}{100}\)

⇒ \(\frac{y}{x}=\frac{4}{6}=\frac{2}{3} \text { or } y=\frac{2}{3} x\)

⇒ \(So, \frac{x \times 4 \times 1}{100}=\frac{\left(2600-\frac{5}{3} x\right) \times 8}{100}\)

⇒ \(\Rightarrow 4 x=\frac{(7800-5 x) \times 8}{3} \Leftrightarrow 52 x=(7800 \times 8) \Leftrightarrow x=\left(\frac{7800 \times 8}{52}\right)=1200 .\)

Money invested at4%= Rs.1200

Question 35. Divide Rs. 2379 into 3 parts so that their amounts after 2, 3, and 4 years respectively may be equal, the rate of interest being 5% per annum at simple interest. The first part is:

- Rs. 759

- Rs. 792

- Rs. 818

- Rs. 828

Solution:

Let the parts be x, y and [2379 – (x +y)]

⇒ \(\mathrm{X}+\left(x \times 2 \times \frac{5}{100}\right)=y+\left(y+3 \times \frac{5}{100}\right)=z+\left(z \times 4 \times \frac{5}{100}\right)\)

⇒ \(\Rightarrow \frac{11 x}{10}=\frac{23 y}{20}=\frac{6 \mathrm{z}}{5}=\mathrm{k} \quad \Rightarrow \quad \mathrm{x}=\frac{10 \mathrm{k}}{11}, \mathrm{y}=\frac{20 \mathrm{k}}{23}, \mathrm{z}=\frac{5 \mathrm{k}}{6}\)

⇒ \( text { But } \mathrm{x}+\mathrm{y}+\mathrm{z}=2379 \)

⇒ \( \Rightarrow \frac{10 \mathrm{k}}{11}+\frac{20 \mathrm{k}}{23}+\frac{5 \mathrm{k}}{6}=2379 \quad \Rightarrow \quad 1380 \mathrm{k}+1320 \mathrm{k}+1265 \mathrm{k}=2379 \times 11 \times 23 \times 6 \)

⇒ \( \mathrm{k}=\frac{2379 \times 11 \times 23 \times 6}{3965}=\frac{3 \times 11 \times 23 \times 6}{5} \)

⇒ \(\mathrm{x}=\left(\frac{10}{11} \times \frac{3 \times 11 \times 23 \times 6}{5}\right)=828\)

Hence, the first part is Rs. 828

Question 36. Two equal sums of money were lent at simple interest at ll%p.a. for 3 years and 4 years respectively.If the difference in interest for two periods was ₹ 412.50, then each sum is:

- ₹3,250

- ₹3,500

- ₹ 3.750

- ₹4,350

Solution:

The difference in is due to the time

Rate of interest for the whole

Duration = [11×4.5 – 11×3.5) = 11%

⇒ \(P=\frac{\text { Total S.I }}{\text { Interest on ₹1 }}=\frac{412.50}{0.11}=₹ 3750\)

Question 37. In how much time would the simple interest on a certain sum be 0.125 times the principal at 10% per annum?

- \(1 \frac{1}{4}\)

- \(1 \frac{3}{4}\)

- \(2\frac{1}{4}years\)

- \(2 \frac{3}{4}years\)

Solution:

⇒ \(\mathrm{t}=\frac{1 / P}{r \%}=\frac{0.125}{0.10}=1.25 \mathrm{yrs}\)

Details: S . I\( =\frac{p . r. t}{100} \)

0r ;\( 0.125 \mathrm{P}=\frac{P, 10 \times t}{100}\)

Or t = 0.125×10 = 1.25 yrs

Question 38. Find the number of years in which a sum doubles itself at the rate of 8% per annum.

- \(11 \frac{1}{2}\)

- \(12 \frac{1}{2}\)

- \(9 \frac{1}{2}\)

- \(13 \frac{1}{2}\)

Solution:

⇒ \(text { Tricks: } \mathrm{t}=\frac{(x-1) \times 100}{r}\)

⇒ \(=\frac{(2-1) \times 100}{B}=12.5 \mathrm{yrs} \)

Question 39. The time by which a sum of money is 8 times its self if it doubles itself in 15 years.

- 42 years

- 43 years

- 45 years

- 46 years

Solution:

It is compound interest Qts.

2t2 =815

Or 212 = 815 Or 212 = (23)15 : tz = 45 yrs

Question 40. What is the rate of simple interest if a sum of money amount ₹2,784 in 4 years and ₹2,688 in. 3 years?

- l%p.a.

- 4% p.a.

- 5% p.a.

- 8% p.aa

Solution:

⇒ \(\text { S.l. pa }=\frac{\text { difference in s.t }}{\text { difference in time }}\)

⇒ \(\frac{s t_2-s t_1}{t_2-t_1}=\frac{2784-2688}{4-3}=90\)

Principal = 1(20(0) – 3 x 00) = 2400

⇒ \(\mathrm{r}=\frac{t \times 100}{p \times t}=\frac{96 \times 100}{2400 \times 1}=4 \%\)

Question 41. If a simple interest on a sum of money at 6% p.a. for 7 years is equal to twice of simple interest on another sum for 9 years at 5% p.a. the ratio will be:

- 2:15

- 7:15

- 15:7

- 1:7

Solution:

⇒ \(P_1 \frac{6.7}{100}=2 \times \frac{P_{2 .} .9 .5}{100} \)

⇒ \(\text { Or } \frac{P_1}{P_2}=2 \times \frac{9 \times 5}{6 \times 7}=\frac{15}{7} \Rightarrow \frac{P_1}{P_2}=\frac{15}{7}\)

Question 42. By mistake, a clerk, calculated the simple interest on the principal for 5 months at 6.5% p.a. instead of 6 months at 5.5% p.a. if the calculation error was ₹25.40. The original sum of principal was____.

- ₹60,690

- ₹60,960

- ₹90,660

- ₹90690

Solution:

⇒ \(P=\frac{25.40}{\frac{5.5}{100} \times \frac{6}{12}-\frac{6.5}{100} \times \frac{5}{12}}\)

⇒ \(\frac{25.40 \times 1200}{5.5 \times 6-6.5 \times 5}=₹ 60,960 \)

Question 43. If the simple interest on ₹1,400 for 3 years is less than the simple interest on ₹1,800 for the same period by ₹80, then the rate of interest is:

- 5.67%

- 6.67%

- 7.20%

- 5.00%

Solution:

⇒ \( r=\frac{80 \times 100}{(1800-1400) \times 3}\)

= 6.67%

Question 44. The S.l on a sum of money is \( \frac{4}{9}\) of the principal and the No. of years is equal to the rate of interest per annum. Find the rate of interest per annum.

- 5%

- 20/3%

- 22/7%

- 6%

Solution:

⇒ \(\text { S.I. }=\frac{p . r. r}{100} \Rightarrow \frac{1}{9} p .=p \cdot\left(\frac{r}{10}\right)^2 \)

⇒ \(\frac{r}{10}=\frac{2}{3}r=\frac{20}{3} \%\)

Question 45. Simple interest on *2,000 for 5 months at 16% p.a. is_.

- ₹133.33

- ₹133.26

- ₹134.00

- ₹132.09

Solution:

⇒ \(\text { S.I. }=2000 \times \frac{5}{12} \times \frac{16}{100}=₹ 133.33\)

Question 46. How much investment is required to yield an Annual income of ₹420 at 7% p.a. simple interest.

- ₹6,000

- ₹6,420

- ₹5,580

- ₹5,000

Solution:

⇒ \(\mathrm{P}=\frac{420 \times 100}{7 \times 1}=₹ 6000\)

2 GBC: P= 420+7% button = 16000

Question 47. Mr. X invests ₹90,500 in the post office at 7.5% p.a. simple interest. While calculating the rate was wrongly taken as 5.7% p.a. the difference in amounts at maturity is ₹9,774. Find the period for which the sum was invested.

- 7 years

- 5.8years

- 6 years

- 8 years

Solution:

⇒ \(\mathrm{t}=\frac{9774 \times 100}{90.500 \times(7.5-5.7)}=6 \mathrm{yrs}\)

Question 48. If the sum of money when compounded annually becomes ₹1140 in 2 years and ₹1710 in 3 years at rate of interest

- 30%

- 40%

- 50%

- 60%

Solution:

Interest in 3rd yr= 1710- 1140 = 570

For 3rd yrs.; it will be like S.l

⇒ \(\mathrm{r}=\frac{l \times 100}{P . t}=\frac{570 \times 100}{1140 \times 1}=50 \%\)

For (c) A = 1140 + 50% (calculator) = 1710

Question 49. In what time will a sum of money double itself at 6.25% p.a at simple interest

- 5 yrs.

- 8 years

- 12 yrs.

- 16 yrs.

Solution:

⇒ \(\mathrm{t}=\frac{(2-1) \times 100}{6.25}=16 \text { years }\)

Question 50. What principal will amount to ₹370 in 6 years at 8% p.a. at simple interest

- ₹210

- ₹250

- ₹310

- ₹350

Solution:

⇒ \( P=\frac{370}{1+6 \times 0.08}=₹ 250\)

Question 51. If a sum trip Per in 15 years at the simple rate of interest then the rate of interest per annum will be

- 13.0%

- 13.3%

- 13.5%

- 18%

Solution:

\(\text { Tricks }=\frac{(3-1) \times 100}{1 \times 15}=13.3\)Calculator Tricks: GBC

(2) r = 15 x 13.333%= 200%

A = 1 + 200% (button) = 3

(2) is correct

Question 52. A certain sum of money was invested at a simple rate of interest for three years. If it was invested at 7% higher, the interest have been *882 more, then the sum has been invested at that rate was

- ₹12,600

- ₹6,800

- ₹4,200

- ₹2,800

Solution:

t=3 years

⇒ \(\mathrm{P}=\frac{1 \times 100}{r t}=\frac{882 \times 100}{7 \times 3}=₹ 4200\)

Question 53. The sum of money will be doubled in 8 years at S.I. In how many years the sum will be tripled?

- 20 years

- 12 years

- 16 years

- None

Solution:

⇒ \( \frac{t_2}{8}=\frac{3-1}{2-1} \quad t_2=16 \text { yrs. }\)

Question 54. A sum of 44,000 is divided into 3 parts such that the corresponding interest earned after 2 years, 3 years and 6 years may be equal at the rate of simple interest are 6% p.a. 8% p.a. & 6% p.a., respectively. Then the smallest part of the sum will be.

- ₹4,000

- ₹8,000

- ₹10,000

- ₹12,000

Solution:

⇒ \( P_1: P_2: P_3=\frac{1}{r_1 t_1}: \frac{1}{r_2 t_2}: \frac{1}{r_3 t_3}\)

⇒ \(\frac{1}{2 \times 6}: \frac{1}{8 \times 3}: \frac{1}{6 \times 6} \)

⇒ \(\left[\frac{1}{12}: \frac{1}{24}: \frac{1}{36}\right] \times 72 \text { LCM of denominators }\)

=6: 3: 2

So, smallest principal \( =\frac{44000}{6+3+2} \times 2=₹ 8000\)

Question 55. No. of years the sum of money becomes 4 times itself at 12% p.a. at simple interest:

- 20

- 21

- 25

- 30

Solution:

⇒ \(\text { (3) Tricks: } \mathrm{t}=\frac{(4-1) \times 100}{1 \times 12}=25 \mathrm{yrs} \text {. }\)

Question 56. No. years of a sum of money becomes 4 times itself at 12% p.a. at simple interest:

- 20

- 21

- 25

- 30

Solution:

(3) is correct

⇒ \(\text { Tricks: } t=\frac{(4-1) \times 100}{1 \times 12}=25 \mathrm{yrs} \text {. }\)

Question 57. If a person lends ₹6,000 for A years and 10,000 for 3 years at S.I. The total interest earned Is ₹2100 then the rate of interest is____.

- 5%

- 6%

- 7%

- 8%

Solution:

(1) is correct.

For (1): Total SI = 6000 x 4. x 5% + 8000 x 3 x 5% =R2400

So, (1) is correct.

Question 58. In simple interest, a certain sum becomes ₹97,920 in years, and ₹1,15,200 in 5 years, then the rate of interest is:

- 10%

- 11.2%

- 12%

- 13.6%

Solution:

(3)

⇒ \(\text { Tricks: S.I p.a. }=\frac{1,15,200-97,920}{5-3}\)=8640

Principal = 97,920 – 3 yrs interest = 97,920 – 3 x 8640 = 72,000

⇒ \(r=\frac{8640 \times 100}{72000}=12 \%\)

Amounts = 72000 + (12 x 3 = 36) %

Button = (True)

So, option (C) is correct.

Question 59. A person borrows Rs. 5,000 for 2 years at 4% per annual simple interest. He immediately lends to another person at \(6 \frac{1}{4} \%\). Per annual for 2 years find his gain in the transaction.

- Rs. 112.50

- Rs. 225

- Rs. 125

- Rs. 107.50

Solution:

Interest Gain =\(\left(6 \frac{1}{4}-4\right)=2 \frac{1}{4}=2.25 \%\)

So, Interest Gain

⇒ \(=\frac{5000 \times 2 \times 2.25}{100}=\text { Rs. } 225\)

Question 60. A certain money doubles itself in 10 years when deposited on simple interest. It would triple itself in.

- 30 year

- 20 years

- 25 years

- 15 years

Solution:

⇒ \(\frac{t_1}{t_1}=\frac{r_2-1}{r_1-1} \quad \Rightarrow \frac{t_2}{t_0}=\frac{3-1}{2-1} \Rightarrow t_2=20 \mathrm{yrs} .\)

Question 61. A certain sum of money Q was deposited for 5 years and 4 months at 4.5% simple interest and amounted to ₹248, then the value of Q is

- 240

- 200

- 220

- 210

Solution:

t = 5 yrs 4 months = \(5+\frac{1}{12}=\frac{16}{3} \mathrm{yrs}\)

⇒ \(A=Q\left(1+\frac{1 t}{100}\right)\)

⇒ \(\text { Or } 248=Q\left[1+\frac{45}{100} \times \frac{16}{3}\right]\)

⇒ \( Q=\frac{248 \times 300}{372}={Rs} .200\)

Rates for 5 yrs 4 Months = 5 ₹ 4.5% + one-third of 4.5% = 24% Note: 4 months means one-third of one year, so rate for 4 months = one-third of one-year interest rale.

Amounts = 200 + 24% = 248 (True) So, (b) is correct.

Question 62. The certain sum of money became Rs. 692 in 2 yrs. And Rs. 800 in 5 yrs. Then the principle amount is_____.

- Rs. 520

- Rs. 620

- Rs. 720

- Rs. 820

Solution:

If a certain sum of money becomes Ai in ti year and A.- in t2 years then

⇒ \(\text { S.I. per annum }=\frac{A_2-A_1}{t_2-t_1}\)

⇒ \(\text { S.I. p. } a=\frac{800-692}{5-2}\)

= Rs. 36.

Principal = A – Interest

= 692 – Interest of 2 yrs.

= 692 – 2 x 36 = Rs. 620

(2) is correct

Question 63. A sum of money amount of Rs. 6,200 in 2 years and Rs 7,400 in 3 years as per S.I. then the principal is

- Rs. 3,000

- Rs. 3,500

- Rs. 3,800

- None

Solution:

S.I. p.a \(=\frac{7400-6200}{3-2}\)

= Rs. 1200.

Principal = 6200 – 2 x 1200

= Rs. 3800.

Question 64. P = Rs. 5,000; R = 15% T \(=4 \frac{1}{2} \text { using } I=\frac{P T K}{100} \text { then I will be } I=\frac{P r t}{100}\)

- Rs. 3,375

- Rs. 3,300

- Rs. 3,735

- None

Solution:

⇒ \(1=\frac{5000 \times 15 \times 4.5}{1000}=3375\)

Question 65. In simple interest if the principal is Rs. 2,000 and the rate and time are the roots of the equation x2-2x- 30 = 0 then simple interest is

- Rs. 500

- Rs. 600

- Rs. 700

- Rs. 800

Solution:

x2 – 11 x + 3 0 = 0

Or x2 – 5x – 6x + 30 = 0

0r x(x-5) – 6(x-5) = 0

Or (x-5) (x-6) = 0

= 5 ; 6

If r = 5% then t = 6 yrs.

⇒ \(S. I=\frac{{Prt}}{100}=\frac{2000 \times 5 \times 6}{100}\)

= Rs. 600.

(2) is correct

Question 66. ₹ 8,000 becomes ₹10,000 in two years at simple interest. The amount that will become ₹6,875 in 3 years at the same rate of interest is:

- ₹ 4,850

- ₹ 5,000

- ₹ 5,500

- ₹ 5,275

Solution:

⇒ \(\text { S.I. } / \text { year }=\frac{10000-8000}{2}=₹ 1000\)

⇒ \(\mathrm{r}=\frac{1000 \times 100}{8000}=12.5 \% \)

⇒ \(\mathrm{P}=\frac{A \mathrm{Amt}}{A m \mathrm{at} \ 1}=\frac{6875}{1+0.125 \times 3}\)

=5,000

Question 67. The rate of simple: interest on a sum of money is 6% p.a. for the first 3 years, 8% p.a. for the next five years, and 10% years for the period beyond 8 years, if the simple interest accrued by the sum for the period for 10 years is ₹1,560. The sum is:

- ₹1,500

- ₹2,000

- ₹3,000

- ₹5,000

Solution:

(2) is correct

Single S.l for 1 year = (6×34-8×5+10×2)%

= 78%

⇒ \( \mathrm{P}=\frac{\text { Total } \mathrm{S} .1}{\text { S.I on Rsl }}=\frac{1560}{0.78}=₹ 2000\)

Question 68. The rate of simple: interest on a sum of money is 6% p.a. for the first 3 years, 8% p.a. for the next five years, and 10% years for the period beyond 8 years, if the simple interest accrued by the sum for the period for 10 years is ₹ 1,560. The sum is:

- ₹1,500

- ₹2,000

- ₹3,000

- ₹5,000

Solution:

(2) is correct

Single S.l for 1 year = (6×34-8×5+10×2)%

= 78%

⇒ \(\text { Tricks: } \mathrm{P}=\frac{\text { Total } \mathrm{S} .1}{\text { S.I on Rsl }}=\frac{1560}{0.78}=₹ 2000\)

How To Calculate Time Value Of Money In CA Foundation

Compound Interest

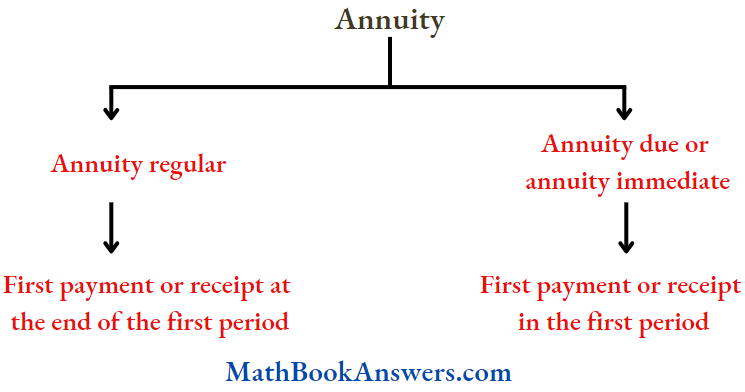

Compound Interest: Sometimes so happens that the born and the lender agree to fix up a certain unit of time, say yearly half-yearly, or quarterly to settle the previous accounts.

- In such cases, the amount after the first unit of tone becomes the principal for the second unit, the amount after the second unit becomes the principal for the third unit, and So on.

- After a specified period, the difference between the amount and the money borrowed is called the Compound Interest (abbreviated as C.l.) for that period.

Let Principal = P, Rate = R% per annum, Time = n years.

1. When interest is compound Annually:

Amount =\(\mathrm{P}\left(1+\frac{R}{100}\right)^n\)

2. When interest is compounded Half-yearly:

Amount = \(P\left[1+\frac{(n / 2)}{100}\right]^{2 n}\)

3. When interest is compounded Quarterly:

Amount =\(\mathrm{P}\left[1+\frac{(R/ 4)}{100}\right]^{4 n}\)

4. When interest is compounded Annually but time is in fraction, say \(3 \frac{2}{5} \text { years. }\)

Amount\(=\mathrm{P}\left(1+\frac{R}{100}\right)^3 \times\left(1+\frac{\frac{2}{5} R}{100}\right)\)

5. When Rates are different for different years, say R1%, R2%, R3% for 1st, 2nd and 3rd year respectively.

Then, Amount = \(\mathrm{P}\left(1+\frac{R_1}{100}\right)\left(1+\frac{R_2}{100}\right)\left(1+\frac{R_3}{100}\right)\)

6. Present worth of Rs. X due n years hence is given by:

Present Worth =\(=\frac{x}{\left(1+\frac{R}{160}\right)^n} .\)

CA Foundation Maths Solutions For Chapter 4 Effective Rate Of Interest

If interest is compounded more than once a year the effective interest rate for a year exceeds the per annum interest rate. Suppose you invest ₹1 0,000 for a year at the rate of 6% per annum compounded semi-annually. The effective interest rate for a year will be more than 6% per annum since interest is being compounded more than once a year. To compute the effective rate of interest first, we have to compute the interest. Let us compute the interest.

Interest for first six months = ₹10,000 ₹ 6/100 ₹ 6/12 = ₹300

Principal for calculation of interest for next six months

= Principal for first period one + Interest for first period

= ₹(10,000 + 300)

= ₹10,300

Interest for next six months = ₹ 10,300 x 6/100 x 6/12 =₹309

Total interest earned during the current year

= Interest for first six months + Interest for next six months

= ₹(300 + 309) = ₹ 609

The interest of ₹ 609 can also be computed directly from the formula or compound Interest, We can compute the effective rate of interest by following the formula

I = PEt

Where I = Amount of interest

E = Effective rate of interest in decimal

t = Period

P = Principal amount

Putting the values we have

609 = 10,000 x E x 1

⇒ \(E=\frac{609}{10,000}\)

= 0.0609 or

= 6.09%

Thus, if we compound the interest more than once a year effective interest rate for the year will be more than the actual interest rate per annum. But if interest is compounded annually effective interest rate for the year will be equal to the actual interest rate per annum.

So effective interest rate can be defined as the equivalent annual rate of interest compounded annually if interest is compounded more than once a year.

The effective interest rate can be computed directly by following the formula:

E = (1 + i)n – 1

Where E is the effective interest rate

i = actual interest rate in decimal

n = number of conversion period

CA Foundation Maths Solutions For Chapter 4 Effective Interest Rate Solved Examples

Question 1. Find compound interest on Rs. 7500 at 4% per annum for 2 years, compounded annually.

Solution:

⇒ \(\text { Amount = Rs. }\left[7500 \times\left(1+\frac{4}{100}\right)^2\right]=\text { Rs. }\left(7500 \times \frac{26}{25} \times \frac{26}{25}\right)=\text { Rs. } 8112\)

C.I. = Rs. (8112 – 7500) = Rs. 612.

Question 2. Find compound interest on Rs. 8000 at 15% per annum for 2 years 4 months, compounded annually.

Solution:

time = 2 years 4 months \(=2 \frac{4}{12} \text { years }=2 \frac{1}{3} \text { years. }\)

⇒ \(\text { Amount }=\text { Rs. }\left[8000 \times\left(1+\frac{15}{100}\right)^2 \times\left(1+\frac{\frac{1}{3} \times 15}{100}\right)\right]=\text { Rs. }\left(8000 \times \frac{23}{20} \times \frac{23}{20} \times \frac{21}{20}\right)\)

= Rs. 11109.

C.I. = Rs. (11109- 8000) = Rs.3109.

Question 3. Find the compound interest on Rs. 10000 in 2 years at 4% per annum, the interest being compounded half-yearly.

Solution:

Principal = Rs. 10000; Rate= 2% per half- year; time = 2 years = 4 half- years,

Amount=\(\text { Rs. }\left[10000 \times\left(1+\frac{2}{100}\right)^4\right]=\text { Rs. }\left(10000 \times \frac{51}{50} \times \frac{51}{50} \times \frac{51}{50} \times \frac{51}{50}\right)\)

Rs. 10824.32 C.I. = Rs. (10824-10000) = Rs. 824.32

Question 4. Find the compound Interest on It. 16000; it is 20% per annum for 0 months. Compounded quarterly.

Solution:

principal = Its. 16000; time = 9 months = 3 quarters;

Rate = 20 % per annum = 5% per quarter.

⇒ \(\text { Amount = Rs. }\left[16000 \times\left(1+\frac{5}{100}\right)^3\right]=\text { Rs. }\left(16000 \times \frac{21}{20} \times \frac{21}{20} \times \frac{21}{20}\right)=\text { Rs. } 18522 .\)

C.I. = Rs. (18522-16000) = Rs. 2522

Question 5. If the simple interest on a sum of money at 5% per annum for 3 years is Rs. 1200, find the compound interest on the same sum for the same period at the same rate.

Solution:

Clearly, Rate = 55 p.a., Time = 3 years, S.I. = Rs. 1200

So, principal = Rs.\(\left(\frac{100 \times 1200}{3 \times 5}\right)=\text { Rs. } 8000 \text {. }\)

⇒ \(\text { Amount }=\text { Rs. }\left[8000\left(1 \times \frac{5}{100}\right)^3\right] \text { Rs. }\left(8000 \times \frac{21}{20} \times \frac{21}{20} \times \frac{21}{20}\right)=\text { Rs. } 9261 .\)

C.I. = Rs. (9261-8000) – Rs. 1261

Question 6. At what time will Rs. 1000 become Rs. 1331 at 10% Per annum compounded annually?

Solution:

Principal = Rs. 1000; Amount = Rs.1331;

Rate= 10 %p.a.

Let the time be N years then,

⇒ \(\left[1000 \times\left(1+\frac{10}{100}\right)^n\right]=1331 \text { or }\left(\frac{11}{10}\right)^n=\left(\frac{1331}{1000}\right)=\left(\frac{11}{10}\right)^3\)

n =3 years.

Question 7. If Rs. 500 amounts to Rs. 583.20 in two years compounded annually find the rate of interest per annum.

Solution:

principal = Rs. 500; Amount =Rs. 583.20; Time = 2 years.;

Let the rate be R% per annum, then

⇒ \({\left[500 \times\left(1+\frac{R}{100}\right)^2\right]=583.20 \text { or }\left(1+\frac{R}{100}\right)^2=\left(\frac{5832}{5000}\right)=\left(\frac{11664}{10000}\right)}\)

⇒ \(\left(1+\frac{R}{100}\right)^2=\left(\frac{108}{100}\right)^2 \text { or } 1+\frac{R}{100}=\frac{108}{100} \text { or } R=8\)

So, rate= 8% p.a.

Question 8. If the compound interest on a certain sum at 16% for 3 years is Rs. 1270 find the simple interest on the same sum at the same rate and for the same period.

Solution:

Let the sum be Rs. X. Then,

⇒ \(\text { C.I. }=\left[x \times\left(1+\frac{50}{3 \times 100}\right)^3-x\right]=\left(\frac{343 x}{216}-x\right)=\frac{127 x}{216} \)

⇒ \( \frac{127 x}{216}=1270 \text { or } \mathrm{x}=\frac{1270 \times 216}{127}=2160\)

Thus, the sum is Rs 2160.

⇒ \(\text { S.I. }=\text { Rs. }\left(2160 \times \frac{50}{3} \times 3 \times \frac{1}{100}\right)=\text { Rs. } 1080\)

Question 9. The difference between compound interest and simple interest on a certain sum at 10% per annum for 2 years is Rs. 631. Find the sum.

Solution:

Let the sum be Rs. X. Then,

⇒ \(\text { C.I. }=x\left(1+\frac{10}{100}\right)^2-x=\frac{21 . x}{100}, S . I .=\left(\frac{x \times 10 \times 2}{100}\right)=\frac{x}{5}\)

⇒ \((\text { C. I. })-(\text { S. I. })=\left(\frac{21 \mathrm{x}}{100}-\frac{x}{5}\right)=\frac{\mathrm{x}}{100}\)

⇒ \(\frac{\mathrm{x}}{100}=631 \Leftrightarrow \mathrm{X}=63100 .\)

Hence, the sum is Rs.63,100.

Question 10. Divide Rs. 1301 between A and X, so that the amount of A after 7 years is equal to the amount of B after 9 years, the interest being compounded at 4% per annum.

Solution:

Let the two parts be Rs. X and Rs. (1301- x)

C.I=\(x\left(1+\frac{4}{100}\right)^7=(1301-x)\left(1+\frac{4}{100}\right)^9 \Leftrightarrow\left(\frac{26}{25} \times \frac{26}{25}\right)\)

⇒ \(\Leftrightarrow 625 x=676(1301-x) \Leftrightarrow 1301 x=676 \times 1301 \Leftrightarrow x=676\)

So, the two parts are Rs. 676 and Rs. (1301-676) i.e. Rs. 676 and Rs. 625.

Question 11. A certain sum amounts to Rs. 7350 in 2 years and to Rs. 8575 in 3 years. Find the sum and rate present.

Solution:

S.I. on Rs. 7350 for 1 year Rs. (8575- 7350)= Rs. 1225.

⇒ \(\text { Rate }=\left(\frac{100 \times 1225}{7350 \times 1}\right) \%=16 \frac{2}{3} \%\)

Let the sum be Rs. x then,

⇒ \(X\left(1+\frac{50}{3 \times 100}\right)^2=7350 \Leftrightarrow x \times \frac{7}{6} \times \frac{7}{6}=7350 \Leftrightarrow x=\left(7350 \times \frac{36}{49}\right)=5400\)

⇒ \(\text { sum }=\text { Rs. } 5400\)

Question 12. A sum of money amounts to Rs. 6690 after 3 years and to RS. 10035 after 6 years on compound interest find the sum.

Solution:

Let the sum be Rs. P. then,

⇒ \(\mathrm{P}\left(1+\frac{R}{100}\right)^3=6690 \quad \ldots \text { (1) } \quad \text { and } \mathrm{P}\left(1+\frac{R}{100}\right)^6=10035\)

On dividing, we get\(\left(1+\frac{R}{100}\right)^3=\frac{10035}{6690}=\frac{3}{2}\)

Substituting this value in (i) we get :

⇒ \(P \times \frac{3}{2}=6690 \text { or } P=\left(6690 \times \frac{2}{3}\right)=4460\)

Hence, the sum is Rs. 4460

Question 13. A sum of money doubles itself at compound interest in 15 years, in how many years will it become eight times?

Solution:

⇒ \( \mathrm{P}\left(1+\frac{R}{100}\right)^{15}=2 P \quad \Rightarrow\left(1+\frac{R}{100}\right)^{15}=\frac{2 P}{P}=2\)

Let\(\mathrm{P}\left(1+\frac{R}{100}\right)^n=8 P \Rightarrow\left(1+\frac{R}{100}\right)^n=8=2^3=\left\{\left(1+\frac{R}{100}\right)^{15}\right\}^3[uning (i) ]\)

⇒ \(\Rightarrow\left(1+\frac{R}{100}\right)^n=\left(1+\frac{n}{100}\right)^{45} \Rightarrow n=45\)

Tints, the required time = 45 years.

Question 14. What annual payment will discharge a debt of Rs. 7620 due in 3 years at \(16 \frac{2}{3} \%\) per annum compound interest?

Solution:

let each installment be Rs. X then,

(P.W. of Rs. X due 1 year hence) + (P.W. of Rs. X due 2 years hence) + (P.W. of Rs. X due 3 years hence) = 7620.

⇒ \(\frac{x}{\left(1+\frac{50}{3 \times 100}\right)}+\frac{x}{\left(1+\frac{50}{3 \times 100}\right)^2}+\frac{x}{\left(1+\frac{50}{3 \times 100}\right)^3}=7620\)

⇒ \(\Leftrightarrow \frac{6 x}{7}+\frac{36 x}{49}+\frac{216 x}{343}=7620 \Leftrightarrow 294 x+252 x+216 x=7620 \times 343\)

⇒ \(\Leftrightarrow X=\left(\frac{7620 \times 343}{762}\right)=3430 \)

Amount of each instalment= Rs. 3430

Question 15.₹5,000 is invested in a Term Deposit Scheme that fetches interest of 6% per annum compounded quarterly. What will be the interest after one year? What is the effective rate of interest?

Solution:

We know that

I = P [(1 + i)n- 1]

Here P = ₹ 5,000

i = 6% p.a. = 0.06 p.a. or 0.015 per quarter

n = 4

and I = amount of compound interest

putting the values, we have

I = ₹ 5,000 [(1 + 0.015)4 — 1]

= ₹ 5,000 x 0.06136355

= ₹ 306.82

For the effective rate of interest using, I = PEt we find

306.82 = 5,000 x E x 1.

306.82

5000

= 0.0613 or 6.13%

Note: We may arrive at the same result by using

E = (1+i)4 – 1

E = (1 + 0.015)4-1

= 1.0613-1

= 0613 or6.13%

We may also note that the effective rate of interest is not related to the amount of principal. It is related to the interest rate and frequency of compounding the interest.

Question 16. Find the amount of compound interest and effective rate of interest if an amount of ₹20,000 is deposited in a bank for one year at the rate of 8% per annum compounded semi-annually.

Solution:

We know that

1 = P [(1 + i)n- 1]

Here P = ₹20,000

i = 8% p.n. = 8/2 % semi-annually = 0.04

n = 2

I = ₹20,000 IO + 0.04)2- 1 1

= ₹20,000 x 0.08 16

= ₹1,632

The effective rate of interest:

We know that

I = PEt

1,632 = 20,000 x E x 1

⇒ \(E=\frac{1632}{20000}\) = =0.0816

= 8.16%

The effective rate of interest can also be computed by following the formula

E = (1 + i)n -1

= (1 + 0.04)2-1

= 0.0816 or 8.16%

Question 17. Which is a better investment 3% per year compounded monthly or 3.2% per year simple interest? Given that (1+0.0025) ‘2 =1.0304.

Solution:

i = 3/12 = 0.25% = 0.0025

= 12

= (1 + i)n -1

= (1 + 0.0025)12 -1

= 1.0304-1 = 0.0304

= 3.04%

With the effective rate of interest (E) being less than 3.2%, the simple interest of 3.2% per year is the better investment.

CA Foundation Maths Time Value Of Money Practice Problems

CA Foundation Maths Solutions For Chapter 4 Exercise – 2

Question 1. Albert invested an amount of Rs. 8000 in a fixed deposit scheme for 2 years at a compound interest rate of 5 p.c.p.a How much amount will Albert get on maturity of the fixed deposit?

- Rs. 8600

- Rs. 8820

- Rs. 8800

- Rs. 8840

- None of these

Solution:

(2) Amount = \(\text { Rs. }\left[8000 \times\left(1+\frac{5}{100}\right)^2\right]=\text { Rs. }\left(8000 \times \frac{21}{20} \times \frac{21}{20}\right)=\text { Rs. } 8820\)

Question 2. What will be the compound interest on a sum of Rs. 25000 after 3 years at the rate of 12 p.c.p.a.?

- Rs. 9000.30

- Rs. 9720

- Rs. 10123.20

- Rs. 10483.20

- None of these

Solution:

(3) Amount = \(\text { Rs. }\left[25000 \times\left(1+\frac{12}{100}\right)^3\right]=\text { Rs. }\left(25000 \times \frac{28}{25} \times \frac{28}{25} \times \frac{28}{25}\right)=\text { Rs. } 35123.20 .\)

C.I. = Rs. (35123.20-25000) = Rs. 10123.20

Question 3. A man saves Rs. 200 at the end of each year and lends the money at 5% compound interest. How much will it become at the end of 3 years?

- Rs. 565.25

- 635

- Rs. 662.02

- Rs. 666.50

Solution:

(3) Amount = \(\text { Rs. }\left[200 \times\left(1+\frac{5}{100}\right)^3+200\left(1 \times \frac{5}{100}\right)^2+200\left(1+\frac{5}{100}\right)\right]\)

⇒ \(\text { Rs. }\left[200 \times \frac{21}{20} \times \frac{21}{20} \times \frac{21}{20}+200 \times \frac{21}{20} \times \frac{21}{20}+200 \times \frac{21}{20}\right]\)

⇒ \( =R s .\left[200 \times \frac{21}{20}\left(\frac{21}{20} \times \frac{21}{20}+\frac{21}{20}+1\right)\right]=\text { Rs. } 662.02 .\)

Question 4. Sam invested Rs. 15000 @10% per annum for one year. If the interest is compounded halfyearly, then the amount received by Sam at the end of the year will be:

- Rs. 16,500

- Rs.525.50

- Rs. 16,537.50

- Rs. 18,150

- None of these

Solution:

(3) P=15000; R=10%p.a.= 5% per half- year; T=1 year=2 half-years

Amount = \({Rs} .\left[15000 \times\left(1+\frac{5}{100}\right)^2\right]=\text { Rs. }\left(15000 \times \frac{21}{20} \times \frac{21}{20}\right)={Rs} .16537 .50\)

Question 5. A bank offers 5% compound interest calculated on half-yearly basis. A customer deposits Rs. 1600 each on 1st of January and 1St July of a year. At the end of the year, the amount he would have gained by way of interest is

- Rs. 120

- Rs. 121

- Rs. 122

- Rs. 123

Solution:

⇒ \(\text { Amount }=\text { Rs. }\left[1600 \times\left(1+\frac{5}{2 \times 100}\right)^2+1600 .\left(1+\frac{5}{2 \times 100}\right)\right]\)

⇒ \(\left[1600 \times \frac{41}{40} \times \frac{41}{40}+1600 \times \frac{41}{40}\right]\)

⇒ \( \text { = Rs. }\left[1600 \times \frac{41}{40}\left(\frac{41}{40}+1\right)\right]=\text { Rs. }\left(\frac{1600 \times 41 \times 81}{40 \times 40}\right)=\text { Rs. } 3321 .\)

C.I. = Rs. (3321-3200) = Rs. 121.

Question 6. What is the difference between the compound interests on RS.5000 for \(1 \frac{1}{2}\) years at 4% per annum compounded yearly and half-yearly?

- Rs. 2.04

- Rs. 3.06

- Rs. 4.80

- Rs. 8.30

Solution:

(1) C.I. when interest is compounded yearly

⇒ \(=\text { Rs. }\left[5000 \times\left(1+\frac{4}{100}\right) \times\left(1+\frac{\frac{1}{2} \times 4}{100}\right)\right]=\text { Rs. }\left(5000 \times \frac{26}{25} \times \frac{51}{50}\right)={Rs} .5304\)

C.l. when interest is compounded half-yearly

⇒ \(\text { Rs. }\left[5000 \times\left(1+\frac{2}{100}\right)^3\right]={Rs} .\left(5000 \times \frac{51}{50} \times \frac{51}{50} \times \frac{51}{50}\right)={Rs} .5306 .04\)

Difference = Rs. (5306.04-5304) = Rs. 2.04.

Question 7. Find the compound interest on Rs. 15625 for 9 months at 16% per annum compounded quarterly.

- Rs. 1851

- Rs. 1941

- Rs. 1951

- Rs. 1961

Solution:

(3) P= RS.15625, n=9 months= 3 quarters, R= 1 6% p.a. = 4% per quarter.

Amount =Rs.\(\left[15625 \times\left(1+\frac{4}{100}\right)^3\right]=R s .\left(15625 \times \frac{26}{25} \times \frac{26}{25} \times \frac{26}{25}\right)=\text { Rs. } 17576\)

C.I. =Rs. (17576 – 15625) =Rs.l951.

Question 8. If the simple interest on a sum of money for 2 years at 5% per annum is Rs. 50, what is the compound interest on the same sum at the same rate and for the same time?

- Rs. 51.25

- Rs. 52

- Rs. 25

- Rs. 60

Solution:

(1) Sum Rs.\(\left(\frac{50 \times 100}{2 \times 6}\right)=R s .500\)

Amount = \(\text { Rs. }\left[500 \times\left(1+\frac{5}{100}\right)^2\right]={Rs} .\left(500 \times \frac{21}{20} \times \frac{21}{20}\right)={Rs} .551 .25\)

C.l. =Rs. (551.25 -500) =Rs.51.25

Question 9. What will be the difference between simple and compound interest @ 10% per sum of Rs. 1000 after 4 years?

- Rs. 31

- Rs. 32.10

- Rs. 40.40

- Rs. 64.10

- None of these

Solution:

S.I.= Rs. \(\left(\frac{1000 \times 10 \times 4}{100}\right)=\text { Rs. } 400\)

⇒ \(\text { C.I. }=\text { Rs. }\left[1000 \times\left(1+\frac{10}{100}\right)^4-1000\right]=\text { Rs. } 464.10\)

Difference = Rs. (464.10 – 400) = Rs.64.10.

Question 10. The difference between simple interest and compound interest on Rs. 1200 for one year at 10% per annum reckoned half-yearly is:

- Rs. 2.50

- Rs. 3

- Rs. 4.75

- Rs. 4

- None

Solution:

⇒ \(\text { Rs. }\left(\frac{1200-111-1}{100}\right)=Rs. 120\)

⇒ \( Rs .\left|1200 \times\left(1+\frac{6}{100}\right)^2-1200\right|=Rs.123\)

Difference = Rs. (123-120)= Rs.3

Question 11. The compound interest on Rs. 30000 at 7% per annum Is Rs. 4347. The period (in years) is:

- 2

- \(2 \frac{1}{2}\)

- 3

- 4

Solution:

Amount = Rs. (30000 + 4347) Rs. 34347

let the time be n years then

⇒ \(30000\left(1+\frac{7}{100}\right)^{11}=34347 \Leftrightarrow\left(\frac{1117}{1000}\right)^{11}=\frac{34347}{300010}=\frac{11449}{10000}=\left(\frac{107}{100}\right)^2n=2 \text { years. }\)

Question 12. The principle that amounts to Rs. 4913 in 3 years at 6% per annum compound interest compounded annually, is:

- Rs. 3096

- Rs. 4076

- Rs. 4085

- Rs. 4096

Solution:

(4) \(\text { (1) Principal }=\text { Rss. }\left|\frac{4913}{\left(11 \frac{25}{1.1000^3}\right)}\right|=\mathrm{Rs.}\left(4913 \times \frac{16}{17} \times \frac{16}{17} \times \frac{16}{17}\right)=\mathrm{Rs} .4096 \text {. }\)

Question 13. In how many years will a sum of Rs. 800 at 10% per annum compounded semi-annually become Rs. 926.10?

- \(1 \frac{1}{3}\)

- \(1 \frac{1}{2}\)

- \(2 \frac{1}{3}\)

- \(2 \frac{1}{2}\)

Solution:

(2) Iet the time and years. Then,

⇒ \( 80\left(0 \times\left(1+\frac{5}{1001}\right)^{2 n}=926.100+\left(1+\frac{5}{100}\right)^{2 n}=\frac{926,1}{10001}\right.\)

⇒ \(\text { Or }\left(\frac{21}{20}\right)^{2 n}=\left(\frac{21}{20}\right)^3 \text { or } 2 n=3 \text { or } n=\frac{3}{2} n=1 \frac{1}{2} \text { years. }\)

Question 14. If the compound interest on a sum for 2 years at \(12 \frac{1}{2}\)%per annum is Rs.510, the simple interest on the same sum at the same rate for the same period is:

- Rs. 400

- Rs. 450

- Rs. 460

- Rs. 480

Solution:

(4) Let the sum he Rs. P, then

⇒ \(\left|P\left(\frac{25}{2 \times 100}\right)^2-P\right|=510 \text { or } P\left|\left(\frac{9}{11}\right)^2-1\right|=5100 \text { r } P=\left(\frac{510 \times 64}{17}\right)=1920 \)

⇒ \(\text { Sum }=\text { Rs. } 1920 .\)

⇒ \(\text { So, S.I. = Rs. }\left(\frac{1920 \times 25 \times 2}{2 \times 100}\right)=\text { Rs. } 480 .\)

Question 15. The compound interest on a certain sum for 2 years at 10% per annum is 525. The simple interest on the same sum for double the time at half the rate present per annum is:

- Rs. 400

- Rs. 500

- Rs. 600

- Rs. 800

Solution:

(2) Let the sum be Rs. P, Then,

⇒ \(\left|p\left(1+\frac{10}{1001}\right)^2-p\right|=525 \Leftrightarrow p\left|\left(\frac{11}{10}\right)^2-1\right|=525 \Leftrightarrow P=\left(\frac{525 \times 100}{21}\right)=2500\)

⇒ \(\text { Sum }=\text { Rs. } 25000 . \)

⇒ \(\text { So, S.I. }=\text { Rs. }\left(\frac{2500 \times 5 \times 1.1}{100}\right)=\text { Rs. } 500\)

Question 16. The simple interest on a certain sum of money for 3 years at 8% per annum is half the compound interest on Rs.4000 for 2 years at 10% per annum the sum placed on simple interest is:

- Rs. 1550

- Rs. 1650

- Rs. 1750

- Rs. 2000

Solution:

(3) \(\text { C.I. }=\text { Rs. }\left|4000 \times\left(1+\frac{10}{100}\right)^2-4000\right|=R s .\left(4000 \times \frac{11}{10} \times \frac{11}{10}-4000\right)=R s .840 . \)

⇒ \( S u m=R s .\left(\frac{420 \times 100}{3 \times 8}\right)=\text { Rs. } 1750\)

Question 17. There is a 60% increase in an amount in 6 years at simple interest. What will be the compound interest of Rs. 12000 after 3 years at the same rate?

- 2160

- Rs. 3120

- Rs. 3972

- Rs. 6240

- None of these

Solution:

Let P = Rs. 1 00 then, S.l. Rs. 60 anil T= 6 years

⇒ \(R=\frac{100 \times 60}{100 \times 6}=10 \% / 0 \mathrm{p.a1} .\)

Now, P= Rs. 1 2000, T= 3 years, and R = 1 0% p.a

⇒ \(\text { C.I. }=\text { Rs. }\left[12000 \times\left\{\left(1+\frac{10}{100}\right)^3-1\right\}\right]=R s .\left(12000 \times \frac{331}{1000}\right)=R s .3972 .\)

Question 18. The difference between compound interest and simple interest on an amount of Rs. 15000 for 2 years is Rs. 96. What is the rate of interest per annum?

- 8

- 10

- 12

- 8

- None of these

Solution:

⇒ \(\text { (a) }\left|15000 \times\left(1+\frac{R}{100}\right)^2-15000\right|-\left(\frac{15000 \times R \times 2}{100}\right)=96\)

⇒ \(\Leftrightarrow 15000\left[\left(1+\frac{R}{100}\right)^2-1-\frac{2 R}{100}\right]=96 \Leftrightarrow 15000\left[\frac{(100+R)^2-10000-200 R}{10000}\right]=96\)

⇒ \(\Leftrightarrow R^2=\frac{96 \times 2}{3}=64 \Leftrightarrow R=8\)

Rate = 8%

Question 19. The difference between simple and compound interests compounded annually on a certain sum of money for 2 years at 4% per annum is Re. 1. The sum (in Rs.) is:

- 625

- 630

- 640

- 650

Solution:

(1) Let the sum he Rs. X, Then

⇒ \(\text { C.I. }=\left[x\left(1+\frac{4}{100}\right)^2-x\right]=\left(\frac{675}{625} x-x\right)=\frac{51}{625} x .\)

⇒ \(\text { S.I. }=\left(\frac{x \times 4 \times 2}{100}\right)=\frac{2 x}{25} \)

⇒ \( \frac{51 x}{625}-\frac{2 x}{25}=1 \text { or } \mathrm{x}=625 \)

Question 20. The difference between the simple interest on a certain sum at the rate of 10% per annum for 2 years and compound interest which is compounded every 6 months is Rs. 124.05. What is the principal sum?

- Rs. 6000

- Rs. 8000

- Rs. 10,000

- Rs. 12,000

- None of these

Solution:

(2) Let the sum be Rs. P. then

⇒ \(\mathrm{P}\left[\left(1+\frac{5}{100}\right)^4-1\right]-\frac{P \times 10 \times 2}{100}=124.05\)

⇒ \(\Rightarrow \mathrm{P}\left[\left(\frac{21}{20}\right)^4-1-\frac{1}{5}\right]=124.05 \Rightarrow P\left[\frac{194481}{160000}-\frac{6}{5}\right]=\frac{12405}{100} \)

⇒ \(\Rightarrow \mathrm{P}\left[\frac{194481-192000}{160000}\right]=\frac{12405}{100} \Rightarrow P=\left(\frac{12405}{100} \times \frac{160000}{2481}\right)=8000\)

Question 21. On a sum of money, the simple interest for 2 years is Rs.660, while the compound interest is Rs. 696.30 the rate of interest being the same in both cases. The rate of interest is:

- 10%

- 10.5%

- 12%

- None of these

Solution:

(4) Difference in C.I. and S.I for 2 years = Rs. (696.30- 660) = Rs. 36.30

S.I. for one year = Rs. 330

S.I. on Rs. 330 for1 year = Rs. 36.30

⇒ \(\text { Rate }\left(\frac{100 \times 36.30}{330 \times 1}\right) \%=11 \%\)

Question 22. The effective annual rate of interest corresponding to a nominal rate of 6% per annum payable half-yearly is:

- 6.06%

- 6.07%

- 6.08%

- 6.09%

Solution:

(4) Amount of Rs. 100 for a year when compounded half-yearly

⇒ \(\text { Rs. }\left[100 \times\left(1+\frac{3}{100}\right)^2\right]={Rs} .106 .09\)

Effective rate = (106.09- 100) % = 6.09 %

Question 23. Mr. Dua invested money in two schemes A and B offering compound interest @ 8 P.c.p.a. and 9 p.c.p.a. Respectively. If the total amount of interest accrued through two schemes together in two years was RS. 4818.30 And the total amount invested was Rs. 27000, what was the amount invested in scheme A?

- Rs. 12,000

- Rs. 13,500

- Rs. 15,000

- Cannot be determined

- None Of these

Solution:

(1) Let the investment in the scheme be Rs. X.

Then, investment in scheme B = Rs. (27000-x)

⇒ \(\left[x \times\left\{\left(1+\frac{8}{100}\right)^2-1\right\}+(27000-x)\left\{\left(1+\frac{9}{100}\right)^2-1\right\}\right]=4818.30\)

⇒ \(\Leftrightarrow\left(x \times \frac{104}{625}\right)+\frac{1881(27000-x)}{10000}=\frac{481830}{100}\)

1664x+ 1881 (27000-x) = 48183000

o (1881x- 1664x) = (50787000- 48183000)

⇒ \(217 x=2604000 \Leftrightarrow x=\frac{2604000}{217}=12000\)

Question 24. A sum of money invested at compound interest amounts to Rs. 800 in 3 years and to Rs.840 in 4 years. The rate of interest per annum is:

- \(Rs. 2 \frac{1}{2} \%\)

- 4%

- 5%

- \(6 \frac{2}{3} \%\)

Solution:

(3) S.I. on Rs. 800 for1 year = Rs. (840-800) =Rs.40

⇒ \(\text { Rate }=\left(\frac{40 \times 100}{800}\right) \%=5 \%\)

Question 25. A sum of money placed at compound interest doubles itself in 5 years. It will amount to eight times itself at the same rate of interest in:

- 7 years

- 15 years

- 24 years

- 36 years

Solution:

(2) \(\mathrm{P}\left(1+\frac{R}{100}\right)^{\mathrm{g}}=2 \mathrm{P} \Rightarrow\left(1+\frac{R}{100}\right)^g=2\)

⇒ \(Let \mathrm{P}\left(1+\frac{R}{100}\right)^n=8 P \Rightarrow\left(1+\frac{R}{100}\right)^n=8=2^3=\left\{\left(1+\frac{R}{100}\right)^5\right\}^3

[using(i)]\)

⇒ \(\left(1+\frac{R}{100}\right)^n=\left(1+\frac{R}{100}\right)^{15} \Rightarrow \mathrm{n}=15\)

Required time 15 Years.

Question 26. The least number of complete years in which a sum of money put out at 20% compound interest will be more than doubled is:

- 3

- 4

- 5

- 6

Solution:

(2)

⇒ \(\mathrm{P}\left(1+\frac{20}{100}\right)^{\mathrm{n}}>2 \mathrm{P} \text { or }\left(\frac{6}{5}\right)^{\mathrm{n}}>2 \quad \text { Now, }\left(\frac{6}{5} \times \frac{6}{5} \times \frac{6}{5} \times \frac{6}{5}\right)>2 \text { so, } \mathrm{n}=4 \text { years. }\)

Question 27. What annual payment will discharge a debt of Rs. 1025 due in 2 years at the rate of 5% compound interest?

- Rs. 550

- Rs. 551.25

- Rs. 560

- Rs. 560.75

Solution:

(2)

bet each installment be Rs. X. Then,

⇒ \(\frac{x}{\left(1+\frac{5}{100}\right)}+\frac{x}{\left(1+\frac{5}{100}\right)^2}=1025 \Leftrightarrow \frac{20 x}{21}+\frac{400 x}{441}=1025\)

₹820x= 1025×441 ⇔ x = \(\left(\frac{1025 \times 441}{120}\right)=551.25 .\). So, the value of each installment = Rs. 551.25

Question 28. A sum of money is borrowed and paid back in two annual installments of Rs. 882 each allowing 5% compound interest. The sum borrowed was:

- Rs. 1620

- Rs.1640

- Rs. 1680

- Rs. 1700

Solution:

(2) Principal = (P.W. of Rs. 882 due 1 year hence) + (P.W. of Rs. 882 due 2 years hence

⇒ \(=\left[\frac{882}{\left(1+\frac{5}{100}\right)}+\frac{882}{\left(1+\frac{5}{100}\right)^2}\right]=\left(\frac{882 \times 20}{21}+\frac{882 \times 400}{441}\right)={Rs} .1640 .\)

Question 29. If the difference between simple interest and compound interest is ₹11 at the rate of 10% for two years, then find the sum:

- ₹1,200

- ₹1,100

- ₹ 1,000

- None of these

Solution:

(2) is correct

⇒ \(\mathrm{P}=\frac{\text { Difference } \times(100)^2}{(\text { rate })^2} \quad=\frac{11 \times(100)^2}{(10)^2}=₹ 1100\)

Question 30. In how many years, a sum will become double at 5% p.a. compound interest?

- 14.0 years

- 14.1 years

- 14.2 years

- 14.3 Years

Solution:

(c) is correct

⇒ \(\mathrm{t}=\frac{\log \left(\frac{1}{p}\right)}{m e \log \left(1+\frac{r}{100 m}\right)}=\frac{\log 2}{\log (1.05)}=14.2 \text { yrs. (approx) }\)

Chapter 4 CA Foundation Maths Answer Key

Question 31. A sum amount to ₹1331 at a principle of ₹1,000 at 10% compounded annually. Find the time.

- 3.31 years

- 4 years

- 3 years

- 2 years

Solution:

(3) is correct

For (C); A = 1000\(\left(1+\frac{10}{100}\right)^3=₹ 1331\)

So; t = 3 yrs

Question 32. The compound interest for a certain sum @ 5% p.a. for the first year is ₹25. The S-I for the same money @ 5% p.a. for 2 years will be.

- ₹40

- ₹50

- ₹60

- ₹70

Solution:

(2) S.I for 1st yrs. = C.l for 1st years. = 25

S.I. for 2 yrs. For same ‘p’ = 2×25 = 50

Question 33. At what % rate of compound interest corresponding (C.I) will the sum of money become 16 times in four years, if interest is being calculated compounding annually:

- r=100%

- r=10%

- r=200%

- r=20%

Solution:

(1) For (a) Let P = 1; A =1\(\left(1+\frac{100}{100}\right)^4=(2)^4=16\)

(1) is correct

Question 34. If the simple interest on a sum of money at 12% p.a. for two years is 3:3,600. The compound interest on the same sum for two years at the same rate is:

- 33,816

- 33,806

- 33,861

- 33,860

Solution:

(1) \( P=\frac{3600 \times 100}{12 \times 2}=₹ 15000\)

⇒ \(\text { C.I. }=15000\left(1+\frac{12}{100}\right)^2-15000=₹ 3816\)

Question 35. The effective annual rate of interest corresponding to the nominal rate of 6% p.a. payable half yearly is

- 6.06%

- 6.07%

- 6.08%

- 6.09%

Solution:

⇒ \(r_e=\left[\left(1+\frac{6}{200}\right)^2-1\right] \times 100=6.09 \%\)

Question 36. The cost of machinery is 31,25,000/- if its useful life is estimated to be 20 years and the rate of depreciation of its cost is 10% p.a. then the scarp value of the Machinery is [given that (0.9)2=0.1215]

- 15,187

- 15,400

- 15,300

- 15,250

Solution:

(1) S (Scrap Value) = p\(\left(1-\frac{d}{100}\right)^1\)

Where P = Principle;

d=rate of depreciation

S = 1,25,000 \(\left(1-\frac{10}{100}\right)^{20}=₹ 15,187.50\)

Question 37. Mr. X invests the ‘P’ amount at a simple rate of 10% and Mr. Y invests the ‘Q’ amount at a compound interest rate of 5% compounded annually. At the end of two years, both get the same amount of interest, then the relation between two amounts P and Q is given by:

- \(P=\frac{41 Q}{80}\)

- \(P=\frac{410}{40}\)

- \(P=\frac{41 Q}{100}\)

- \(P=\frac{41 Q}{200}\)

Solution:

(1) is correct \(\mathrm{S} .\mathrm{I}=\frac{P .10 \times 2}{100}=\frac{P}{5}\)

⇒ \(C. I=Q\left[\left(1+\frac{5}{100}\right)^2-1\right]=0.1025 . Q\)

From Question

S.I = C.I

⇒ \(\frac{11 Q}{80}=0.1025 Q\)

Or P = 5×0.1025Q = 0.5125Q

⇒ \(P=\frac{5125}{10000} Q=\frac{205 Q}{400}=\frac{41 Q}{80}\)

⇒ \(P=\frac{41 Q}{80}\)

Question 38. If the difference between S.I and C. I am 372 at 12% for 2 years. Calculate the amount.

- 8,000

- 6,000

- 5,000

- 7,750

Solution:

(3)\(\mathrm{P}=\frac{(C . I-S . I) \times(100)^2}{12 \times 12}=\frac{72 \times 100 \times 100}{12 \times 12}=₹ 5000\)

Question 39. The nominal rate of interest is 9.9% p.a. if interest is compounded monthly. What will be the effective rate of interest?

⇒ \(\left({Given}\left(\frac{4033}{4000}\right)^{12}=1.1036\right. \text { (approx)? }\)

- 10.36%

- 9.36%

- 11.36%

- 9.9%

Solution:

(1) \(\mathrm{r}_{\mathrm{e}}=\left[\left(1+\frac{9.9}{1200}\right)^{12}-1\right] \times 100 \quad=10.36 \%\)

Question 40. The difference between Cl and SI on a certain sum of money for 2 years at 4% per annum is 1. The sum is

- 625

- 630

- 640

- 635

Solution:

(1) for 2 yrs Sum of Money =\(\frac{\text { Diff.(100) }}{r^2}=\frac{1 \times(100)^2}{4^2}=₹ 625\)

Question 41. If the sum of money when compounded annually becomes 1 140 in 2 years and 1710 in 3 years at a rate of interest

- 30%

- 40%

- 50%

- 60%

Solution:

(3) Interest in 3rd yr. = 511710 – 511140 = 51570

For 3rd yr; it will be like S.l r=\(\frac{1 \times 100}{P t}=\frac{570 \times 100}{1140 \times 1}=50 \%\)

For (3) A = 1140 + 50% (calculator) = ₹ 1710

Question 42. The difference between and C. I and S.I at 7% p.a. for 2 years is 329.4 then the principal is

- 35,000

- 35,5000

- 36,000

- 36,500

Solution:

(2) \(\mathrm{P}=\frac{\text { Difference } \times(100)^2}{r^2}=\frac{29.4 \times(100)^2}{(7)^2}=₹ 6000 \text {. }\)

Question 43. The partners A & B together lent 33903 at 4% p.a. interest compounded annually. After a span of 7 years. A gets the same amount as B gets after 9 years. The share of A in the sum of 33903/- would have been

- 31875

- 32280

- 32028

- 32820

Solution:

⇒ \(A\left(1+\frac{4}{100}\right)^7=B\left(1+\frac{4}{100}\right)^9 \quad \text { Or } \frac{A}{B}=\left(1+\frac{4}{100}\right)^2=\left(\frac{26}{25}\right)^2 =\frac{676}{625}\)

⇒ \(A: B=676: 625 \quad A=\frac{676}{676+625} \times 3903=₹ 2028\)

Question 44. A certain sum of money doubled itself in 4 years at C.I. In how many years it will become 32 times to itself

- 15 years

- 24 years

- 20 years

- None

Solution:

2tz = 324

= 2t2 = (25)4 = 220

= t2= 20 yrs.

Question 45. On a certain sum rate of interest @ 10% p.a, S.I = 3 90 Term = 2 year, Find compound interest for the same:

- ₹544.5

- ₹94.5

- ₹ 450

- ₹ 18

Solution:

⇒ \(\text { S.I p.a }=\frac{90}{2}=₹ 45\)

Compound interest = 45 + (45+10%) = 94.5

Question 46. If an amount is kept at simple interest, it earns ₹600 in the first 2 years but when kept at compound interest it earns an interest of ₹660 for the same period: then the rate of interest and principal amount respectively are

- 20%; ₹1200

- 10%; ₹1200

- 20%; ₹1500

- 10%; ₹1500

Solution:

(2)\(\text { S.I. }=\frac{1500 \times 2 \times 20}{100}=₹ 600 \text { (true) }\)

⇒ \(\text { C.I }=1500\left[\left(1+\frac{20}{100}\right)^2-1\right]=₹ 660 \text { (also true) }\)

Question 47. Mr. X bought an electronic item for ₹1000. What would be the future value of the same item after two years,if the value is compounded semi-annually at the rate of 22% per annum?

- ₹1488.40

- ₹ 1518.07

- ₹2008.07

- ₹2200.00

Solution:

(b)

FV = P (1 + i)n